XRP’s range-bound price action: Will whales tip the scales?

- There was evidence for whale accumulation based on XRP supply distribution

- The social metrics and network activity showed bulls likely don’t have the strength for a resurgence

Ripple [XRP] was trading within a ten-month range and has been in the lower half of the range since mid-April. The Open Interest remained uninspiring as a consequence. Whales continued to accumulate the token regardless.

A recent AMBCrypto report explored the potential for a bullish trend shift. The drop in supply on exchanges suggested accumulation, but this might not be enough for a recovery.

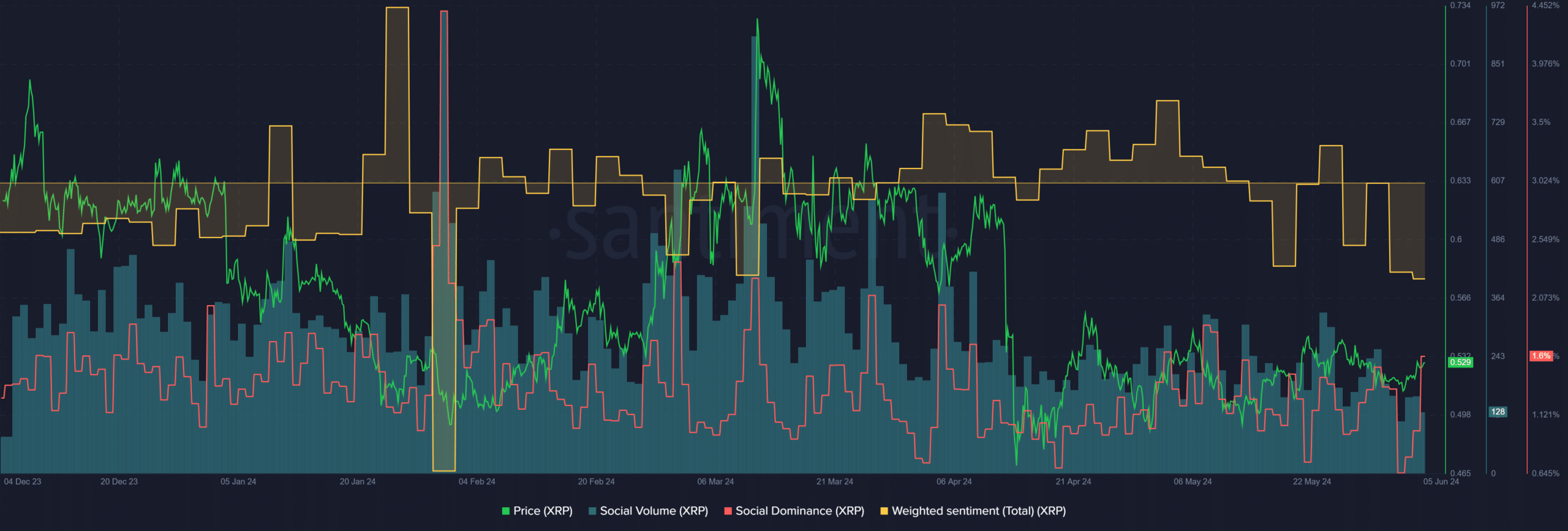

The social media engagement was in a decay

Source: Santiment

The 3-day interval weighted sentiment has been negative for most of the past month. It was positive in April despite the fall below the mid-range support level at $0.58.

This enthusiasm has waned since then. The bearish engagement has begun to dominate.

The social volume trend has not changed since early April, but the volume was lower than March’s. This was understandable as the altcoin hype has quieted down and the price action was subdued.

