XRP NVT ratio spikes: Does it signal a price correction?

- XRP’s NVT ratio has surged to new highs, suggesting a growing gap between its market cap and actual network activity

- High NVT ratios have historically led to corrections, making XRP’s current rally appear speculative.

XRP’s recent price surge has captured the attention of both traders and long-term investors. A sharp spike in the NVT ratio, among other on-chain indicators, raises questions about the sustainability of this rally.

While price momentum is strong, the surge in NVT suggested a growing disconnect between market value and network activity.

This analysis will examine whether this signals an opportunity or a warning for the future direction of XRP.

XRP NVT ratio surges

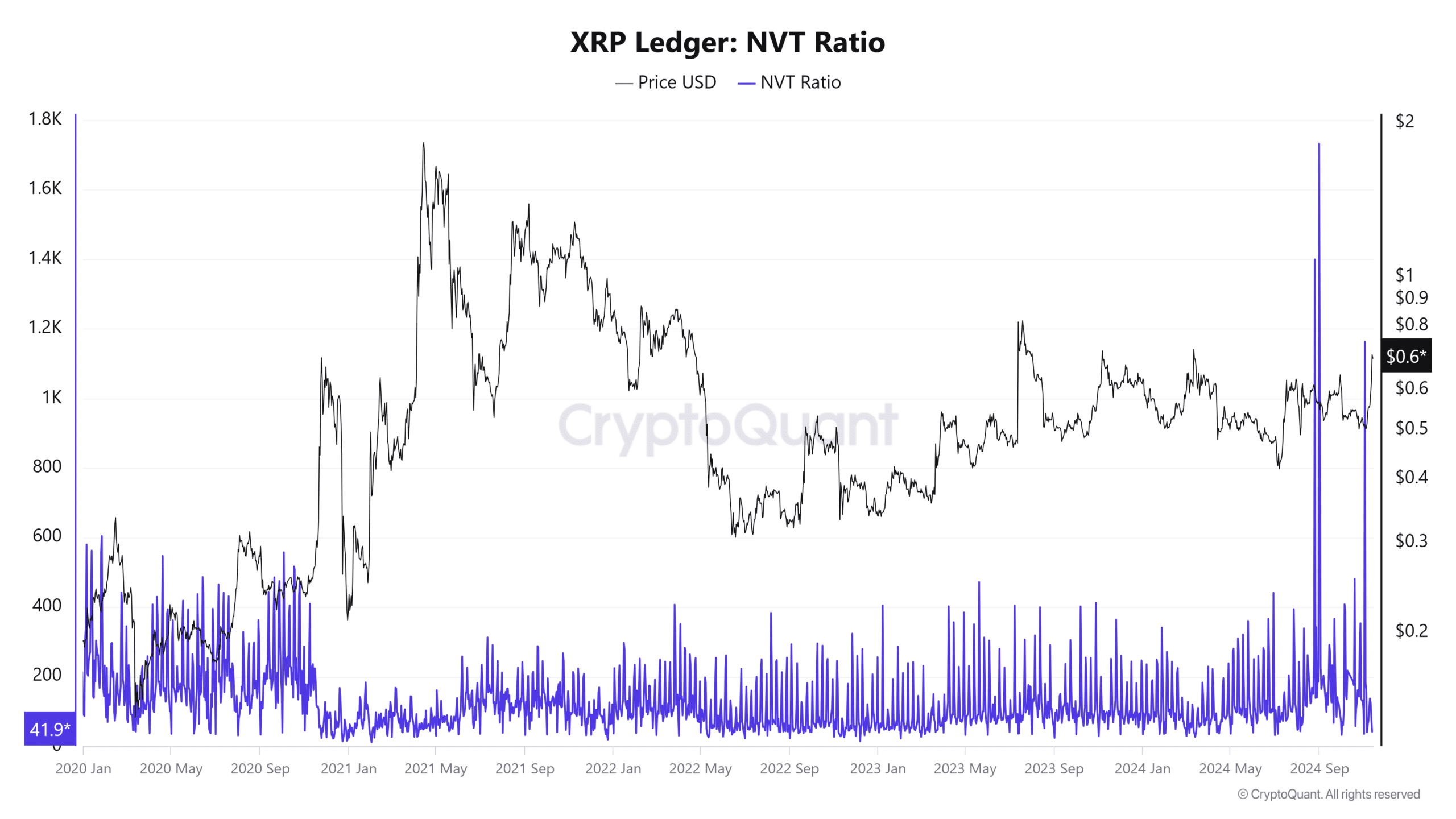

XRP’s NVT ratio has seen significant fluctuations in recent years. Between 2020 and early 2021, it ranged from 200 to 600, reflecting a balanced market.

However, from mid-2021 to early 2022, it spiked above 1,000, indicating periods of overvaluation driven by speculation.

Recently, the NVT ratio surged to around 1,800, one of its highest levels, suggesting a disconnect between XRP’s market cap and on-chain transaction volume.

Historically, such spikes have preceded price corrections. To sustain current price levels, XRP needs a sharp rise in on-chain activity.

