Ethereum Classic: Reasons why you can consider shorting ETC now

Ethereum Classic [ETC] just concluded its most bullish week in the last three months. It managed to pull off a 120% rally from $12.47, its lowest price point during the 2022 bear market.

The alt is now showing signs of a potential retracement, which is normal due to profit-taking after such a sizable rally.

Well, ETC’s impressive rally facilitated a recovery above the 50-day moving average, and briefly pushed above the 200-day moving average.

Even more interesting is that ETC bulls managed to push back above the cryptocurrency’s lowest levels in January.

Notably, not many cryptocurrencies managed to recover above their January lows during the latest bullish uptick.

ETC traded at $26.20 on 24 July after a slight pullback from its recent top at $28.19.

This price level is within the 0.382 Fibonacci retracement level.

The slight retracement and increased friction near the Fibonacci line is a sign of increased selling pressure.

There are also some signs that a bigger retracement is coming. For example, the price managed to push up to a higher local top while the RSI dropped.

This signifies trend weakness, hence the bullish uptick is already on the tail end. The outflows registered by the MFI reflect the profit taking at the top of the trend.

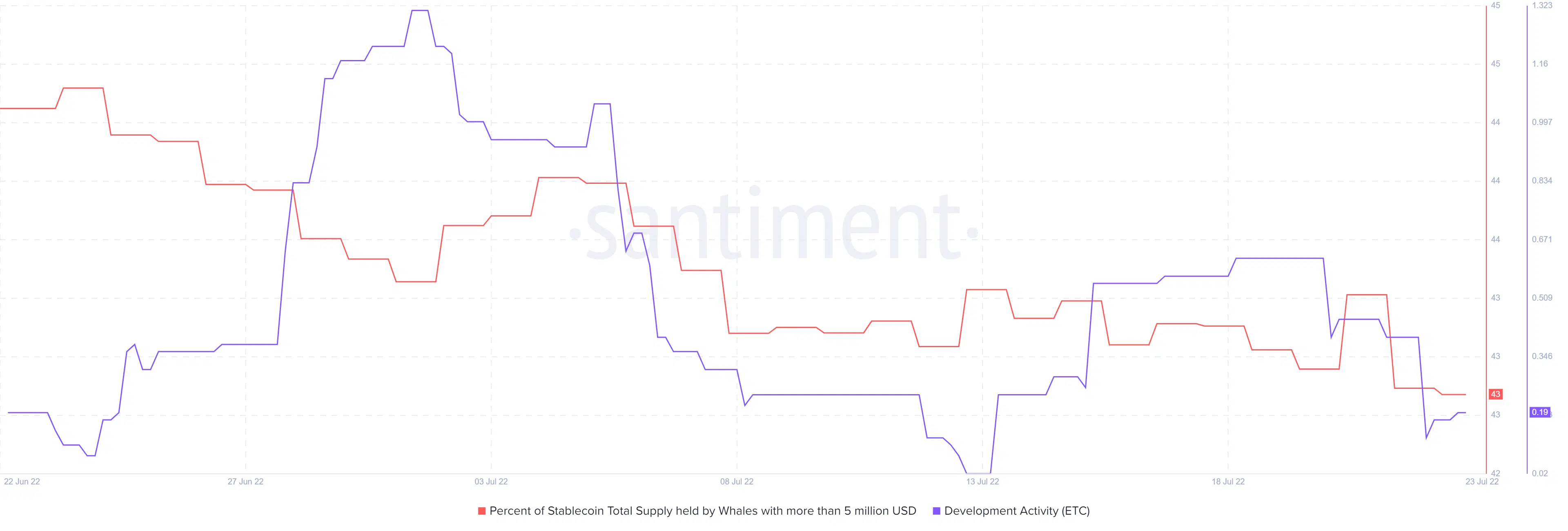

The bearish expectations are further supported by outflows from whale addresses.

The total supply held by whales metric registered significant outflows since 21 July.

This outcome means ETC will likely continue to experience more selling pressure in the coming days.

This is also backed by a drop in development activity.

Can the bulls keep up the fight?

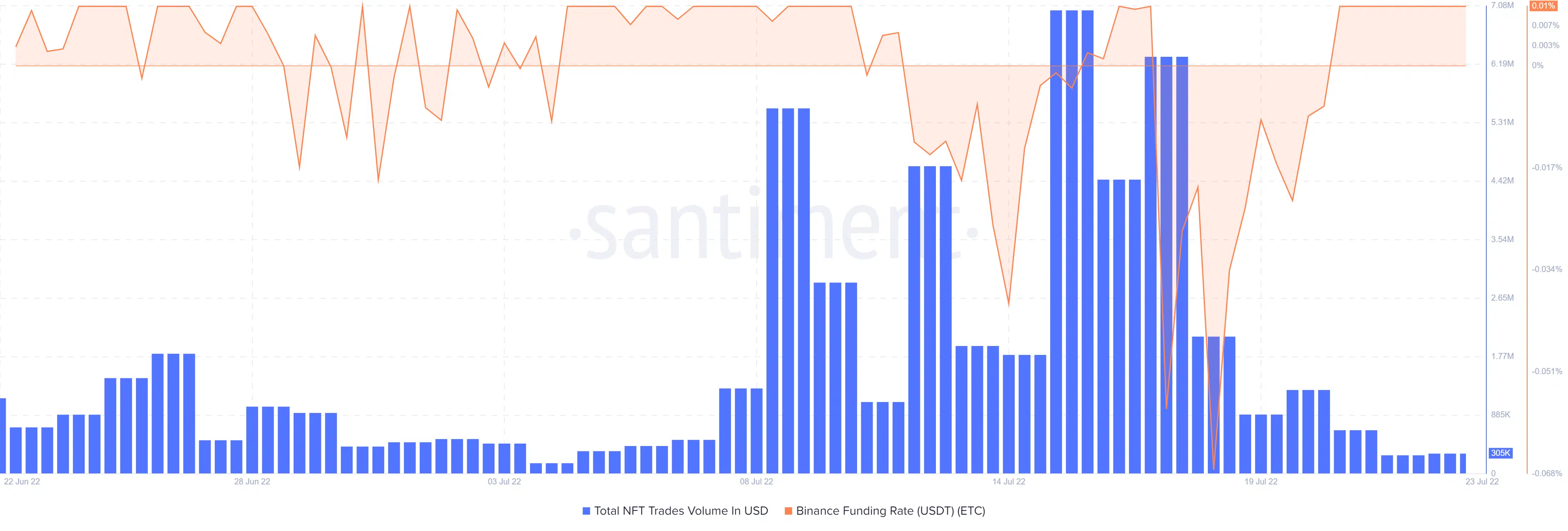

ETC’s Binance funding rate suggests that there is still a healthy level of demand from the derivatives market.

This might reflect the current outcome in the spot market but the bears will eventually overpower the bulls if the whales will not back the upside.

Organic demand is currently not in favor of ETC bulls. Even the total NFT trade volumes dropped substantially in the last seven days.

The only way that ETC might maintain the bullish momentum without a substantial retracement is if the market continues to rally.

Otherwise, profit taking is bound to trigger a sell-off before it can regain its upside.

It remains to be seen if Ethereum’s upcoming merge will impact Ethereum Classic’s price action.