XLM shows signs of potential retracement, enters overbought territory

- Juicy gains threatened to support a bearish takeover for XLM if market conditions allowed.

- Stellar’s partnership with Coinme was largely responsible for the rejuvenated demand for XLM.

Crypto investors or holders of Stellar Lumens [XLM] are celebrating another bullish week. But what goes up must come down, and so, XLM was already showing signs of a potential retracement at press time.

Is your portfolio green? Check out the Stellar Profit Calculator

XLM pulled off a 26% upside in the last seven days, courtesy of extended bullish demand, as was the case in the week prior. The cryptocurrency traded at $0.11 at press time, marking a 49% upside from its lowest point in March.

This robust performance allowed XLM to be in the top 5 best gainers among the top crypto projects by market cap.

The strong bullish performance also pushed XLM back above the 200-day moving average. It shoved the cryptocurrency into overbought territory, underscoring a major reason why sell pressure is likely to manifest.

Metrics reveal why XLM traders should tread cautiously

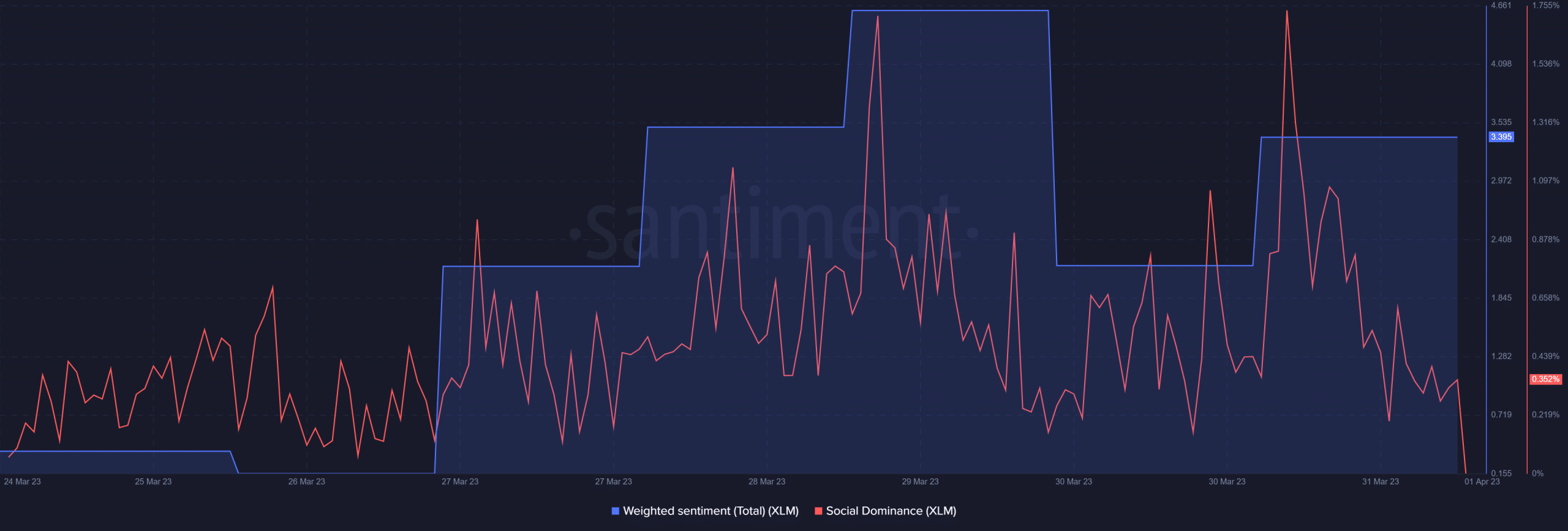

The latest on-chain data on XLM revealed a fall in weighted sentiment, meaning investor confidence had faded. The social dominance metric highlighted a similar outcome.

XLM’s price rally was backed by a volume surge in the last seven days. It concluded March with a surge to its highest weekly level.

This was confirmation that the cryptocurrency was still experiencing significant demand despite being overbought. It also suggested that XLM might extend the rally if sell pressure was not strong enough for a bearish pivot.

Stellar’s market cap highlighted a similar result. There were instances at the end of the week where the market cap dipped slightly, only to extend its upside. XLM’s volatility underscored the exponential demand that prevailed in the market for the last few days.

How much are 1,10,100 XLMs worth today?

While the volatility was growing, the network development activity has been slowing down, an outcome that may not necessarily inspire confidence among investors. However, it did not come in the way of the strong weekly rally.

The hype around the XLM cryptocurrency is largely due to the announcement about Stellar network’s partnership with Coinme. The collaboration will facilitate a crypto on-off ramp, easing the flow of liquidity through stablecoins. The Stellar network is thus in a position to leverage robust growth in the future, hence the strong demand for XLM.