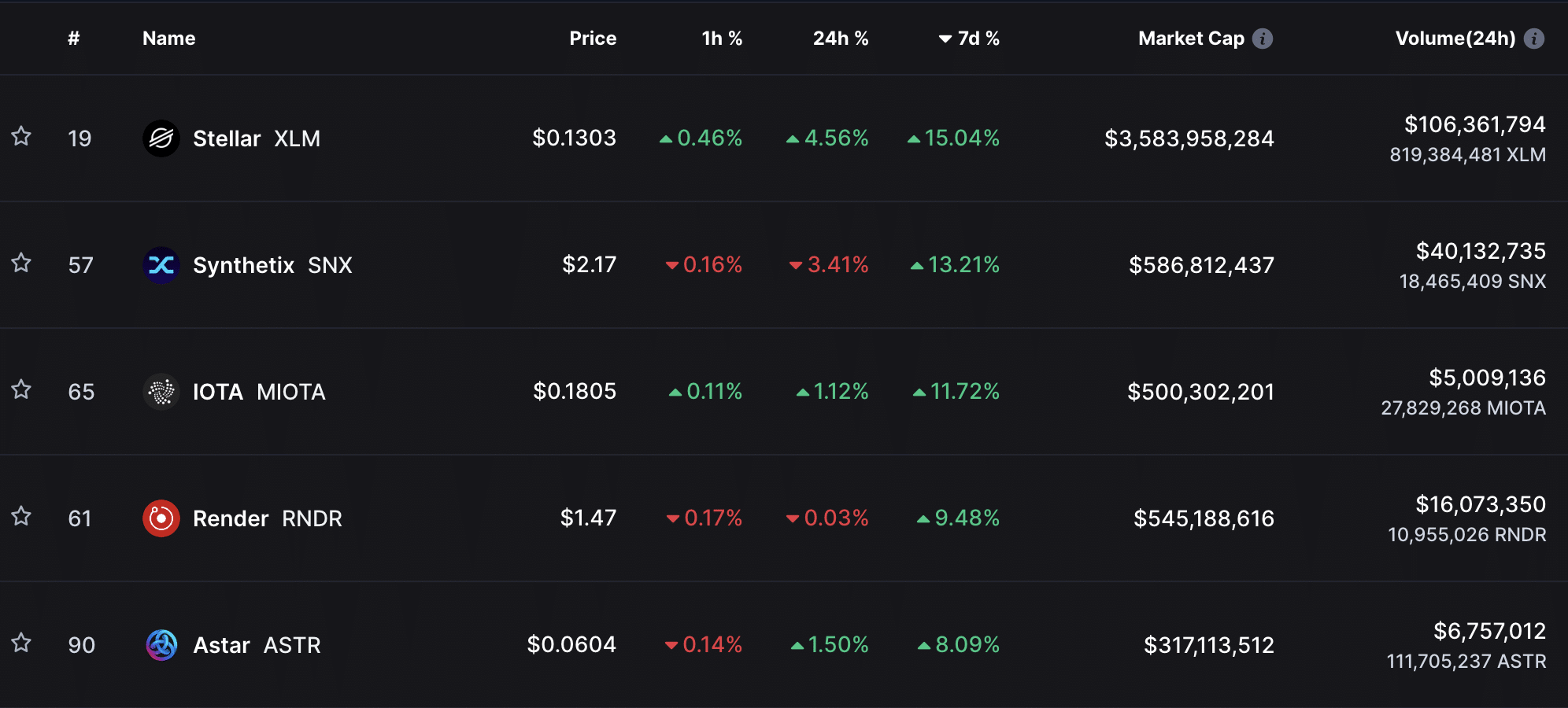

XLM soars 15% in 7 days, but short traders remain resilient

- XLM’s value rallied by 15% in the last week.

- Short traders, however, were eyeing a price decline.

With a 15% hike in its value, Stellar [XLM] has closed the week as the cryptocurrency asset with the most gains in the last seven days, data from CoinMarketCap showed. At press time, the altcoin exchanged hands at $0.13.

Read Stellar’s [XLM] Price Prediction 2023-2024

The price jump has occurred despite sharing a statistically significant positive correlation with leading coin Bitcoin [BTC], whose value grew by a mere 0.30% within the same period.

