XRP surges, led by retail – But will THIS group cause a crash?

- Ripple’s XRP gains are shaky as short-term holders dominate, raising risks of volatility and sell-offs.

- With 62% of XRP’s realized cap in short-term hands, price drops could trigger panic-driven selling.

Ripple’s [XRP] February rally sparked retail enthusiasm, driving billions into XRP and nearly doubling its realized cap.

However, with short-term holders dominating and profit margins shrinking, the foundation of XRP’s gains looks shaky.

Now, with sentiment cooling and confidence slipping, XRP might be hitting a turning point — where all that retail hype starts running into the hard truth of fading profits and a fragile setup.

XRP’s realized cap surge

Realized cap tracks the value of XRP based on the last time each coin moved — essentially a measure of actual invested capital.

In February, XRP’s realized cap nearly doubled, jumping from $30.1 billion to $64.2 billion, driven overwhelmingly by new retail inflows.

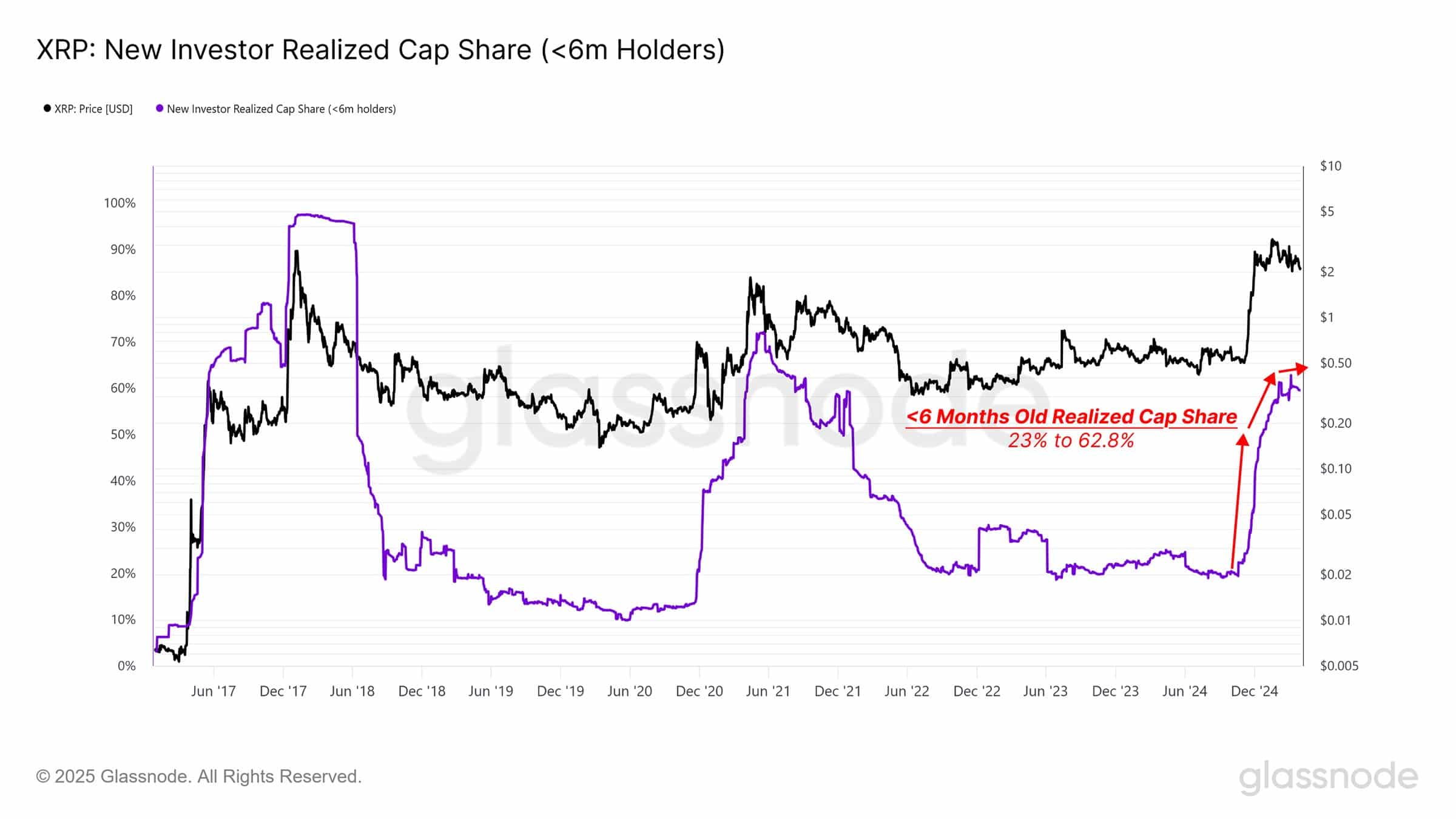

As the chart shows, tokens held for less than six months now account for 62.8% of the realized cap, up from just 23%.

This influx of short-term holders has tilted XRP’s foundation toward newer, higher-cost investors; raising the risk of sharper volatility and profit-driven selloffs if sentiment continues to fade.

The rise of retail investors

Short-term holders now account for 62.8% of the asset’s realized cap.

This sharp rise reflects an overwhelming wave of retail entry during February’s rally, where new investors chased momentum at elevated prices.

STHs are typically more reactive to market swings, prone to sell at the first sign of volatility. Data shows that the share of newly acquired XRP jumped from 23% to nearly 63% in a matter of weeks.

With wealth concentrated in these newer, more sensitive hands, XRP’s price is now far more exposed to sharp corrections and cascading sell-offs.

The profit/loss ratio

The P/L ratio is a vital gauge of market sentiment — measuring the aggregate dollar value of realized profits against losses. A sharp drop in this metric, as shown in the chart, reflects a loss of confidence among investors.

XRP’s profit/loss ratio has plunged from highs to a 90-day average of 46.1, indicative of net realized losses. This downturn coincides with a surge in short-term holder dominance, amplifying market fragility.

With newer investors now largely underwater, fear-driven sell-offs become more likely.

A closer look at downside potential

When most of the supply is in the hands of STHs, things can get shaky fast for XRP. With over 62% of the realized cap held by reactive, short-term investors, even modest price drops could trigger panic-driven sell-offs.

The falling profit/loss ratio reinforces the fragility — investors are already realizing losses, suggesting growing unease.

A sudden regulatory setback, negative market sentiment, or broader crypto pullback could act as catalysts. In such a scenario, the lack of strong LTH support may leave XRP exposed to steep and swift price corrections.