XRP witnesses steady influx of buyers despite being trapped at $0.5

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- XRP has a firm bearish structure on the higher timeframe charts.

- It was unclear if the short-term demand could turn the tides for the asset.

XRP whales could have increased their holdings over the past week as data showed whale transactions had risen. The short-term price action lacked a strong trend, but the higher timeframe charts showed a bearish bias.

Read XRP’s Price Prediction 2023-24

The price action hinted at new lows for XRP not seen since March. This was because XRP bulls were unable to defend key areas of interest on the chart in August. Can the buyers drive a recovery, or do the sellers still have the upper hand?

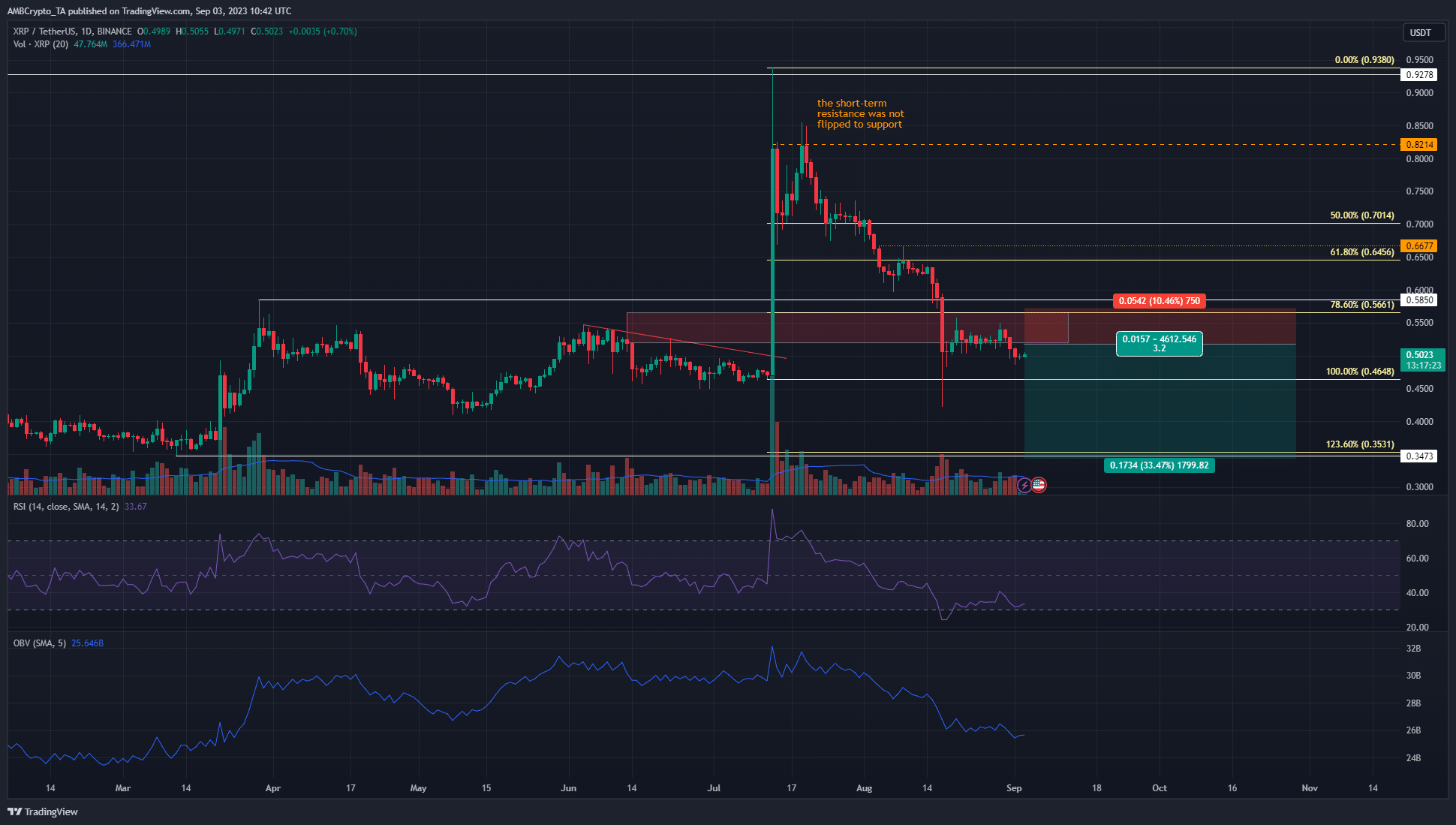

The Fibonacci levels laid out a strongly bearish scenario for XRP

Based on the surge from $0.4648 to $0.938, a set of Fibonacci retracement levels were plotted. The 78.6% level sat at $0.56 and had confluence with a bullish order block from mid-June. The waves of selling pressure in August saw both of them flipping to resistance.

