XRP: Twin trading opportunities await traders only if…

XRP’s price presents traders with an opportunity to capitalize on a quick 20% uptrend. However, informed investors can also capitalize on the 30% downtrend that will follow.

XRP fails to reap the benefits

XRP’s price action since 23 December has created three distinctive lower highs and three higher lows. This, when connected using trend lines, shows the formation of a symmetrical triangle.

This setup converges between two trend lines, squeezing the price and reducing the volatility. Hence, a breakout from the said coiling up will result in a volatile move.

Unlike other setups that have a bias, however, XRP’s price breached the lower trend line on 11 April. This suggested that a bearish trend will follow. The technical formation forecasts a 46% move to $0.362, obtained by adding the distance between the first swing high and low to the breakout point.

Since the breakdown, XRP has crashed by 56% and sliced through the $0.693 and $0.509-support levels and tagged the $0.362-barrier. A resurgence of buyers around the $0.362-level resulted in a 25% recovery rally to where the remittance token hovered at press time – $0.417.

Since BTC is looking extremely bullish and hints at a rally to $35,000, investors can expect XRP to follow its lead. Therefore, the $0.509-barrier is the most likely target the crypto will revisit. This move would constitute a 22% upswing, but bulls are likely to sustain this uptrend.

This rally is a dead cat bounce and the chances of rejection at $0.509 followed by a sell-off is what traders should expect. The best opportunity to short would be when bulls are exhausted, causing sellers to take over.

The resulting reversal could crash XRP’s price by 30% to $0.362. However, a breakdown of this level could push it down to $0.33.

The MVRV says XRP is…

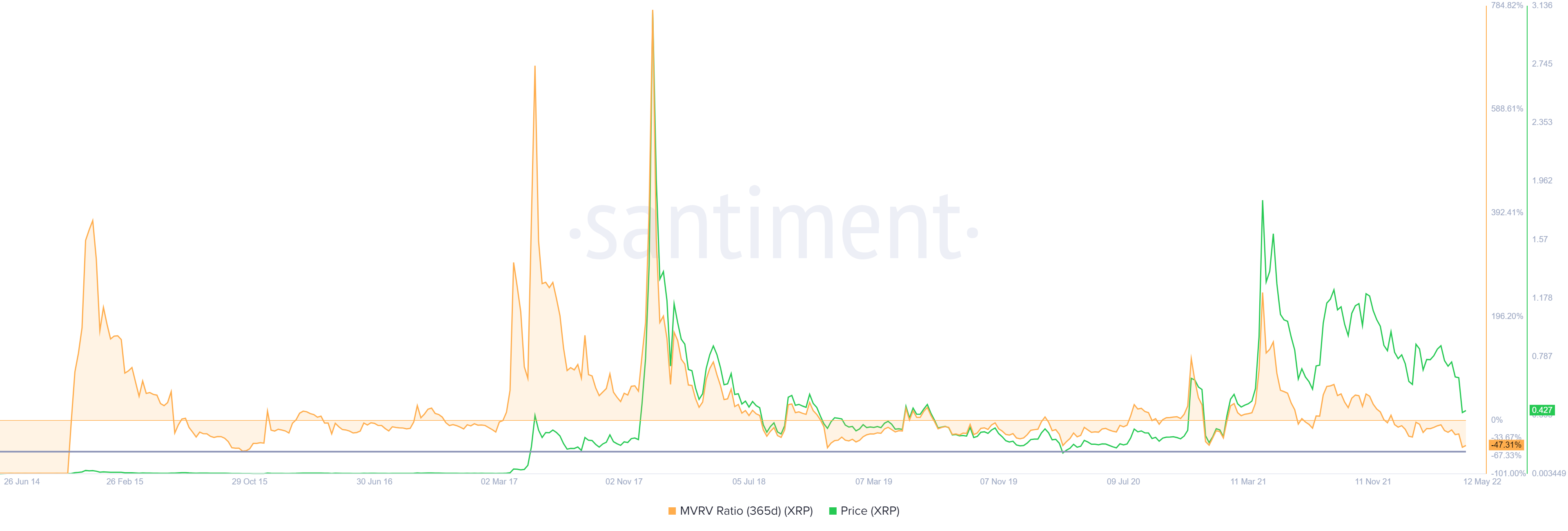

Supporting this potential move to the upside for XRP’s price is the 365-day Market Value to Realized Value (MVRV) model. This index is used to assess the sentiment of holders by measuring the average profit/loss of investors who purchased XRP tokens over the past year.

Generally, a negative value indicates that these holders are underwater and hence, a sell-off is unlikely. However, a positive value indicates that holders are in profit, which apparently increases the chances of a crash.

For XRP, the 365-day MVRV is currently hovering around -47% after a retest of the 2015 support level at -52%. Therefore, the chances of a sell-off are extremely low and it makes sense for the remittance token to trigger an uptrend. This will be in line with the forecasts from a technical perspective.