XRPL posts lowest monthly volume in 22 months – Why?

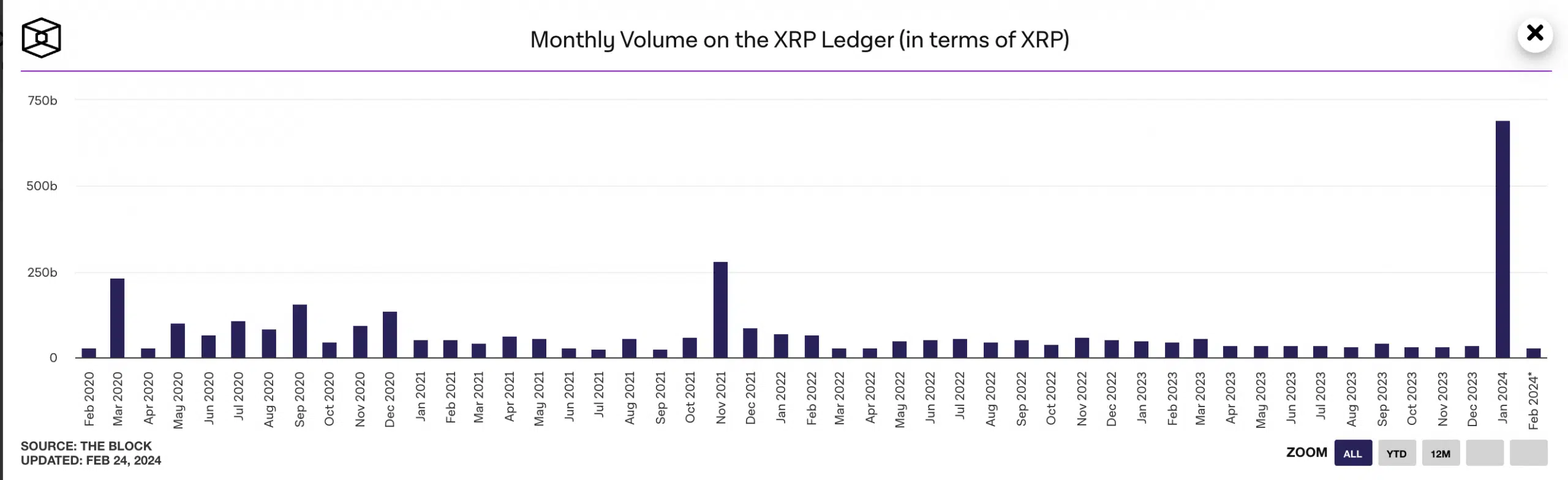

- XRPL’s monthly transaction volume totaled 26 billion XRP in February.

- This represented its lowest since April 2022.

The XRP Ledger [XRPL] is poised to close February with its lowest monthly volume, as measured in XRP, since April 2022, according to The Block Data dashboard.

With four days till the end of the month, the total value moved in XRP transactions on the open-source and decentralized blockchain has totaled 26 billion XRP.

This decline comes after the network recorded an all-time high of 691 billion XRP in monthly transaction volume in January.

AMBCrypto reported earlier that this milestone occurred despite an attempted hack on cryptocurrency exchange Bitfinex on the 14th of January through the “Partial Payments Exploit” feature.

According to The Block, the last time XRPL’s monthly transaction volume was below 30 billion XRP was in April 2022, when its transaction volume within the 30-day period totaled 26 billion XRP.

Are the bears making a comeback?

