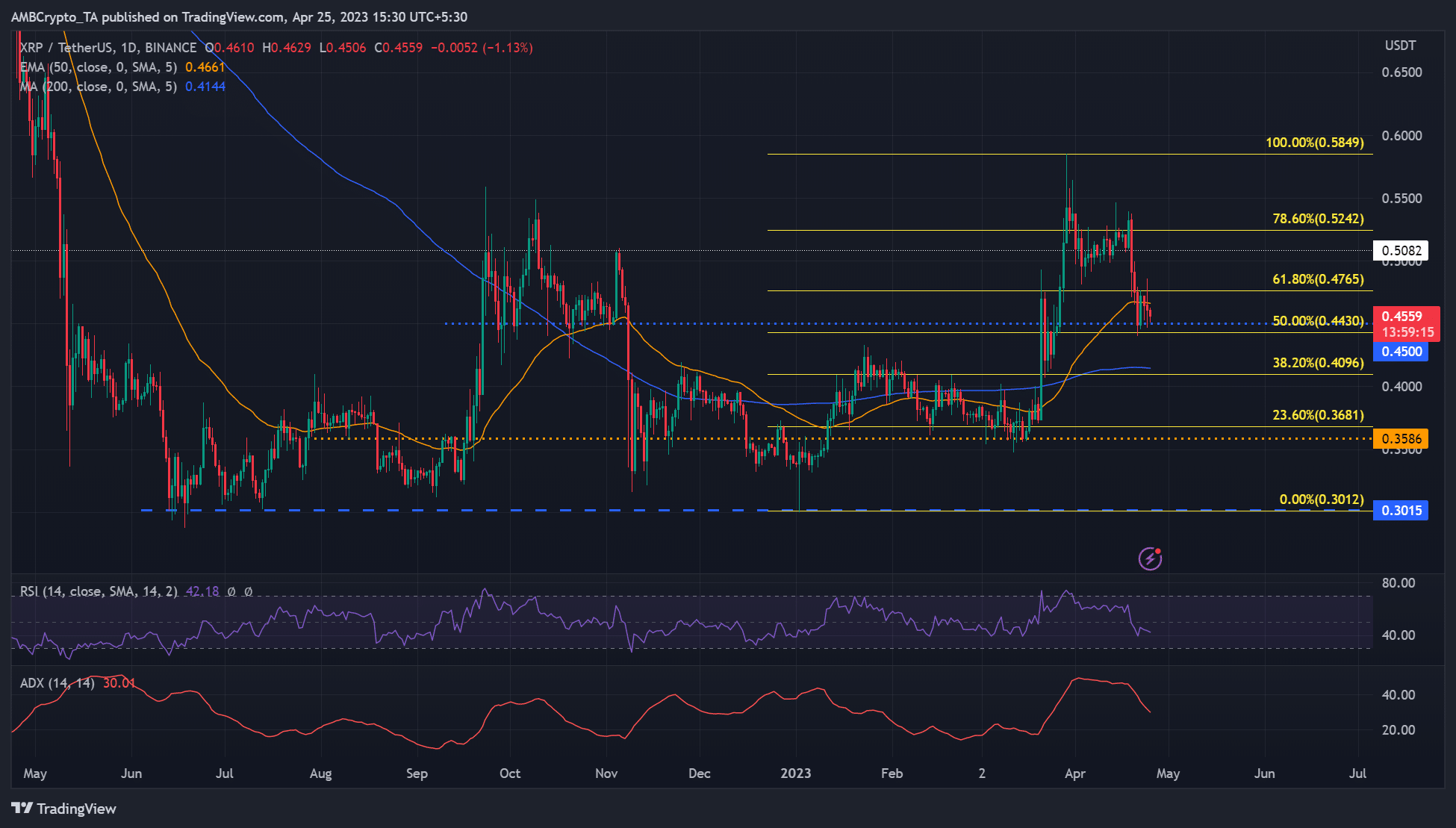

XRP’s plunge hit $0.4500 support – Here are key levels to consider

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- XRP was bearish on the daily chart at press time.

