XRP faces a critical level of resistance at the range high, watch out for a false breakout

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The daily bearish order block was beaten last week and retested as a bullish breaker.

- The mid-range mark could be retested and can offer a buying opportunity for XRP bulls.

The crypto market was bullish over the past two weeks as it slowly ground its way back above important short-term resistance levels. Near-term bullish momentum took hold over the past week, as Bitcoin [BTC] was able to climb past the $17.6k resistance.

Is your portfolio green? Check the XRP Profit Calculator

This saw XRP also flip an important zone of resistance near $0.37 to support. Since then, XRP has made some gains and pushed toward the range highs. However, a breakout might not occur on the first try.

The highs of the two-month range can offer a deviation and a pullback before a true breakout

Yellow highlighted a range that XRP has traded within since the November 2022 crash. Inside the range, the mid-range resistance at $0.37 was respected in late December and saw a rejection. A bearish order block formed on the daily chart just before this rejection. Last week, this bearish order block was broken and flipped to a bullish breaker, highlighted in cyan.

This retest signaled that, even though there was no strong trend on longer timeframes, it was possible that XRP would move toward the range highs. Despite the gains of the past week, the range high value at $0.41 was not yet tested.

Realistic or not, here is XRP’s market cap in BTC’s terms

Over the past few days, the RSI has made lower highs while XRP bulls tried to break above the $0.405 mark. This indicated that momentum had slowed down, and a dip toward the near-term support at $0.383 was possible. The drop in the OBV also indicated some selling pressure in recent days.

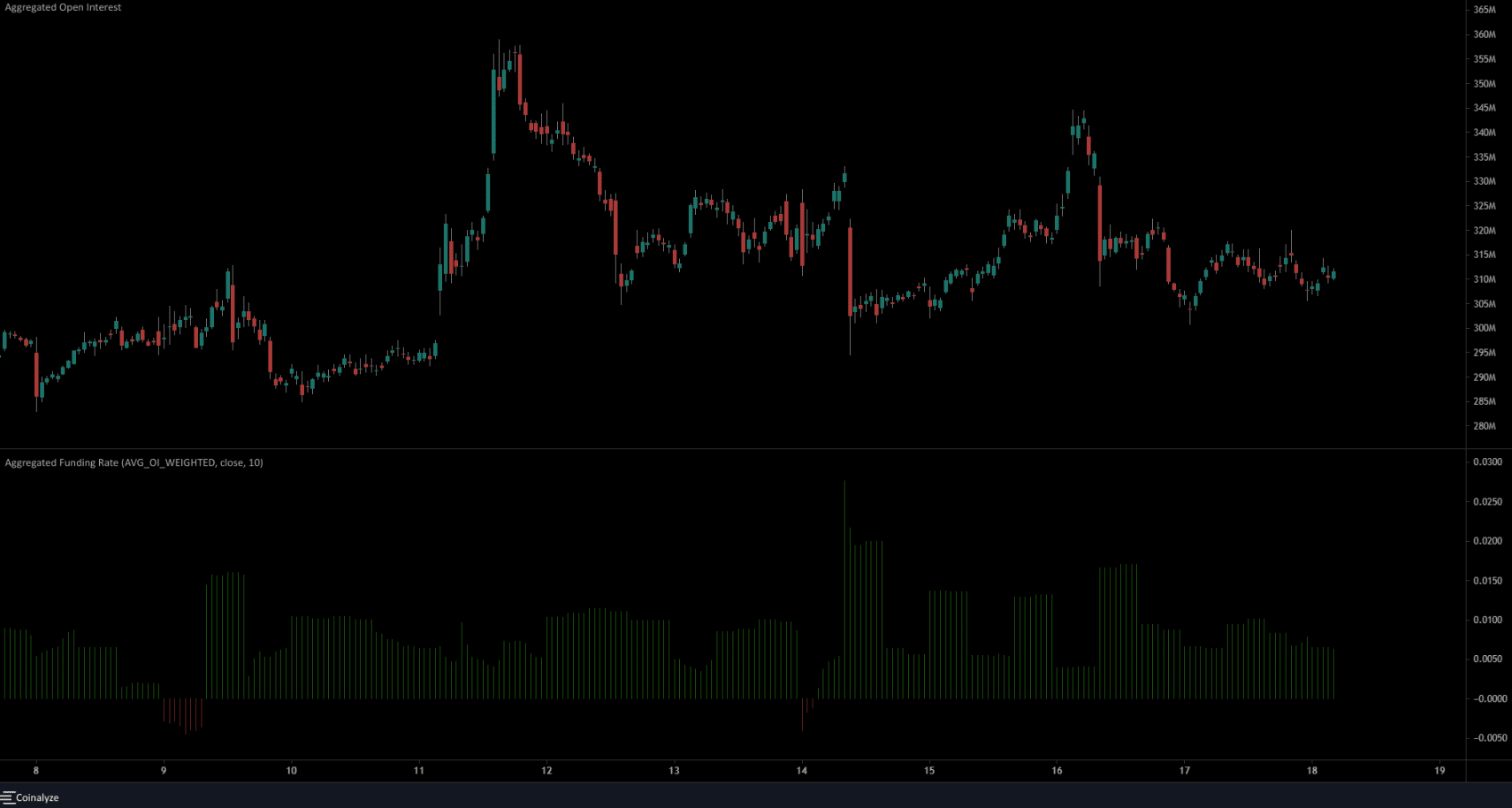

The Open Interest also took a dip since Monday to signal weary bulls

Source: Coinalyze

Since 16 January, when XRP climbed to $0.405, the OI has formed a series of lower highs. On the price chart, XRP faced rejection at $0.405 and has traded beneath $0.395 over the past couple of days. Together, the inference was that long positions were discouraged. The funding rate remained positive to show bullish sentiment.

The market structure, based on the price action, was bullish. A drop to $0.379-$0.385 could offer a buying opportunity over the next few days.