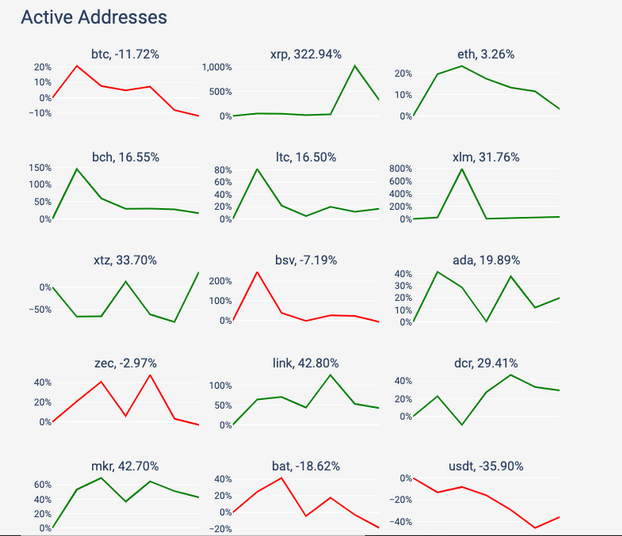

XRP records 322% growth in active addresses over the week

January continued to be a great month for the digital assets industry as the likes of Ethereum and XRP continued to record positive metrics in the market.

According to Coinmetrics’ recent report, over the past week, ETH and XRP transfers have both hiked by 10.5 percent and 20.7 percent, respectively. For Ethereum, the mining revenue also increased over the 7-day average to 15.7 percent, while the adjusted transfer value in terms of USD rose by 45.2 percent.

XRP was the leading crypto-asset in terms of growth percentage of active addresses over the past seven days. However, it is important to note that in terms of numbers, the third-largest crypto-asset had only had 10.9k addresses in the industry. The number is largely outperformed by the likes of Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Bitcoin led the way with over 726k active addresses, whereas Ethereum followed with 293k addresses. Only Bitcoin Cash was ahead of XRP, but BCH registered over 40K active addresses as well.

Source: Coinmetrics

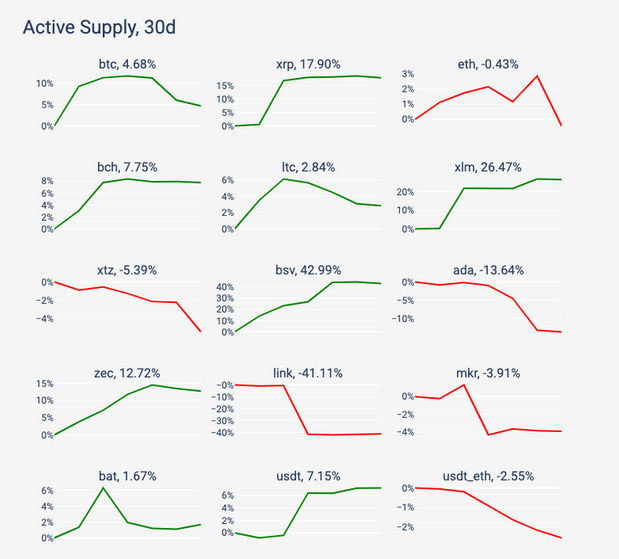

In terms of active supply, Bitcoin SV ousted every crypto-asset in the top 20, with a massive growth percentage of 42.99%. The controversial crypto-asset spiked by 300 percent over the past week, a development that played a major role in these statistics.

XLM and XRP followed with 26.47 percent and 17.90 percent, respectively, with regard to active supply, whereas Ethereum incurred a negative return of 0.43 percent.

Source: Coinmetrics

Despite leading the active supply charts, however, Bitcoin SV dipped in terms of active addresses, a development that backed the speculations that the coin’s price hike was triggered by just a few entities in the industry. Bitcoin dipped in terms of active addresses as well, even though the price hike was around 6 percent over the 7 days. XRP’s performance in terms of active addresses toppled every other crypto-asset as mentioned earlier, with Ripple’s growing list of partnerships with other firms likely supporting its growth.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)