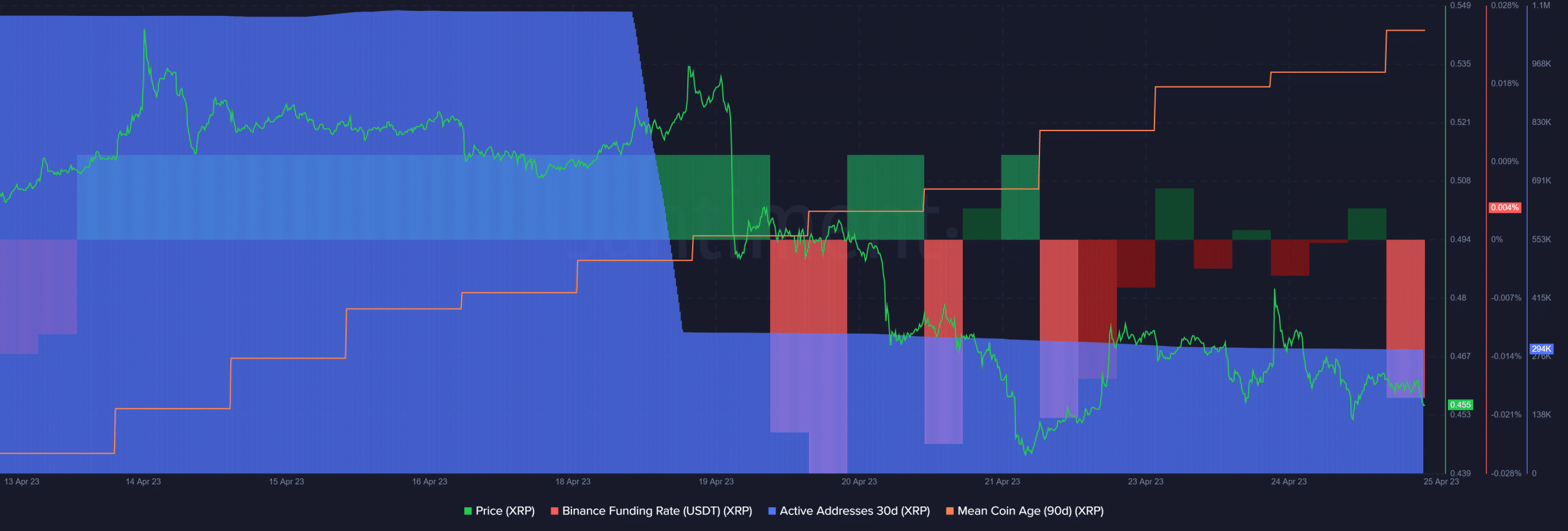

- Mean coin age rose; active addresses and funding rates dipped.

Ripple [XRP] surged beyond half-dollar value at the end of March but shed over 20% following intensified selling wave. On 21 April, sellers breached the 50-EMA ($0.4661) but faced resistance at the $0.4500 support level.

The support also aligns with the 50% Fib pullback level and could stall sellers, especially if Bitcoin [BTC] doesn’t fall below the $27k price range.

Read Ripple [XRP] Price Prediction 2023-24

Will the $0.4500 support hold?

Technical indicators on the daily chart leaned towards sellers, but price action showed indecision between buyers and sellers. Notably, the 200-MA (blue line) and 50-EMA (orange line) were flat, meaning long and short trends were in agreement with a lack of clear price direction.

In addition, the ADX (Average Directional Index) retreated – suggesting a likely consolidation or extended downtrend, while RSI was below the neutral level, showing sellers had the upper hand.

As such, XRP could trade sideways between 50% ($0.4430) and 61.8% ($0.4765) for a while before sliding to the $0.3586 – $0.4500 range.

Note that the 38.2% Fib level also aligns with the 200-MA and could offer resistance to an extended drop. A close below the hurdle would attract more aggressive selling.

Alternatively, XRP could close above the 61.8% Fib level of $0.4765 if $0.4500 support is secured. Such a move could make the pair retest the half-dollar value again at $0.5082 or 78.6% Fib level ($0.5242).

Daily active addresses and funding rates declined

Is your portfolio green? Check XRP Profit Calculator

XRP’s active addresses surged to over one million during mid-April. However, the number has since dropped to below 400K at press time, more than a 50% drop in active addresses, impacting trading volumes and providing more leverage to sellers.

In addition, the funding rates turned negative at the time of writing – a dip in demand for XRP in the derivatives market and a bearish sentiment.

But the 90-day mean coin age rose, highlighting increased accumulation in the past few days – evidence of a likely rally that could offer slight hope to bulls. Investors should track BTC price action and new developments on the SEC lawsuit before making moves.