Here’s where zkSync has beaten Ethereum

![zkSync defeats Ethereum [ETH] on key metric, attracting a wider user base](https://ambcrypto.com/wp-content/uploads/2023/05/ETH.png)

- For the second time, a roll-up’s daily active addresses surpassed those of Ethereum.

- Sentiment around ETH remained negative last week, but network growth and funding rates were high.

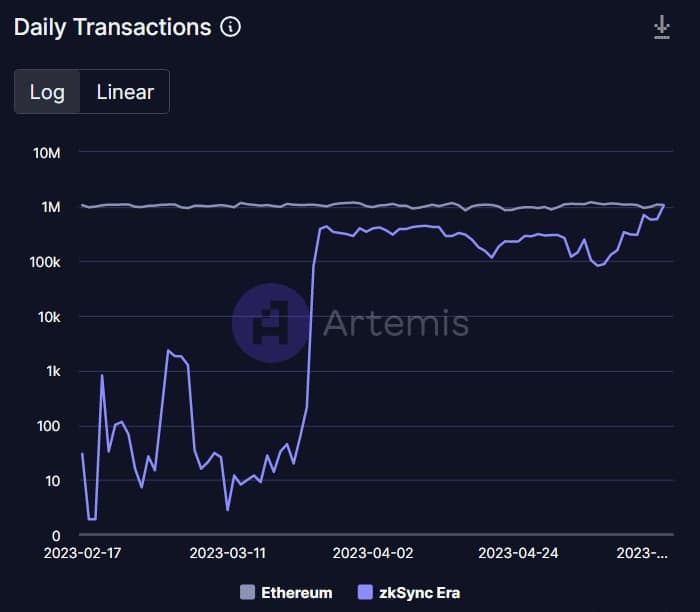

Ethereum’s [ETH] daily active addresses were stagnant for quite a few months. While ETH’s metric plateaued, roll-ups, on the other hand, flourished.

Is your portfolio green? Check the Ethereum Profit Calculator

Artemis posted a tweet on 17 May mentioning that for only the second time in its history, Ethereum mainnet daily active addresses were flipped by a roll-up that settles directly to it.

For only the second time in its history, Ethereum mainnet daily active addresses have been flipped by a roll-up that settles directly to it

DAU

? zkSync Era: 358K

? Ethereum Mainnet: 323K

? Arbitrum: 218K pic.twitter.com/iryoDVmgvo— Artemis ? (@Artemis__xyz) May 17, 2023

Who outshined Ethereum?

The roll-up that overtook Ethereum was zkSync Era. For starters, zkSync Era is a Layer-2 protocol that scales Ethereum.

It was interesting to see that not only did zkSync outperform ETH in terms of daily active addresses, but their daily transactions were also very close to each other.

However, Ethereum was way ahead of zkSync on other fronts. For example, while ETH boasted a TVL of more than $27 billion, zkSync’s TVL stood at just about $108 million.

Additionally, Ethereum’s DEX volume also remained considerably higher than that of zkSync’s.

Does zkEVM stand a chance?

