XRP can reach $3, but it must first cross a key level

- XRP’s value dropped by more than 4% in the last seven days.

- A few metrics and indicators hinted at a trend reversal.

Like most cryptos, Ripple’s [XRP] price also witnessed a correction as the market condition turned bearish. However, there was good news, as a key indicator hinted that XRP might soon touch $3.

Therefore, AMBCrypto analyzed XRP’s metrics to see whether that’s a viable possibility.

XRP has hope

CoinMarketCap’s data revealed that the token’s price had dropped by over 4% in the last seven days. In the last 24 hours, the token’s value sank by over 2%.

At the time of writing, XRP was trading at $0.5055 with a market capitalization of over $27.9 billion. During this period, XRP’s fear and greed index entered the fear zone, as it had a value of 38%.

Though this was bearish, the upcoming weeks might just be different. Notably, Milkybull, a popular crypto analyst, recently posted a tweet, which highlighted a particular “rare” indicator.

This indicator has a 100% positive track record, as it accurately predicted XRP’s price back in 2017, 2018, and 2021.

During the previous cycle, it predicted XRP’s price to $1.9, which somewhat translated into reality as the token’s price reached $1.79.

XRP’s conservative bull target for this cycle is $2.4–$3.

XRP to turn bullish again?

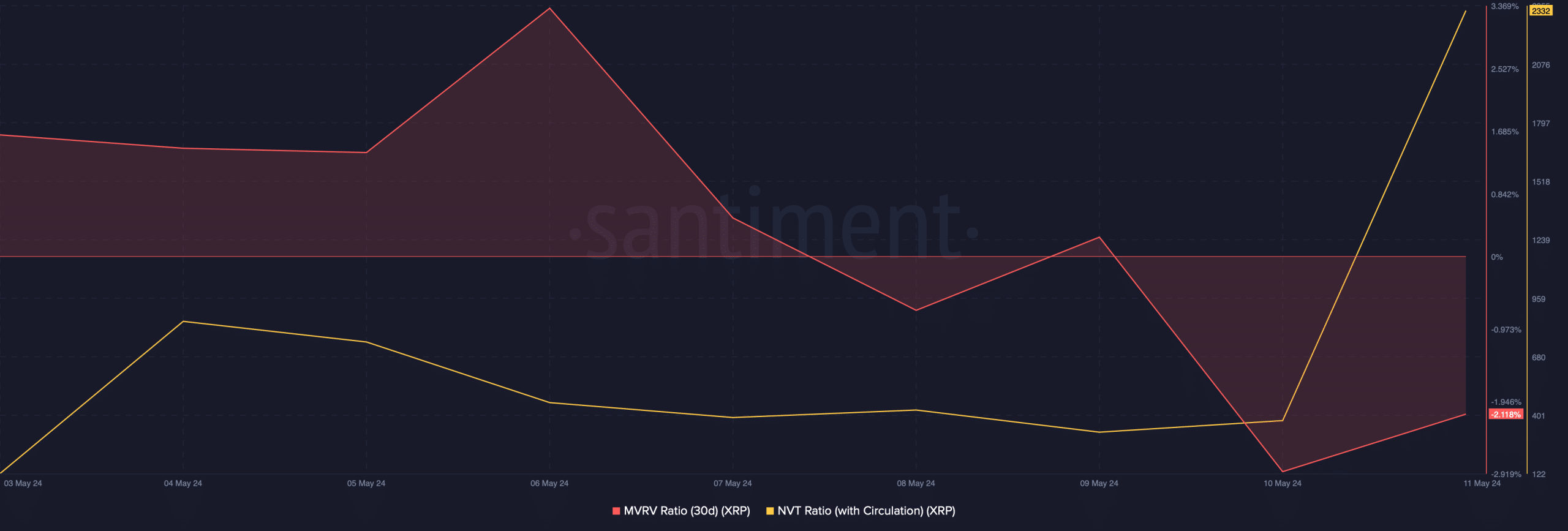

AMBCrypto’s analysis of Santiment’s data revealed that the token’s MVRV ratio remained bearish. At press time, it had a value of -2%.