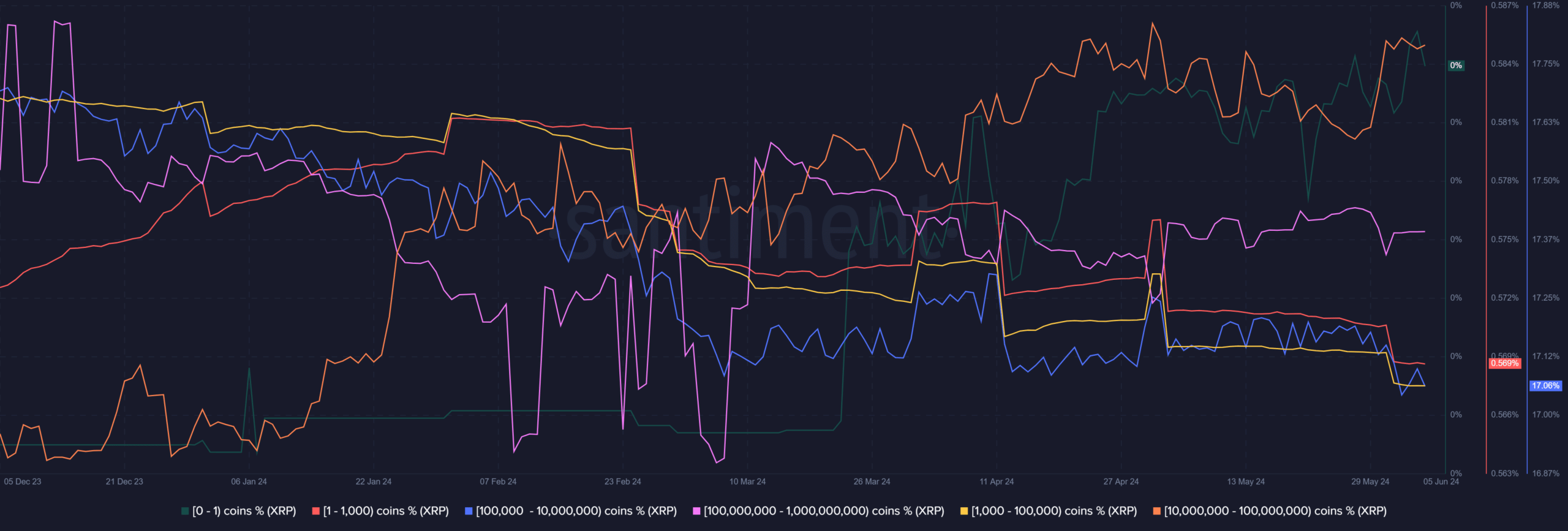

Source: Santiment

The supply distribution showed that almost every bracket of XRP holders was selling except for the very largest ones with 10 million or more tokens. On the other end, holders with 1 or fewer XRP also trended higher.

This finding is in line with the earlier reports of whale accumulation and less XRP supply on exchanges ready for selling. It was a positive sign, but the lack of holder conviction among smaller wallets in the past two months might be a concern.

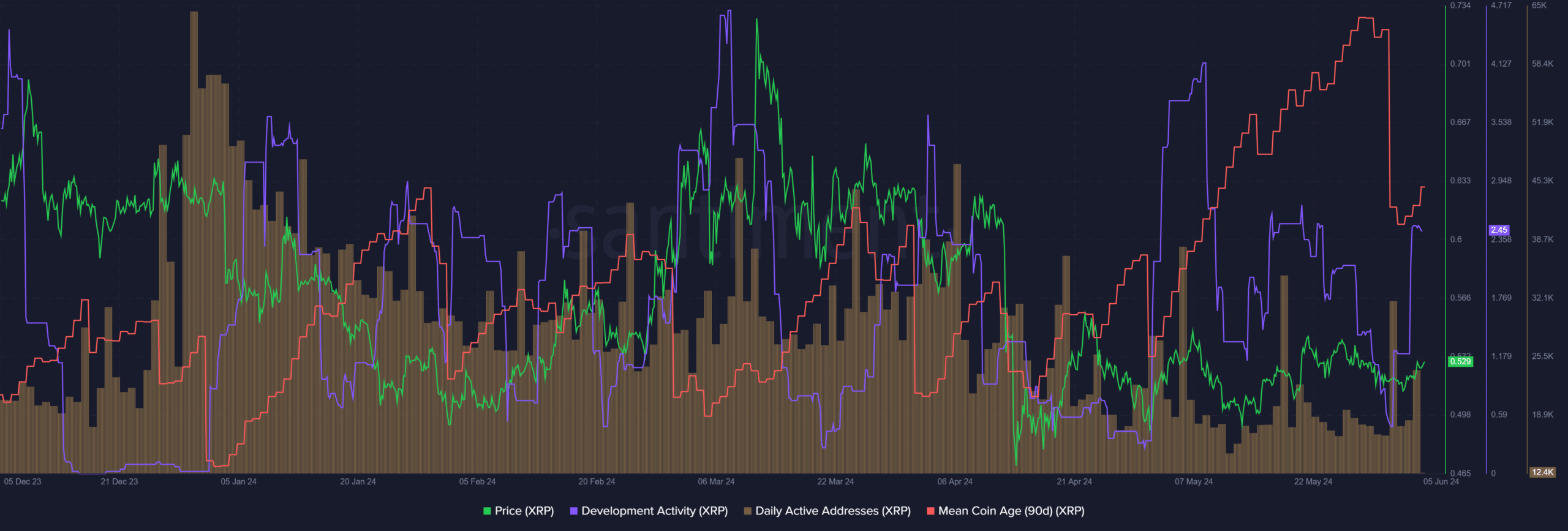

The mean coin age dip could be bad news in the short-term

Source: Santiment

The development activity trend has been steady. However, the activity count was extremely low, standing at 2.5 at press time and posting a high of 4.67 in March. To compare, Ethereum [ETH] has 48.7 and Cardano [ADA] at 62.9.

The daily active addresses have trended downward with occasional bouts of increased activity.

Realistic or not, here’s XRP’s market cap in BTC’s terms

The mean coin age had trended strongly higher in the past six weeks but tumbled in the past few days, hinting at a large movement of previously dormant tokens.

Overall, XRP bulls have an uphill battle ahead. Like the previous cycle, the token might be dormant for most of the bull run and wake up in the final two months to register triple digit percentage gains.