Therefore, it was now likely that the 23.6% extension level to the south was the target for the XRP bears. The market structure and trend agreed, and the OBV showed consistent sell pressure over the past month.

Therefore, a shorting opportunity for swing traders was present. This idea would be invalidated upon a move above the $0.56-$0.57 area. The target is the $0.353 level, which was also close to the XRP low from March.

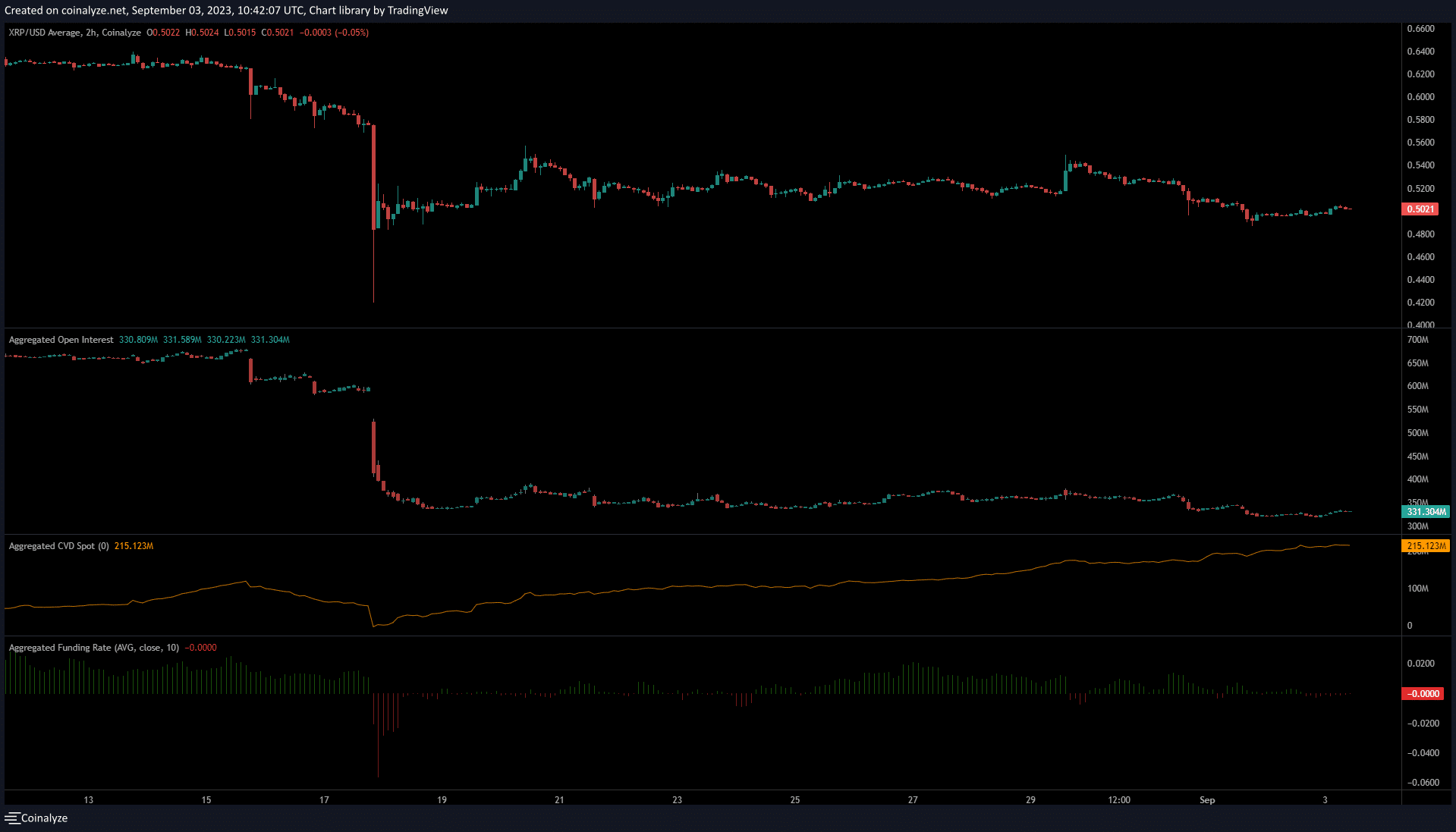

The Open Interest refused to budge but buyers are coming in

Source: Coinalyze

Since 18 August the Open Interest has remained flat. The price action also showed no strong short-term trend. This signaled a lack of conviction from speculators, but it was important to note that the sentiment wasn’t yet bullish.

Is your portfolio green? Check the XRP Profit Calculator

On the other hand, the spot CVD has trended higher since 18 August to signify a steady inflow of capital to the market. It was evidence of buyers entering long-term psychological support- but will these buyers be vindicated?

An XRP move above $0.57 would be the first step, at which point traders can assess if the conditions were favorable for the bulls.