XRP faces short-term resistance: Will this key update trigger a breakout?

- XRP struggles to find demand at key resistance level despite major positive development.

- Ripple makes headway in Singapore after receiving an operating license.

Ripple’s XRP cryptocurrency is back on the path toward recovery after giving up the gains achieved in July. However, this rally attempt was facing a key resistance level that might make it tough to overcome the lower range.

Is your portfolio green? Check out the XRP Profit Calculator

Many traders saw the pullback in August and part of September as an opportunity to secure more XRP at discounted prices. After all, the previous spike in July confirmed that the cryptocurrency can still command robust demand if conditions are in favor. The rally in the last three weeks indicated that there was significant accumulation.

That rally has now pushed XRP into an important resistance range at the $0.54 price range. It has now been retested at the same level three times in the last seven days. This was confirmation that the same price level is once again yielding significant resistance.

For those worried about the possibility of another pullback, the good news is that the Money Flow Index (MFI) indicated that sell pressure was low. The previous rally was triggered by a demand shock as a result of Ripple’s win. The XRP might need another catalyst to fuel a breakout beyond the current resistance zone.

A step in the right direction for mass adoption and institutional liquidity

According to a recent announcement, Ripple just secured a license to offer digital payment token services in Singapore. This signals that the initial announcement regarding Ripple’s win against the SEC is already paving a path for a favorable regulatory environment.

It’s official: Ripple is now fully licensed to provide digital payment token services in Singapore by @MAS_sg! Ripple is committed to delivering real-world crypto solutions for businesses in APAC.

Learn more: https://t.co/jD8xSc2pdd

— Ripple (@Ripple) October 4, 2023

The Singapore license will pave the way for Ripple to attract institutional investment in the Asian country. This is the type of development that usually has an impact on investor sentiment. So, how did XRP fair after the announcement?