Investors should monitor transaction volumes closely, as a failure to increase could signal a potential price pullback.

Speculation or continued momentum?

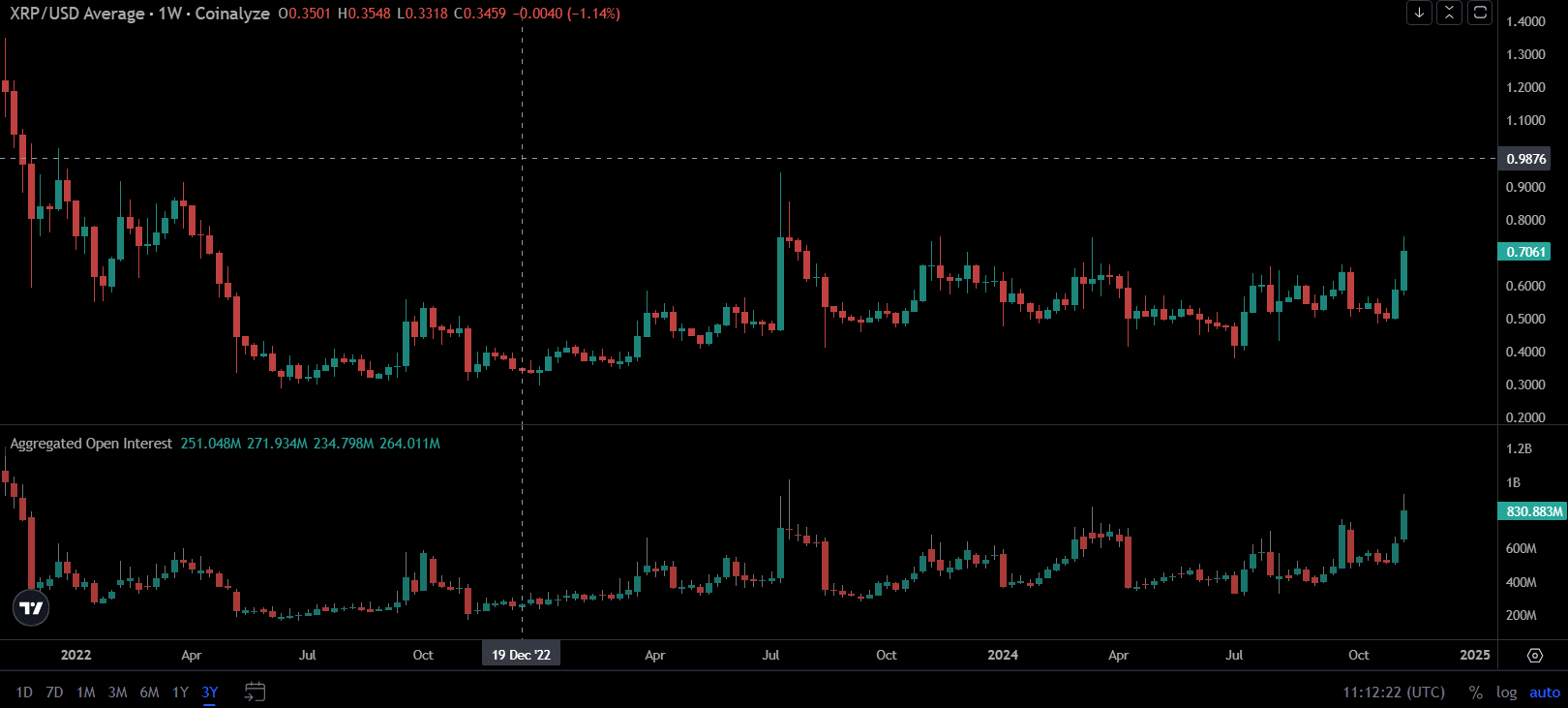

XRP’s recent price rise has been accompanied by a sharp increase in Open Interest, reaching around $830M, signaling growing market speculation and leverage.

Historically, spikes in Open Interest coincide with significant price moves, but they also raise concerns about over-leverage, which can lead to volatility or corrections.

Positive Funding Rates indicate a strong bullish bias, fueling upward momentum, but also increasing the risk of a reversal if momentum slows.

Combined with the high NVT ratio, this suggests speculative interest may be outpacing on-chain activity, raising questions about the sustainability of the rally.

Network health

XRP’s 24-hour trading volume stood at $6.81 billion at press time, according to CoinGecko.

While this high figure demonstrated significant market activity, it also warrants further analysis in the context of XRP’s overall network health.

Elevated trading volume can be a sign of growing market interest and liquidity, potentially supporting XRP’s price rise.

However, when coupled with the high NVT ratio and increasing Open Interest, this figure could also point to heightened speculation rather than organic growth driven by network utility.

Read Ripple’s [XRP] Price Prediction 2024-25

A high trading volume alongside speculative behavior often signals short-term price movements rather than long-term value appreciation.

For XRP’s price surge to be sustainable, a more balanced relationship between trading volume and on-chain activity is needed.