As UNI seeks respite, Uniswap achieves key milestone: The chances of a reprieve are…

- Uniswap celebrated a new milestone as volume soared to historic highs.

- UNI retested short-term support, but bearish sentiments prevailed.

There’s no doubt that the crypto market has been choppy lately, and DeFi platforms such as Uniswap [UNI] are feeling the heat, as evident in UNI’s price action. Despite that, Uniswap was celebrating an important milestone at press time.

Is your portfolio green? Check out the Uniswap Profit Calculator

Uniswap’s latest update revealed a steady volume uptrend over the years. The same volume metric recently crossed above $1.5 trillion, which marks an important milestone.

The Uniswap Protocol has officially passed $1.5T in trading volume ? pic.twitter.com/Fjd8IP7ngc

— Uniswap Labs ? (@Uniswap) April 24, 2023

The above milestone was aided by a surge in the number of Uniswap active users since mid-April. Uniswap’s TVL also achieved some upside since the start of 2023. However, recent market events triggered some TVL losses in the last few days, from as high as $4.41 billion to $4 billion.

Source: DeFiLlama

UNI bears extend their dominance

Uniswap’s TVL reflected the bearish market conditions that prevailed in the last few days. Its native token, UNI, has been on a bearish trajectory since 19 April, the same day that its TVL started falling. The token’s $5.30 press time price tag represents an 18% pullback in the last seven days.

Source: TradingView

UNI is currently resting on a short-term support level, which means that a bullish bounce back might be in the cards if it secures enough accumulation. Nevertheless, UNI traders should note that bearish sentiments and a lack of market confidence have resulted in weak support and more downside for many top coins.

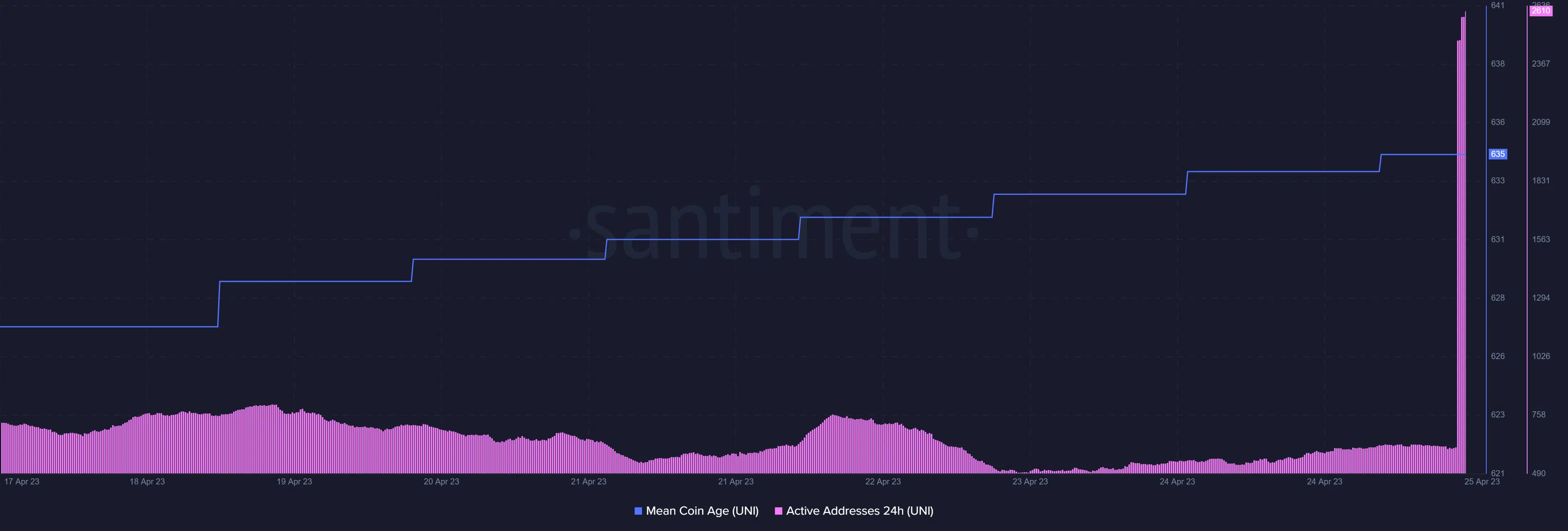

UNI still has some room for more downside before it dips into oversold territory. If the current support level fails, the next one will be near the $5 price zone, where it demonstrated support in November and December. A look at UNI’s daily active addresses metric reveals a surge within the last 24 hours at the time of writing.

How many are 1,10,100 UNIs worth today?

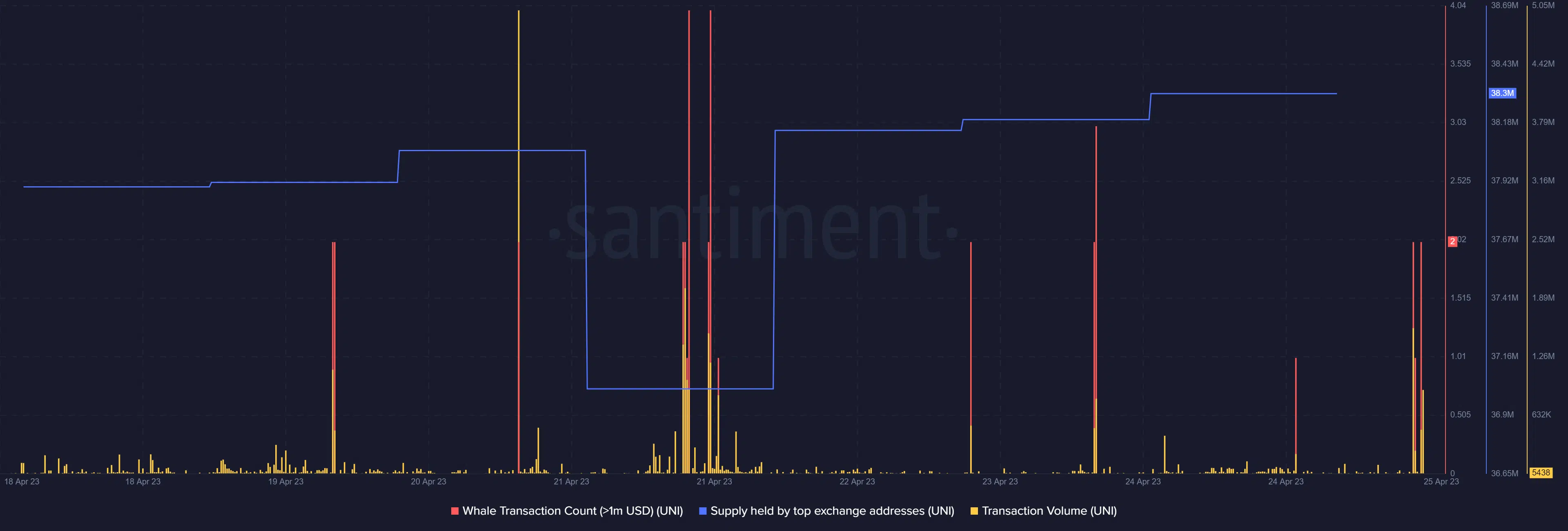

This surge may reflect buying momentum at the support level. UNI’s mean coin age maintained an upward trajectory despite the sell pressure that occurred during the last seven days. So, what is happening at the support level? Well, on-chain data reveals a surge in whale transaction count (above $1 million).

Also worth noting is that there was a transaction volume surge in the last few hours and top exchanges have been accumulating in the last four days. The next 24 hours will determine whether the bulls or the bears emerge victorious.