Its NVT ratio spiked sharply on the 11th of May, suggesting that the token was still overvalued.

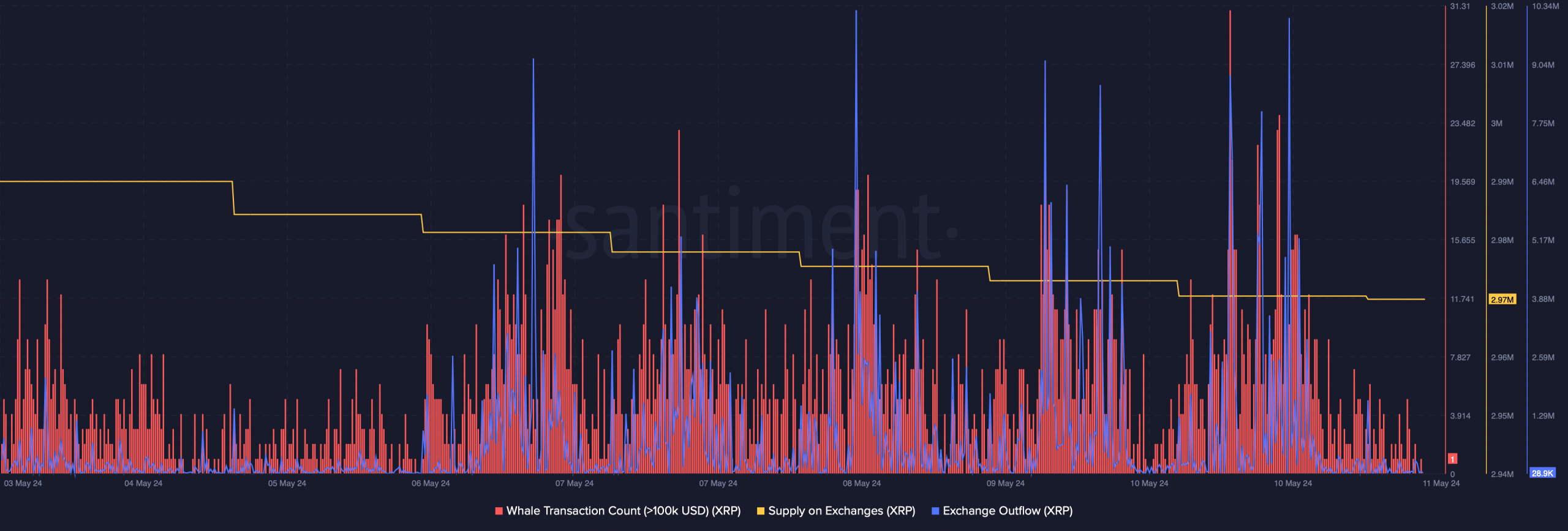

However, buying pressure on the token was high, which was evident from the rise in its Exchange Outflow. The token’s Supply on Exchanges also dropped, showing that investors were buying.

Whale activity around the token also remained high in the last week.