Read about XRP’s price prediction for 2024

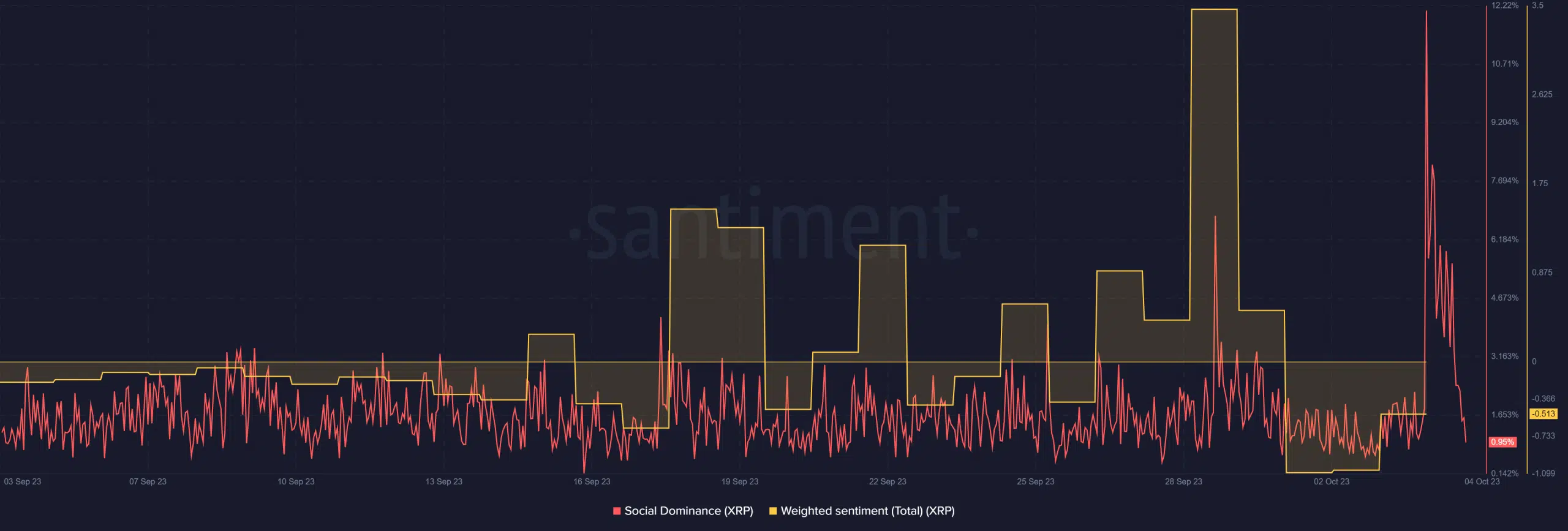

The first major observation was that there was a large spike in social dominance in the last 24 hours. However, it is worth pointing out that it was short-lived.

Meanwhile, the weighted sentiment was already attempting a recovery from its lowest level in the last four weeks. However, its data was not as up-to-date to indicate a clear impact of the announcement.

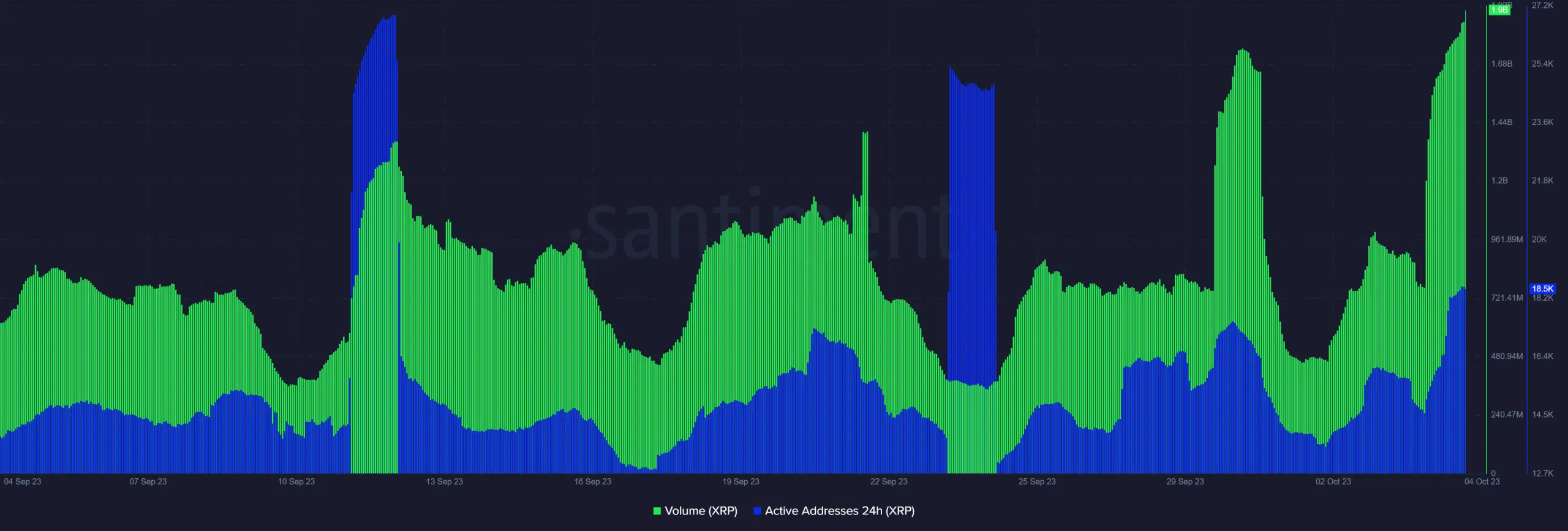

While the weighted sentiment metric might be lacking, other metrics may prove more useful. For example, its volume metric registered its highest monthly spike in the last 24 hours. There was also a significant surge in the number of daily active addresses during the same period.

The demand for XRP failed to push beyond the resistance line as noted earlier despite the above findings. This could be due to the resurgence of sell pressure near the resistance level, thus undoing any incoming bullish momentum.