The spot market excels

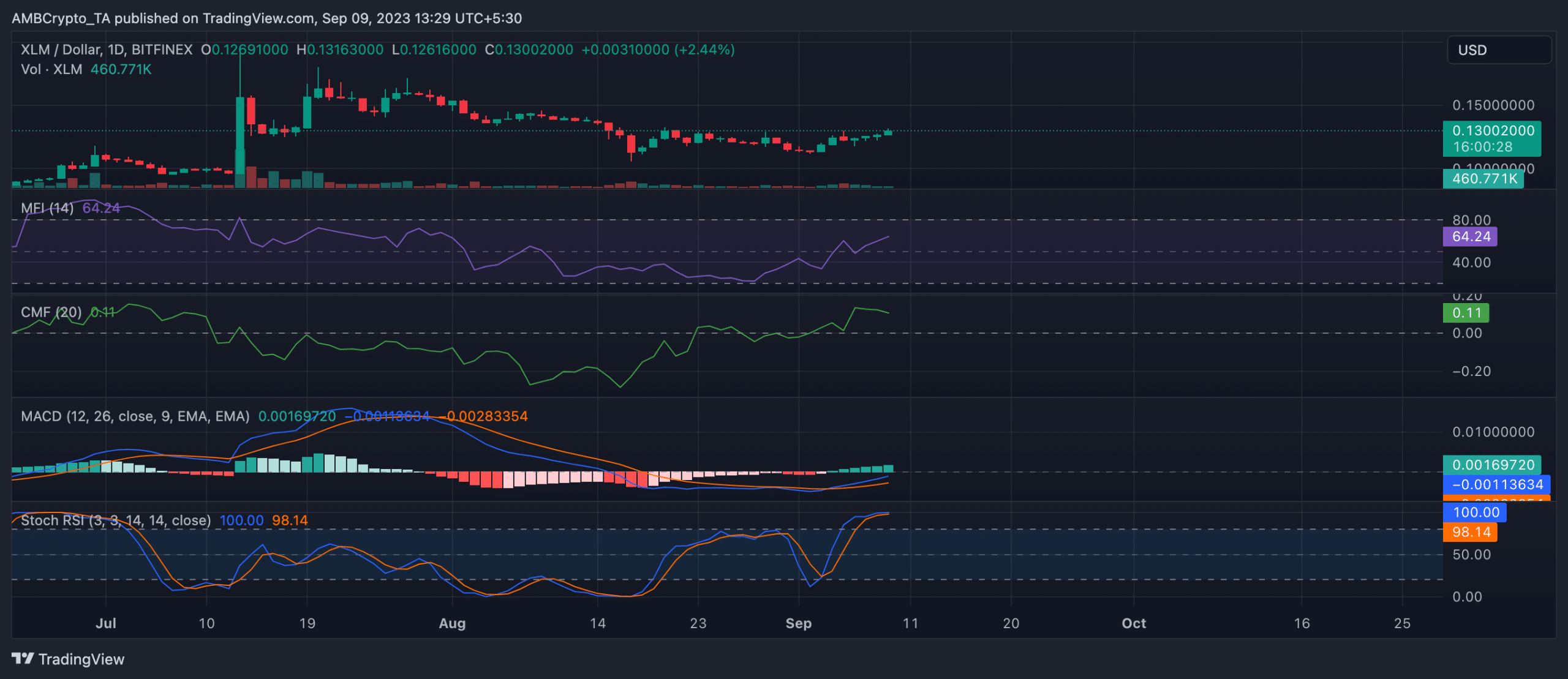

The price uptick in the last week has been driven primarily by a renewed interest in XLM, leading to a surge in new demand. Amongst traders in the token’s spot market, the bulls regained control on 4 September and immediately initiated an 8% intraday price jump on that day’s trading session.

As of this writing, the Moving Average Convergence/Divergence (MACD) indicator confirmed the bulls to remain in control, with the MACD indicator positioned above the trend line. Since 4 September, the indicator has only posted green histogram bars.

Further, key momentum indicators signaled increased XLM accumulation amongst daily traders. For example, the token’s Money Flow Index (MFI) was positioned in an uptrend at 64.24, signaling that XLM accumulation outpaced sell-offs.

Likewise, the %K line (blue) of the altcoin’s Stochastic RSI indicator was pegged at 100%, suggesting that the volume of XLM accumulation exceeded distribution. The Stochastic RSI indicator measures momentum and identifies overbought and oversold conditions in the market.

At 100%, XLM was overbought at press time.

It is key to note that buyers often find it tasking to support further price rallies at this overbought level. Thus, a retraction might be imminent.

The slight retraction in XLM’s Chaikin Money Flow (CMF) also lent some credence to the above position. While still above its center line and positive at press time, the token’s CMF has trended downward since 6 September.

Is your portfolio green? Check out the XLM Profit Calculator

This signaled a drop in capital inflow into XLM spot markets and hinted at the commencement of profit-taking activity.

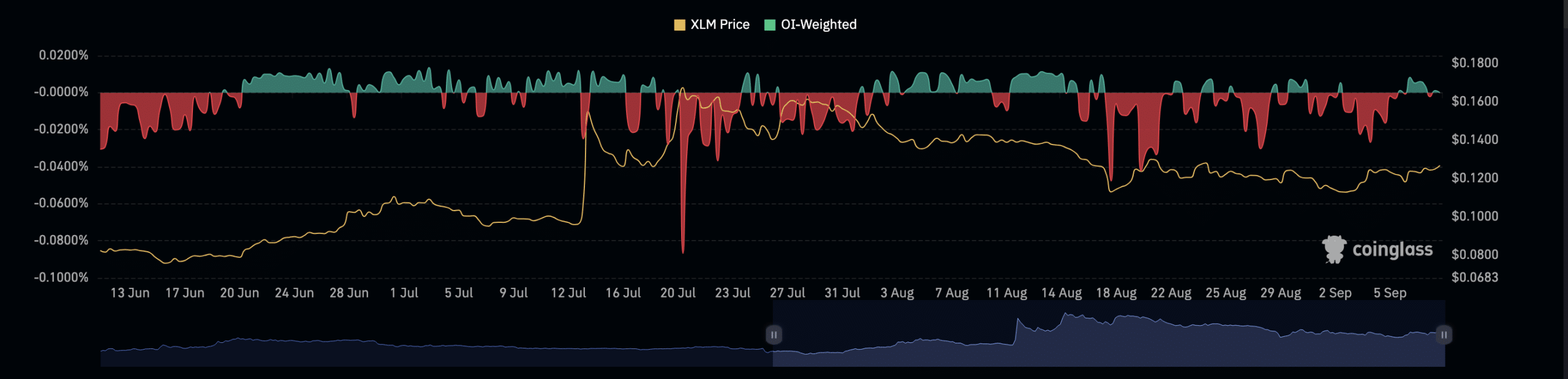

Interestingly, futures markets have increasingly placed bets against XLM’s price. Data from Coinglass showed that funding rates across cryptocurrency exchanges have been increasingly negative since 17 August.