Odds on XRP’s price reversal are as high or low as…

- XRP continues flat negative price trends.

- Supply in profit remains over 80% despite the price decline.

XRP appears to be struggling to stabilize following a significant price decline in the past week. Considering the recent flat trend in price over the last couple of days, what does this indicate for XRP holders?

XRP continues to see bearish trends

On 12th January, a study of the XRP daily timeframe showed a decline of over 5%, dropping from around $0.6 to around $0.5. Following this decline, the price has encountered difficulty in recovering the $0.6 price level, exhibiting marginal gains and losses.

The chart showed a slight negative trend over the past three days. At the time of writing, XRP was trading at around $0.57, reflecting a 0.8% decline.

Furthermore, the Relative Strength Index (RSI) showed that XRP has experienced a bullish trend only twice this year.

Presently, the RSI was below 50 and close to 40. Furthermore, the chart showed that it was trending below both short and long-moving averages (yellow and blue lines). This indicates a weak price trend, which aligns with the observations from the RSI.

XRP holders take a 4% hit

An examination of the seven-day Market Value to Realized Value ratio (MVRV) for XRP showed that the asset has faced challenges in maintaining profitability.

The chart indicates previous instances where Ripple (XRP) trended above zero, but the recent price movement has driven it further below zero on its MVRV.

At the time of this analysis, the MVRV was recorded at above -4.6, signifying a considerable loss for current holders. This current MVRV value suggests that holders have incurred a loss exceeding 4% in the value of their XRP assets.

Supply in profit remains above 80% for now

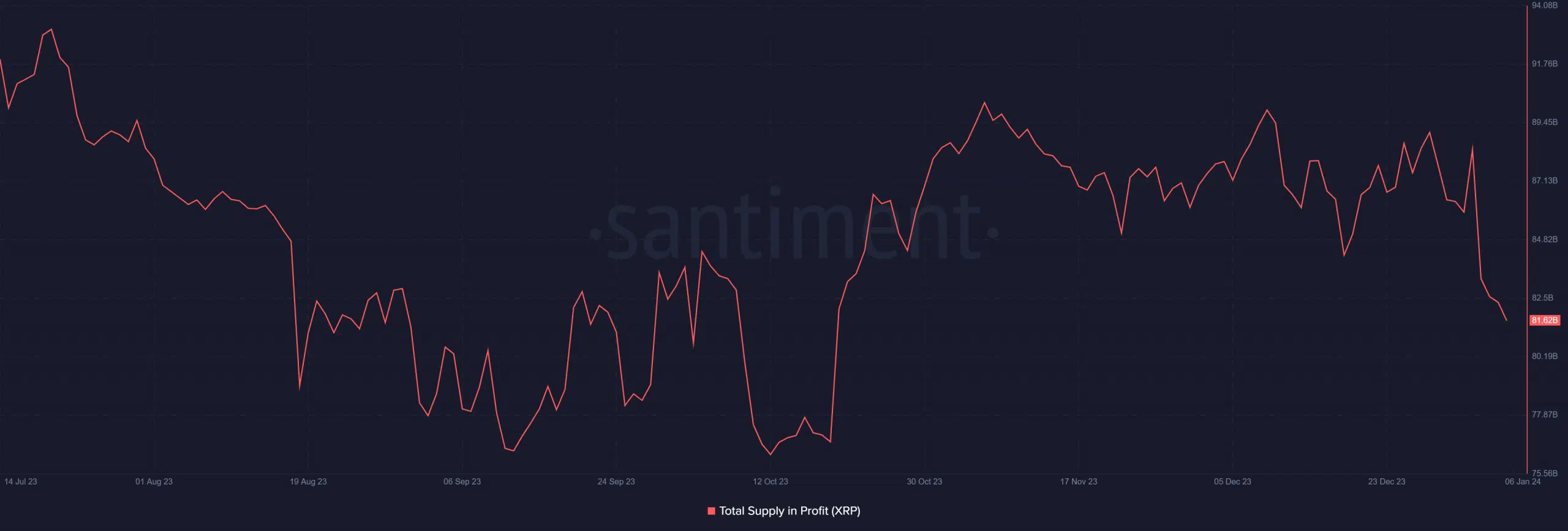

At the start of the year, the Santiment chart showed that the total supply of XRP in profit was over 88 billion. However, a noticeable decline has been evident, particularly in correlation with the falling price.

Realistic or not, here’s XRP’s market cap in BTC terms

As of this writing, the supply in profit was around 81.6 billion, constituting around 81% of the total supply. It’s worth noting that despite the decrease, this is not the lowest point the supply in profit has reached.

The lowest figure was recorded around October when the supply in profit dropped to about 71 billion, representing 71% of the total supply.