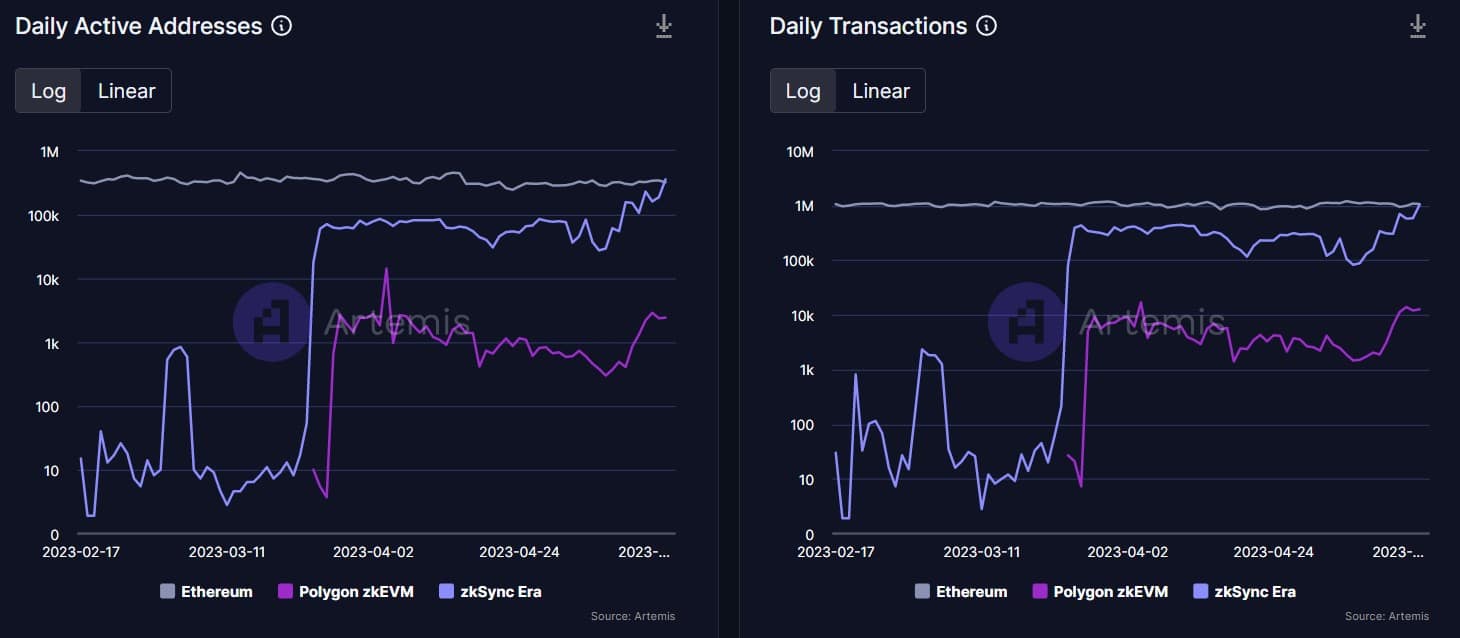

Polygon’s [MATIC] zkEVM recently made news as its transaction volume reached a new all-time high. Not only that, but the roll-up’s TVL also registered growth of more than 100%.

However, when put head-to-head against ETH and zkSync, zkEVM’s performance was not comparable. As per Artemis, zkEVM’s daily active addresses and daily transactions were both considerably lower than that of the other two.

