Ethereum, Bitcoin users rush to Solana [SOL] as they seek…

![Solana [SOL] welcomes Ethereum, Bitcoin users seeking refuge from high fees](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_A_bustling_metropolis_of_digital_transactions_comes_a_798d6665-31ed-49cf-9444-0d04ed9d02ca.jpg.webp)

- High transaction fees on Ethereum and Bitcoin have led to increased network activity on Solana.

- While network activity sees growth, other ecosystem metrics experience a decline.

Solana saw an influx of new users as high transaction fees on Ethereum [ETH] and Bitcoin[BTC] drove new demand to the Layer 1 (L1) network, data from The Block showed.

Read Solana’s [SOL] Price Prediction 2023-24

On the Ethereum network, the meme coin craze led by the unprecedented rally in the price, trading volume, and market capitalization of frog-themed Pepe (PEPE) situated a spike in transaction fees on the chain.

According to data from Messari, average transaction fees rallied to a high of $27.61 on 9 May, its highest level since May 2022.

As for the Bitcoin network, the introduction of Ordinals and BRC-20 tokens led to a significant increase in network activity and fees on the chain.

Data from Messari further showed that the average transaction fees on the chain went as high as $30 on 8 May, its highest since April 2021.

SOL emerges as the winner

Intending to find blockchain networks that offer lower transaction fees, users have been moving away from Ethereum and Bitcoin.

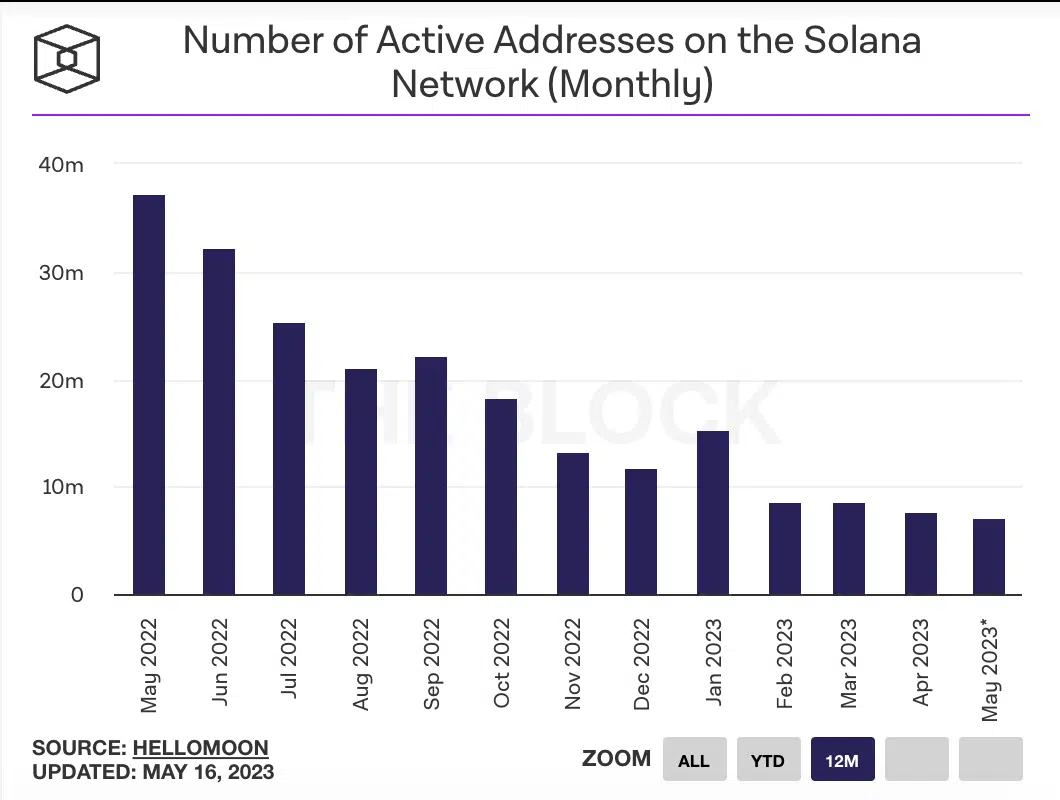

Solana emerged as a top contender in this quest, garnering increased attention and leading to a rise in the number of active addresses on its network. Data from The Block revealed a 113% increment in the count of daily active addresses on the chain.

Assessed on a month-over-month (MoM) basis, Solana recorded a total of 7.72 million active addresses in April. Interestingly, with about two weeks left to go in May, the chain has already seen 7 million active addresses.

Additionally, data from The Block showed that new address count on the chain has grown significantly since the end of April.

New users flock in

In May, Solana witnessed the creation of 4.19 million new addresses, surpassing the count of 3.76 million new addresses that joined the network in April.

This surge in new address creation on the L1 network highlights the growing adoption of the platform amid high transaction fees on the Ethereum and Bitcoin networks.

However, while Solana’s network activity has experienced growth since the end of April, data from Artemis revealed a decline in other ecosystem metrics.

For example, according to the on-chain data, the network’s total value locked (TVL) was on a downtrend since 19 April. At $269.78 million at press time, it has since fallen by 8%.

Realistic or not, here’s SOL’s market cap in BTC terms

Likewise, the decentralized exchanges (DEXes) housed within the L1 network suffered a drop in transaction volume since the month started. Per data from Artemis, DEX volume on Solana has plummeted by 66% since the beginning of May.

Regarding the chain’s native coin SOL, trading at $20.73 at press time, its value declined by double digits (17%) in the last month.