XMR price finds support at $115: What do predictions say?

- Monero saw its bullish structure flip dramatically.

- A move above $115 can give short-term traders hope of continued gains, but it might not last.

Monero [XMR] had a bullish market structure in the first week of February. The trading on the 6th of February saw XMR experience 39.8% losses within a day.

AMBCrypto explored the reasons for this crash in an earlier report.

At press time, the price was well below the $130 mark which had served as support throughout 2023.

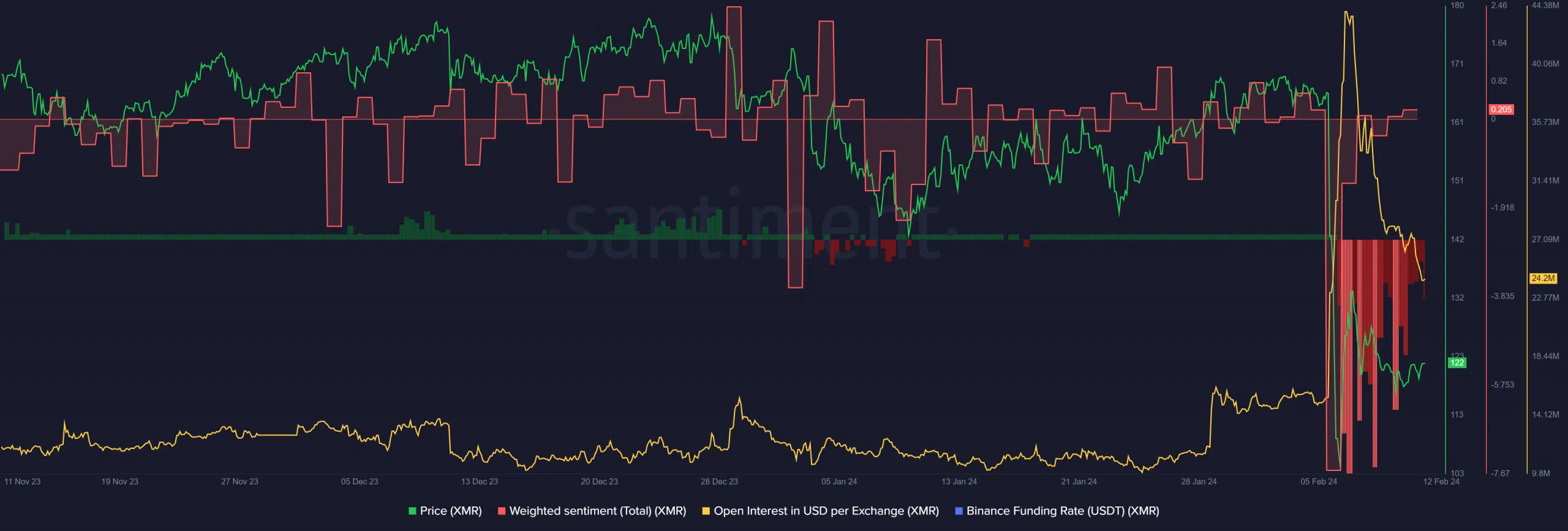

Holders exhibited intensely negative sentiment in the past few days, and the futures markets also favored the sellers.

Where to short XMR and its invalidation

Monero has a bearish market structure on the one-day timeframe after the price action of the 6th of February. The near 40% drop was followed by a 31% bounce the very next day.

However, this jump in prices to the $135 mark could likely be a retest of the former demand zone.

The RSI reflected heavily bearish momentum with a reading of 36. The OBV, which had been trending higher till December 2023, began to form a range over the past two months. This showed buyer exhaustion.

A drop below the local OBV support could be followed by a downtrend on the price chart.

The $136 and $144 levels represented key Fibonacci retracement levels. Hence, they are expected to act as stern resistances.

However, if XMR can climb above the $156 level, the idea of a downtrend would be invalidated.

Meanwhile, a revisit to the $100 level and lower remains likely as things stand. XMR holders could capitulate and sell a greater chunk of their assets should prices continue to tumble.

The Futures market highlights strong bearish sentiment

The price drop on the 6th was accompanied by a massive increase in the Open Interest in USD per exchange. This meant that Futures market participants were willing to short XMR.

Source: Santiment

The sharp drop in Funding Rate also pointed toward the XMR market being skewed massively in favor of the bears.

Read Monero’s [XMR] Price Prediction 2024-25

The Weighted Sentiment dropped to levels not seen in more than a year and was only slightly positive at press time.

Putting the metrics and price action together, it appeared that Monero would more likely trend lower than higher over the next few weeks.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.