XRP reverses July gains: When will prices stabilize?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The extended pullback threatened to claw all July gains.

- Quarterly and monthly XRP holders posted mixed performance.

Ripple’s [XRP] tidings have changed swiftly in the last few days. The euphoria in mid-July after Ripple Labs’ partial legal win dissipated afterwards. Notably, the firm termed the legal suit “propaganda” in an official report on the partial legal win.

Is your portfolio green? Check out the XRP Profit Calculator

But XRP’s price bled further, threatening to reverse July gains after the win.

Bitcoin’s [BTC] price action wasn’t impressive too. As the king coin struggled to hold on to the $29.0k mark, the weak BTC could delay a solid corrective rebound for XRP.

Sellers overwhelmed 50% Fib level

The price chart indicators underscored a strong bearish inclination. For example, the Relative Strength Index retreated steadily from the overbought zone in mid-July and was an inch away from sliding into the oversold territory at press time.

Similarly, the Chaikin Money Flow has stayed below the threshold since late July, denoting the reduced capital inflows to XRP markets. The above bearish pressure tipped XRP to crack a crucial 50% Fibonacci retracement level of $0.6751.

Above the 50% Fib level lies a bearish order block (OB) of $0.68 – $0.71(red), which could be used to track a shift in market structure. So, a price rejection at the level could be used to short the asset, with targets at 38.2% Fib level ($0.613) or the previous breaker of $0.5850.

A candlestick session close above H12 bearish OB will shift the market structure to bullish. To the north, key resistance levels lay at $0.74 and $0.83.

Quarterly holders outperformed monthly holders

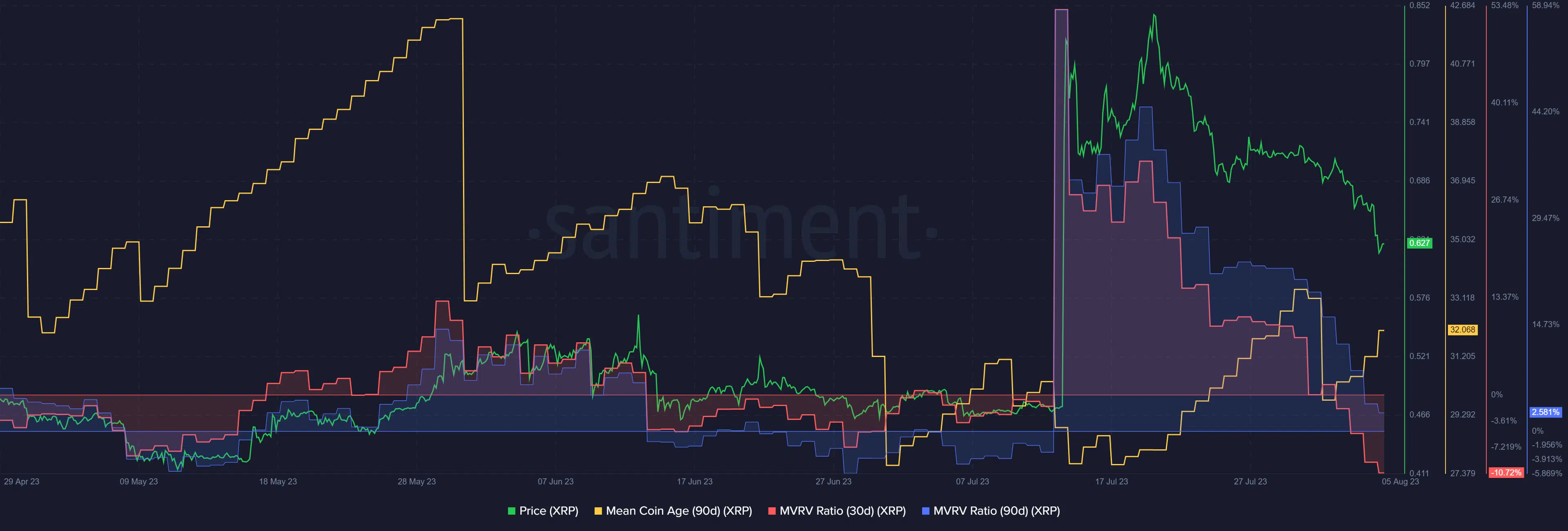

The MVRV (Market Value Realized Value), which tracks profit and loss for tokens that haven’t moved within a specific period, indicated that monthly holders suffered more losses than quarterly holders as of press time.

How much are 1,10,100 XRPs worth today?

Quarterly holders were at 2.5% profit, as shown by 90-day MVRV. But the profit was way less than the over 55% gains they had during the peak of the XRP’s hike after the partial legal win in mid-July.

However, monthly holders were in a 10% loss, as illustrated by the 30-day MVRV. Despite the dismal performance, considerable accumulation occurred during the pullback, as shown by the rising Mean Coin Age.