A look at Ethereum’s state

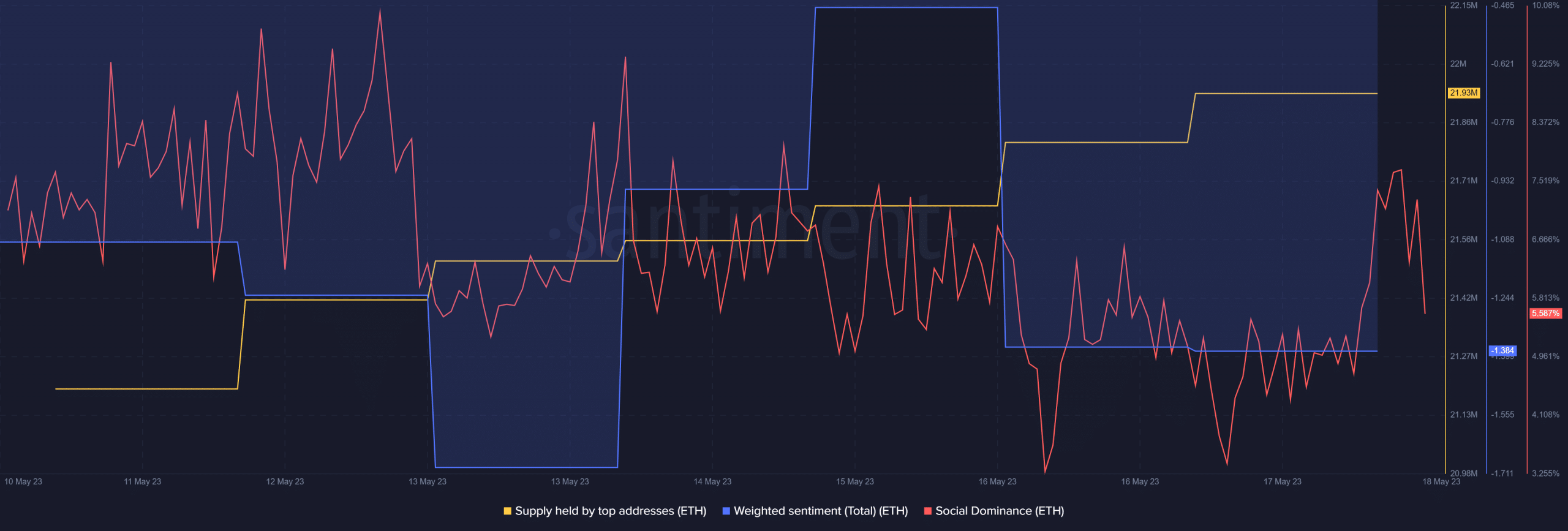

ETH’s price action has turned sluggish of late. According to CoinMarketCap, ETH’s price moved marginally over the last week.

At the time of writing, ETH was trading at $1,824.01 with a market capitalization of over $219 billion. Ethereum’s social dominance remained low for most of the days during last week.

Negative sentiments around the token dominated the market as evident from its weighted sentiments. However, it was interesting to see that the investors were confident in ETH as its supply held by top addresses went up.

Read Ethereum’s [ETH] Price Prediction 2023-24

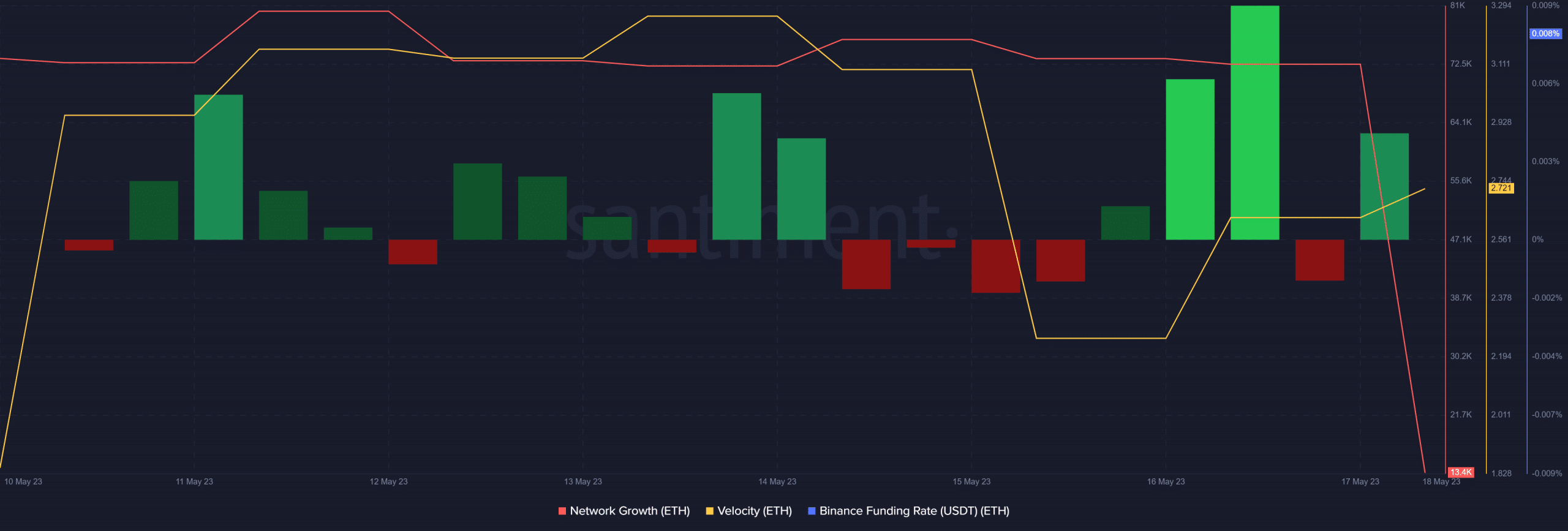

ETH’s health remains fine

Though the market sentiments around ETH were negative, its network health looked decent. For instance, Ethereum’s network growth was high, suggesting that new addresses were created.

Moreover, its velocity also followed the same trend. A higher velocity means that a token is used in transactions more often within a set time frame. ETH’s Binance funding rate was also green, reflecting its demand in the futures market.