XRP has struggled all year long to record a significant rally. While the asset did register a yearly high of $1.97 in April 2021, it has been a start-stop rally due to the SEC’s intervention.

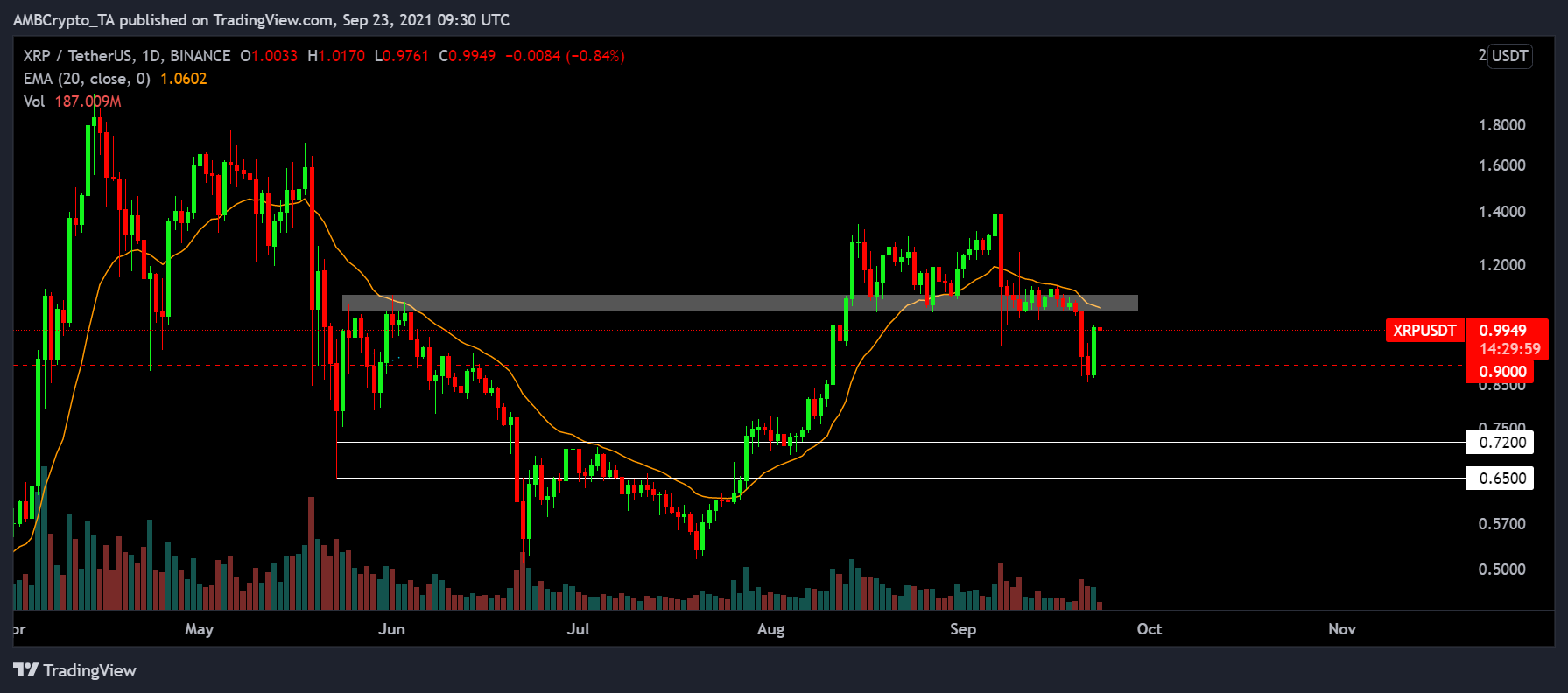

The likes of Bitcoin, Ethereum, and Cardano were all able to establish new ATHs, but not XRP. At press time, the asset was once again under its psychological $1-mark. What’s more, there seemed to be fundamental utilization discrepancies observed across its larger industry as well.

Liquidity Index for XRP on shaky grounds?

According to data retrieved from Liquidity Index Bot, some of the major Ripple ODL corridors have significantly low liquidity indexes. The liquidity index for XRP/EUR has been in the negatives since the 1st week of September whereas the XRP/AUD corridors have been negative since July 2021.

Source: Twitter

XRP/PHP maintained positive liquidity, but the decline was evident. On the contrary, the XRP/MXN corridors continue to maintain higher levels on Bitso exchange.

Now, these signs might suggest that XRP’s blockchain usage has been somewhat diminished. However, according to Messari’s active chain data, the narrative has been quite different.

XRP, at the time of writing, was one of the top-10 most active chains in terms of on-chain data, facilitating over $822 million in adjusted transactions over the last 24 hours. XRP was only behind Bitcoin, Ethereum, Cardano, and Bitcoin Cash.

Is there a contradiction in metrics?

Now, according to Adjusted Price DAA divergences, the current market is actually indicative of a buy signal for XRP since the active addresses have risen during a period of price decline.

This is a commendable bullish sign but yet again, there is a bearish contradiction, according to the MVRV indicator.

Source: Santiment

The Market Value-to Realized Value Ratio or MVRV seemed to suggest that the losses experienced by XRP investors are pretty definite at the moment. What’s more, prolonged consolidation in the press time range may increase the propensity of these declines.

What is XRP’s major hurdle right now?

Structurally, the market resistance remains at $1.05-$1.10. However, ODL corridors need to experience replenishment of liquidity as it could prove to be a fundamental boost.

Over the past year, we have witnessed multiple projects sustaining stronger rallies on the back of utility. Currently, XRP’s active chain statistics need to align with its ODL movement in order to attain a sustainable rally in the future.