XRP faces a lower timeframe resistance region, can it punch through

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

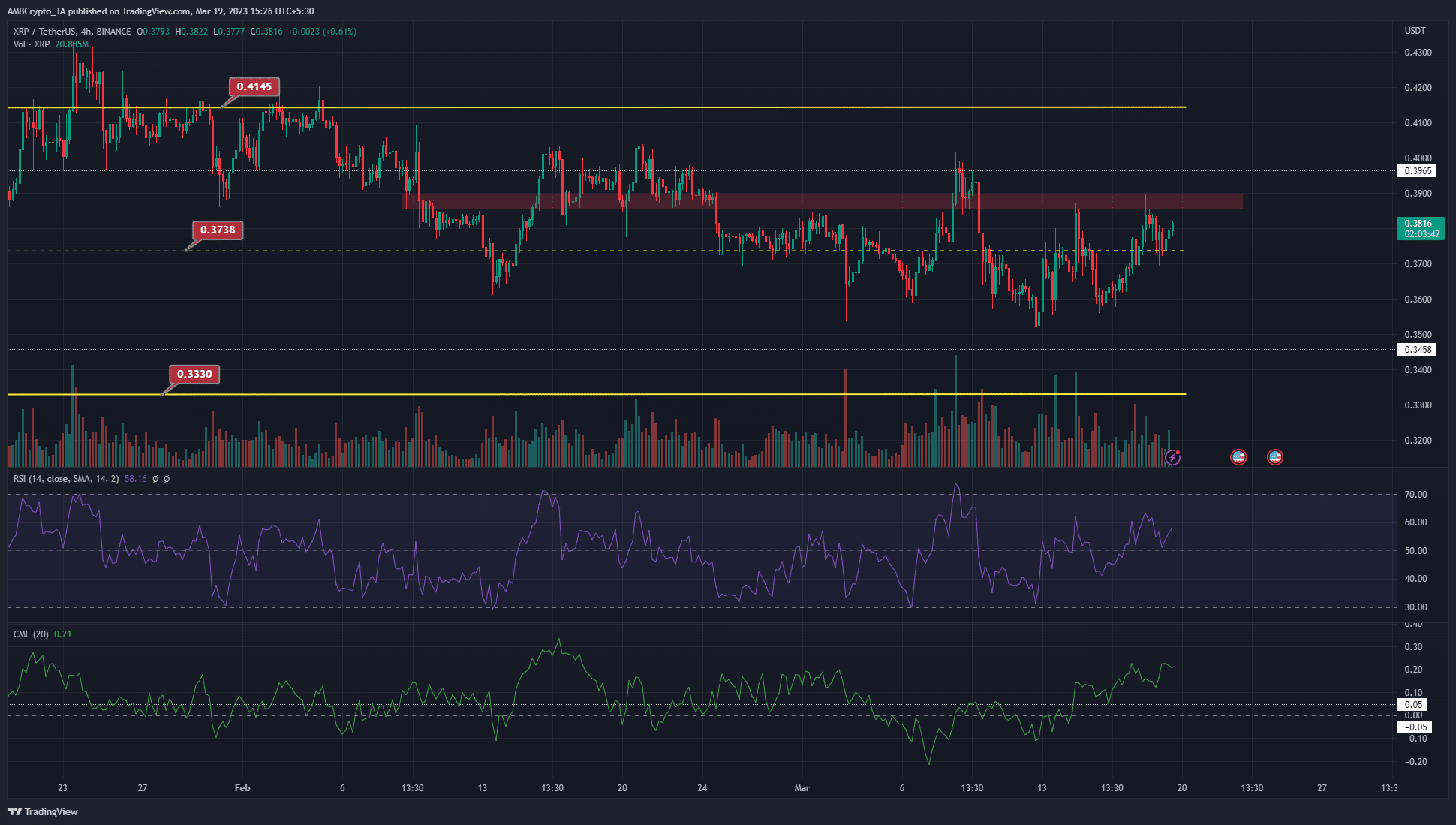

- The H4 market structure was bullish.

- Momentum and demand could fuel a rally toward $0.4.

Bitcoin showed a bearish divergence develop over the past few days between momentum and price action. This suggested a pullback was likely.

The FOMC meeting on 21-22 March could see high volatility across the market. XRP has traded within a range since November. It had a bullish outlook at the time of writing.

Realistic or not, here’s XRP’s market cap in BTC’s terms

The market structure was bullish, but that does not necessarily mean the price will go to the range highs at $0.415 soon. Yet, it did signal bulls had the upper hand after last week’s trading.

XRP needs to flip this lower timeframe zone of resistance to support

Highlighted in red was a zone of resistance at $0.39 that has been important in the past two months. It acted as support in mid-February, but over the past week, it has served as resistance. The RSI on the 4-hour chart showed the RSI bounced from the neutral 50 level. It indicated the momentum remained on the side of the bulls.

The CMF was also above +0.05 and showed significant capital flow into the market and backed up the argument of buying pressure strengthening recently.

