With VeChain up by 4%, risk-averse VET investors can take profits at this level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Risk-averse VET investors can consider locking profits at $0.01775

- A break below $0.01563 can invalidate the bullish bias

VeChain [VET] has been subject to massive selling pressure over the past five days, breaking some support levels. However, the bulls found a stable zone at $0.01582 and initiated a price recovery.

At press time, VET was trading at $0.01647, up over 4%, as demand increased at reduced prices. If buying pressure continues, VET could head for its main supply zone and resistance level around the 100% Fibonacci level of $0.01965.

Read VeChain’s [VET] price prediction 2023-2024

However, before that happens, the bulls have to overcome some obstacles, including the former support that turned into resistance at $0.01775. Do they have enough support to pull this off?

Can VET bulls reach the 100% Fib level?

VET bulls have significant backing to reach the main supply zone around the 100% Fibonacci level. For example, the Relative Strength Index (RSI) recorded a sharp uptick after retreating from the oversold zone. This indicated that buying pressure had increased massively. Buyers thus, gained more influence on the market.

The On-Balance Volume (OBV), which had been falling recently, also witnessed a surge. This showed that trading volume increased with a rise in the overall buying pressure. If this trend continues, VET could be well on its way to reaching the profit target in the supply zone around $0.01965.

However, there are many resistances along the way that the bulls of VET will have to overcome. Risk-averse investors can lock in their profits at the immediate key resistance of $0.01775. A break below $0.01563 would invalidate the above bullish bias and potentially push VET back to new support at $0.01469.

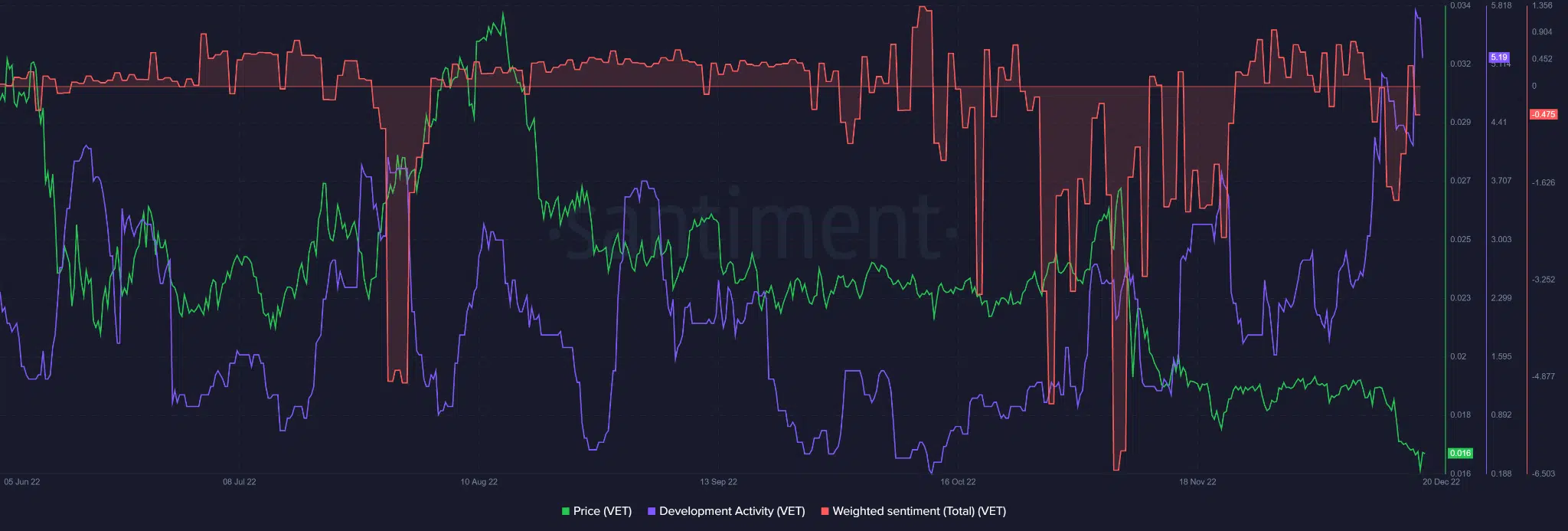

VET recorded an increased development activity

VET’s development activity has been on the rise since 12 December. This showed that developers were invested heavily in blockchain, thus improving its future prospects.

Although the development activity of VET has affected the price in the past, the recent increase did not reflect anything as the price decreased when the development activity increased.

Are your VET holdings flashing green? Check the profit calculator

Nonetheless, the recent upswing in development activity was also accompanied by improved weighted sentiment. This showed that investor confidence was boosted.

Unfortunately, a sharp decline in development activity occurred on 20 December, pushing weighted sentiment into negative territory. Can these conditions undermine the current uptrend?