XRP drops 12.24%, but analysts rally for $27: What happens now?

- XRP dropped to $0.40, falling 12.24% in 24 hours.

- Ripple’s legal case with the SEC remains crucial, with potential outcomes significantly influencing XRP’s future market performance.

The crypto market has been experiencing substantial declines over the past several days, with the global market capitalization falling by over 7%.

This downturn has significantly affected XRP, which saw a sharp decrease in value.

As of the time of writing, XRP was trading at $0.400692, with a 24-hour trading volume of $2,099,990,889. The token has dropped by 12.24% in the last 24 hours, reflecting the broader market trend.

XRP’s press time CoinMarketCap ranking was #7, with a live market cap of $22,327,796,369.

XRP: Price predictions

On the 3rd of July, when XRP was valued around $0.46, analyst EGRAG CRYPTO noted that the token was nearing a crucial resistance level, specifically the Fibonacci 1.618 level.

The analyst suggested,

“If history repeats itself halfway, then we’re eyeing $27.”

This optimistic prediction, however, contrasted with the current downward trend observed in the market.

A significant factor that has influenced XRP’s future price is the ongoing lawsuit between Ripple and the U.S. Securities and Exchange Commission (SEC).

The legal dispute began in December 2020, with allegations that Ripple and some of its executives conducted an unregistered security offering by selling XRP tokens.

The outcome of this case will have a substantial impact on XRP’s market performance. A favorable resolution for Ripple could potentially lead to a rally in XRP’s price.

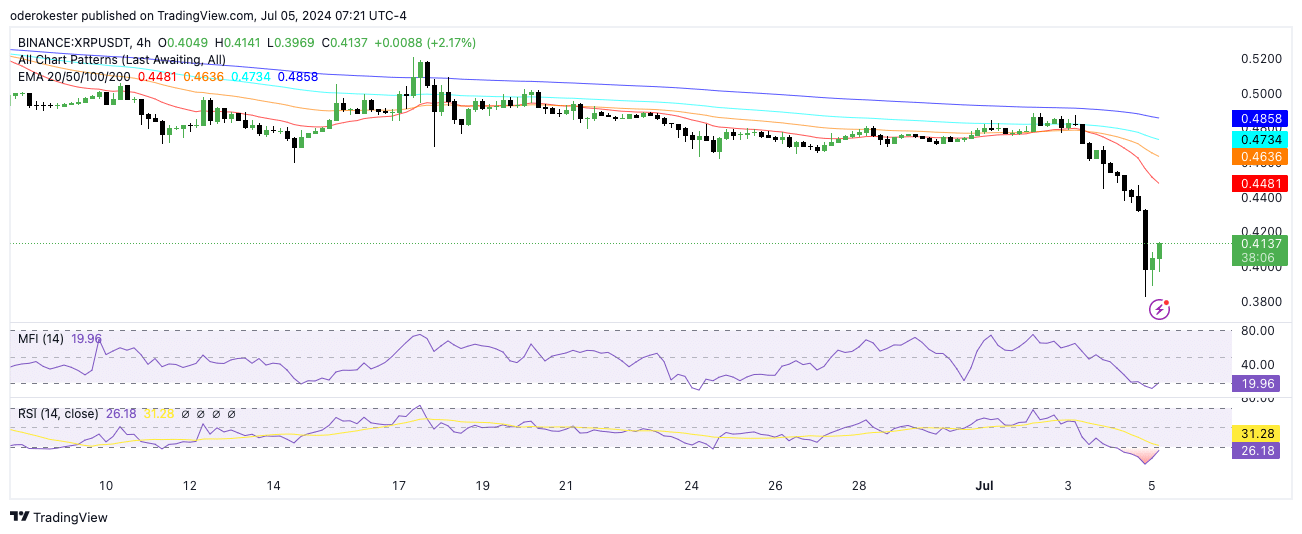

Technical analysis

Indicators such as the Moving Average Convergence Divergence (MACD) showed bearish momentum, while the Money Flow Index (MFI) and Relative Strength Index (RSI) were in oversold territories at 16.83 and 17.98, respectively.

This suggested a potential for a short-term bounce.

Is your portfolio green? Check out the XRP Profit Calculator

However, the price remained below key exponential moving averages (20, 50, 100, and 200 EMA), which may continue to exert bearish pressure unless a substantial reversal occurs.

According to XRPSCAN, transaction volume increased noticeably in late June and early July 2024. However, a slight increase in payment activity was also observed in these months, indicating renewed user engagement.