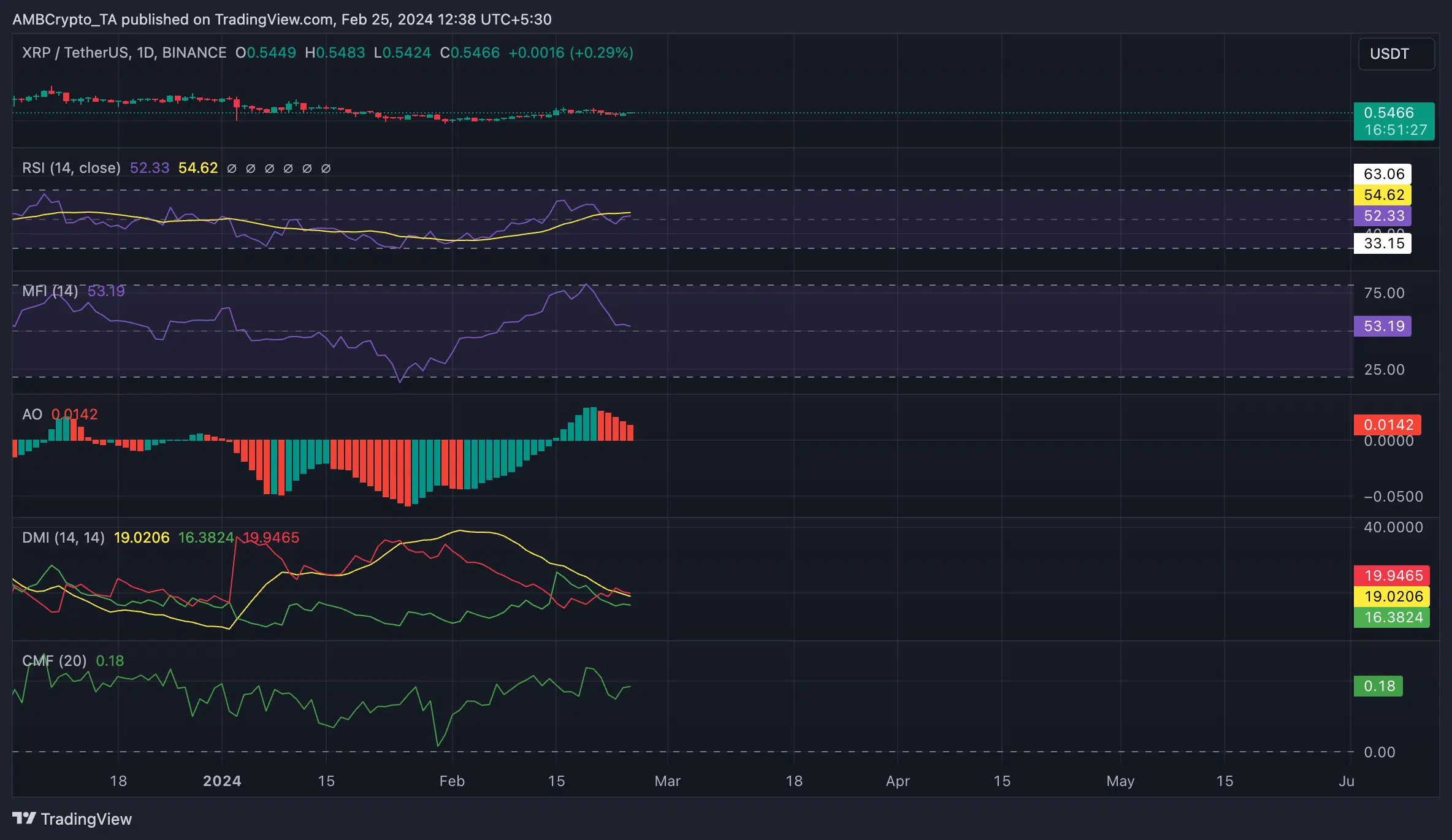

AMBCrypto’s assessment of XRP’s performance on a daily chart revealed that a bearish crossover between its positive directional index (green) and negative directional index (red) occurred on the 20th of February.

When such readings are made from an asset’s Directional Movement Index (DMI), it suggests a weakening of upward momentum and a potential shift towards a bearish trend.

In addition, the token’s Awesome Oscillator indicator has posted only red upward-facing histogram bars since the 20th of February.

This meant that despite the generally bullish outlook, the XRP market still harbors some bearish elements.

However, despite this, token accumulation remains steady among spot market participants.

At press time, XRP’s Relative Strength Index (RSI) and Money Flow Index (MFI) returned values of 52.33 and 53.19, respectively.

Above their respective center lines, these indicators showed that buying pressure was beyond token selloffs.

Also, XRP’s Chaikin Money Flow (CMF) was 0.18. A CMF value above zero is seen as a sign of strength in the market.

The rising positive CMF value suggested a steady inflow of liquidity needed to maintain XRP’s 30-day-long price rally.

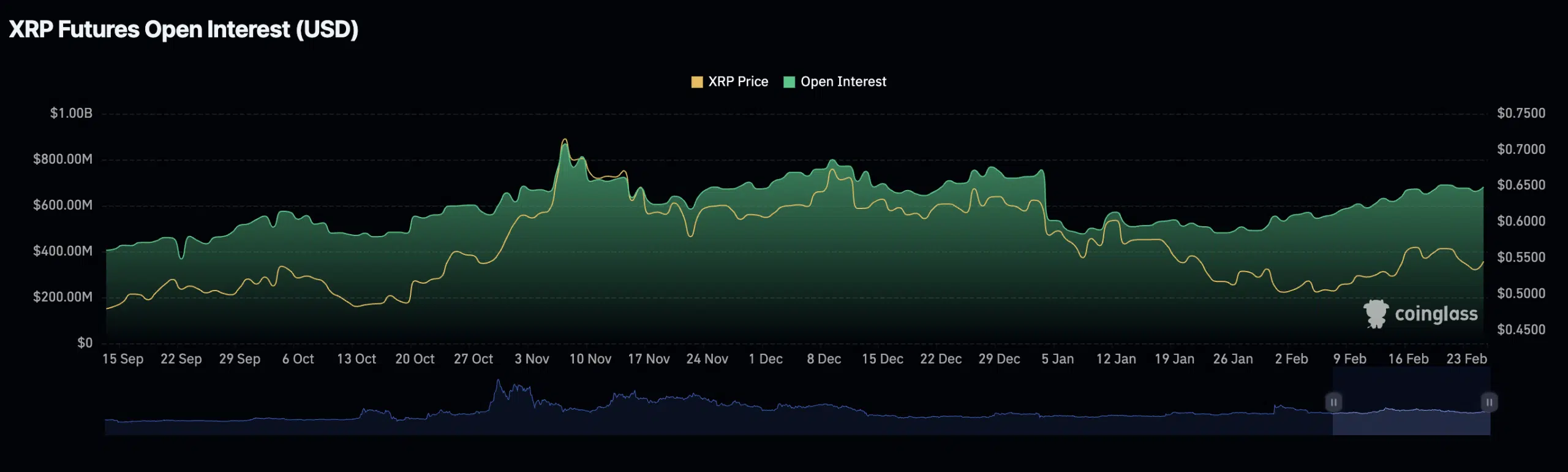

Regarding activity in the token’s derivatives market, its Futures Open Interest has increased since the month began.

Read Ripple’s [XRP] Price Prediction 2024-2025

At $681 million as of this writing, XRP’s Futures Open Interest has climbed by 28% since the 1st of February, per data from Coinglass.

This and the significantly positive Funding Rates recorded across derivate exchanges showed that XRP investors continue to open trade positions in favor of sustained price growth.