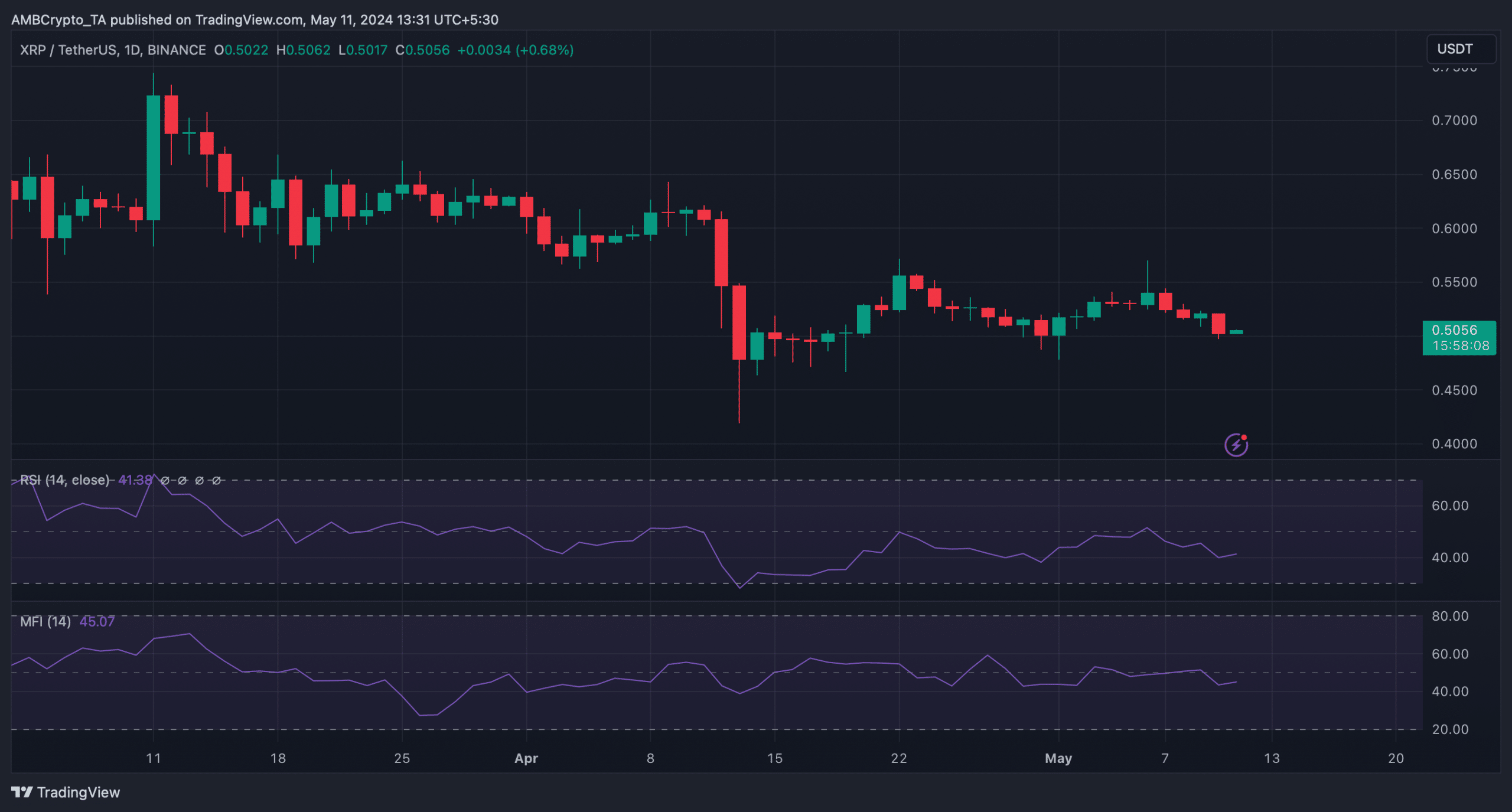

Since a few metrics looked bearish as well, AMBCrypto analyzed XRP’s daily chart to see whether an uptrend is possible in the short term.

We found that its Relative Strength Index (RSI) registered a slight uptick. The token’s Money Flow Index (MFI) also went up slightly, suggesting a possible trend reversal.

If the market trend changes and XRP gains bullish momentum, it might then reach $3. However, before targeting that level, the token has to overcome a challenge.

Realistic or not, here’s XRP market cap in BTC’s terms

As per Hyblock Capital’s data, the token’s liquidation would rise sharply near $0.512, which can trigger yet another price correction.

Therefore, before XRP begins its journey to $3, it’s crucial for the token to go above the aforementioned resistance.