XRP struggles at $2.04: Why a breakout is unlikely right now

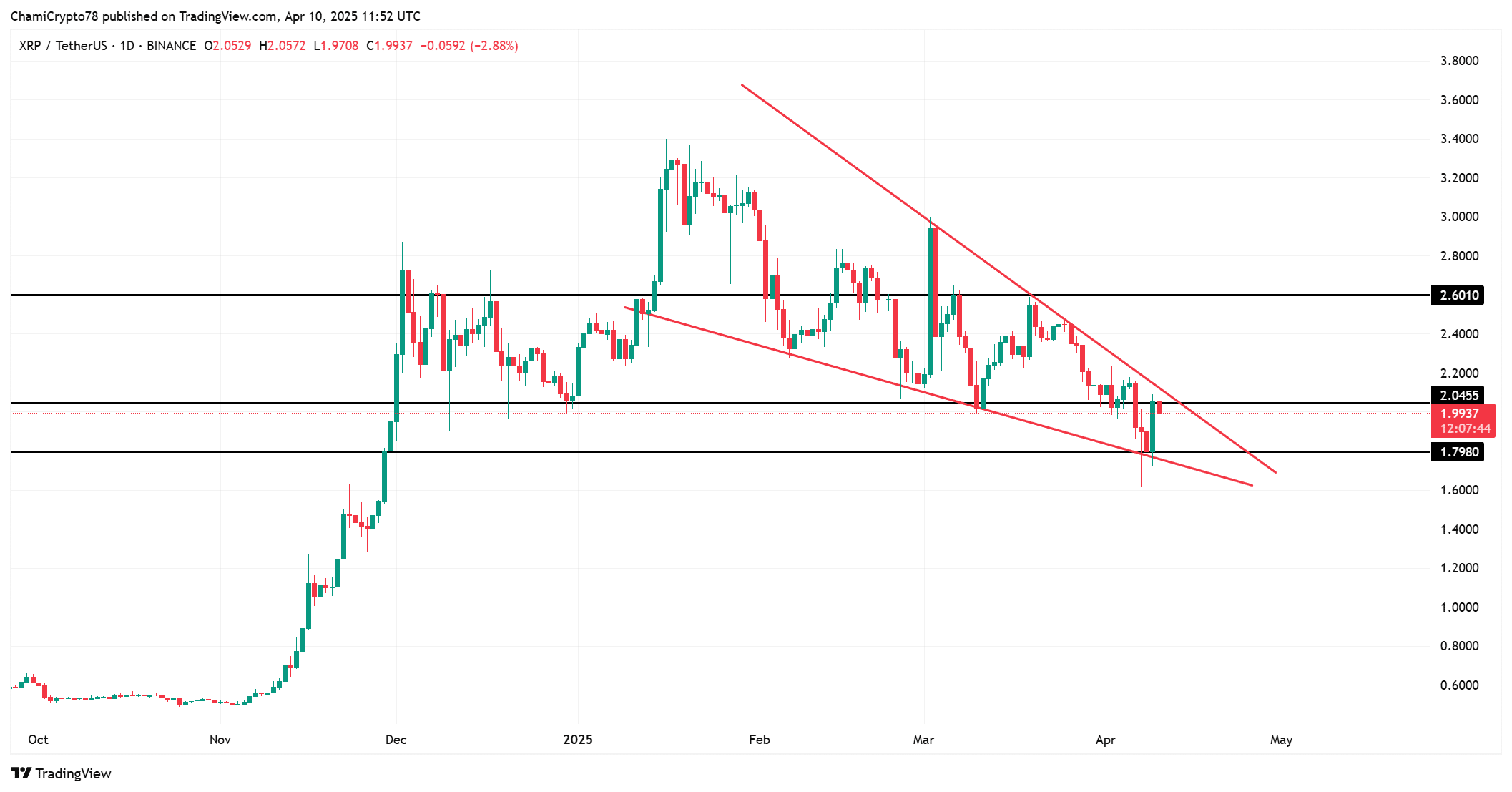

- XRP remained trapped in a falling wedge, with $2.04 acting as strong resistance.

- On-chain metrics and whale activity hint at weakness, not momentum, for a breakout.

Ripple [XRP] was trading within a defined range, at press time, with critical support levels at $1.67 and $1.39 helping bulls absorb downward pressure.

Meanwhile, strong resistance at $2.04 and $2.38 continues to reject upward moves.

At the time of writing, XRP was priced at $1.99 following an 11.49% daily gain, but this increase has not resulted in any structural breakout.

Why the technical pattern does not confirm a breakout

XRP remains confined within a falling wedge pattern that has persisted for several months. While the recent rebound from $1.79 demonstrated some strength, the price faced rejection precisely at the $2.04 resistance—the wedge’s upper boundary.

Moreover, the appearance of long upper wicks on candles near this resistance indicates strong selling pressure and limited bullish momentum.

This supports the bearish outlook for XRP, which will likely persist unless the price achieves a decisive daily close above $2.04. For now, despite occasional short-term rallies, XRP continues to trade with a downward bias.

Why on-chain activity weakens the bullish case

Beyond price action, on-chain metrics tell a more cautious story.

The price Daily Active Addresses (DAA) divergence was at -273%, which reflects a major disconnection between price and usage. XRP’s price has climbed, but user activity has stayed flat.

This disconnect often points to a rally fueled more by speculation than real demand. Additionally, similar divergence patterns have preceded reversals in the past.

The absence of strong address growth weakens confidence in this move. Therefore, unless user activity rises, the rally lacks long-term strength.

Why network value to transactions ratio signals risk

Adding to these concerns, the Network Value to Transaction (NVT) climbed to 474.93, indicating a significant overvaluation relative to XRP’s transaction activity.

Historically, high NVT readings point to market caps outpacing real network utility, which often precedes corrections.

This gap between valuation and usage must close through either increased activity or a pullback in price. Therefore, unless transaction volumes improve sharply, the current rally appears unsustainable.

Why whale activity and leveraged positioning raise red flags

On the 9th of April, Whale Alert reported a massive transaction of 230,770,000 XRP, worth over $414 million, moved between unknown wallets. Such large-scale movement typically reflects internal rebalancing, institutional shifts, or off-exchange activity.

However, without further clarity, it introduces uncertainty rather than confirming accumulation or distribution trends.

At the same time, liquidation data shows $2.1 million in long positions were wiped out compared to just $705K in shorts, signaling aggressive bullish exposure.

If XRP continues to face rejection at $2.04, more long liquidations could occur, amplifying downside pressure.

That is why both whale behavior and leveraged trading data suggest elevated risk rather than a breakout setup.

Will XRP break above $2.04 anytime soon?

XRP is unlikely to break above $2.04 in the immediate term. The rejection at the wedge’s upper boundary, weak on-chain metrics, and lack of follow-through confirm that momentum is not strong enough.

The network appears overvalued, and large whale transfers add to short-term uncertainty.

Therefore, unless both technical and on-chain conditions improve, XRP will continue to struggle below this resistance.