The mid-range level at $0.374 acted as support during the latest bounce. An H4 trading session close beneath this level would flip the market structure to bearish.

At the time of writing, the signs remained bullish. Lower timeframe traders can wait for a flip of the highlighted resistance region to support before looking to buy.

How much are 1,10,100 XRPs worth today?

More aggressive traders can look to sell the retest of the $0.39 resistance. They would need to monitor their risk strictly as the trade would be against the market structure in the 4-hour timeframe.

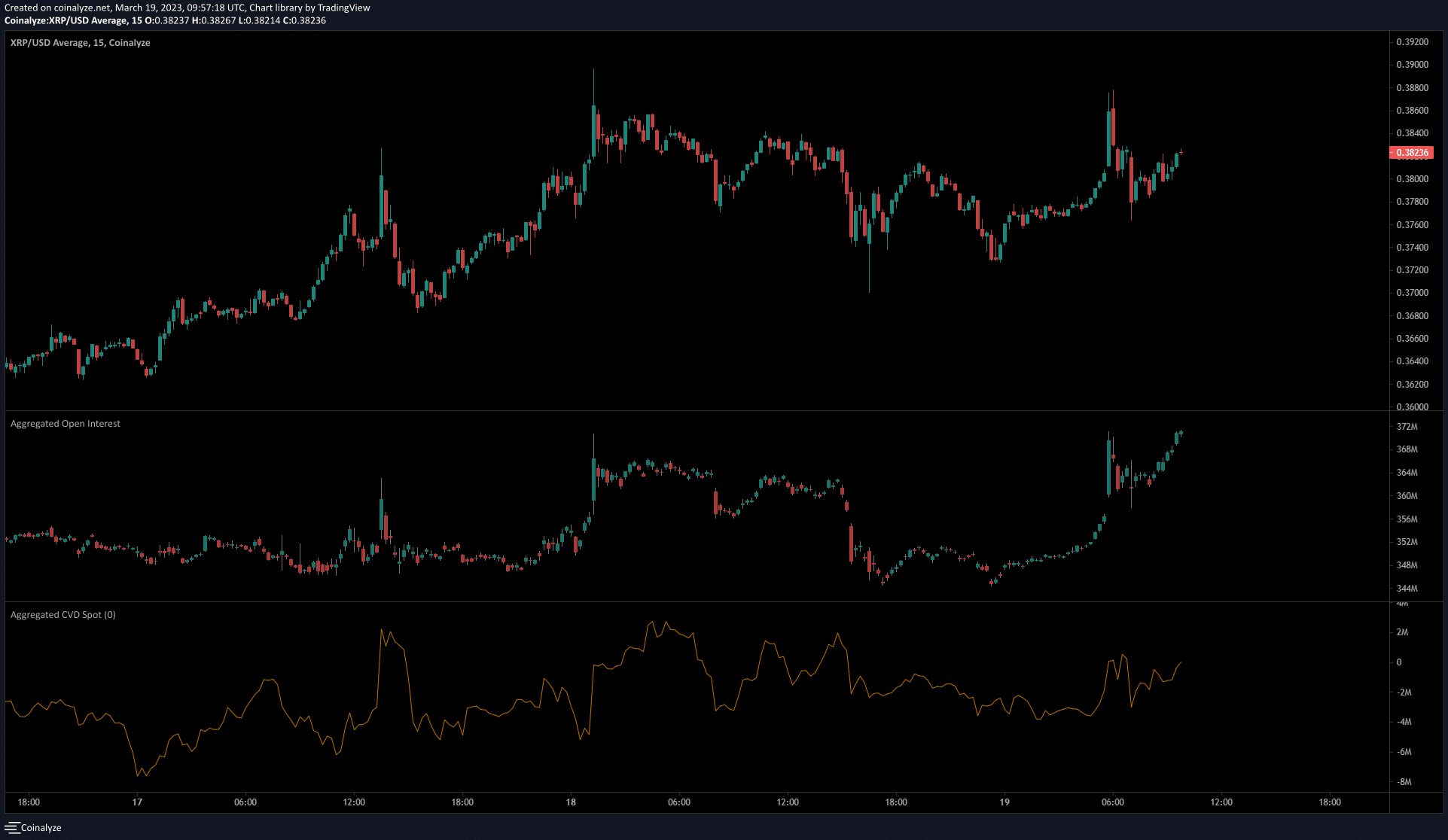

Bulls gather strength as the price ascended steadily

Source: Coinalyze

The 15-minute timeframe showed the Open Interest surging in the past few hours. The OI has been rapidly rising over the past 24 hours and noted a rise of close to $20 million. Alongside the appreciation in XRP prices, the indication was that bullish momentum was likely in the coming hours.

The spot CVD has also climbed over the past 12 hours and showed lower timeframe buying strength as well. This could result in a breakout past $0.39 for XRP. In that scenario, $0.4 and $0.415 would become resistance levels to watch out for in the lower timeframe charts.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)