MakerDAO: Watch out for this if you hold MKR

- MKR’s value has risen by almost double digits in the last week.

- Key technical indicators have confirmed the possibility of a further rally.

The value of Maker [MKR], the governance token of the stablecoin lending platform MakerDAO, has surged by almost 10% in the past 24 hours, and appears primed to extend its gains this week.

According to CoinMarketCap’s data, MKR exchanged hands at $3,246 at press time. A double-digit uptick in trading volume has accompanied the price rally in the past 24 hours.

MKR to see more gains

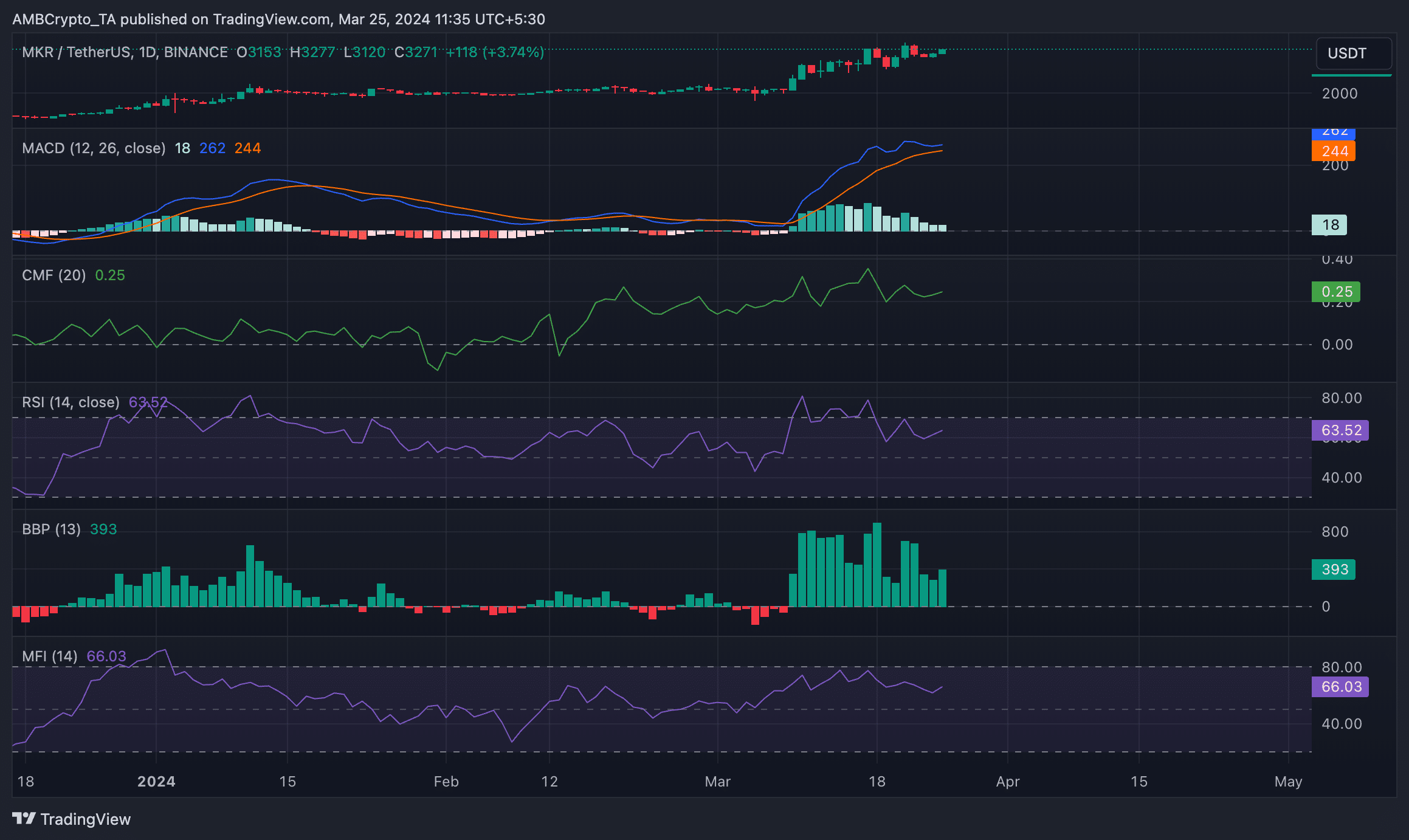

An assessment of some key technical indicators hinted at the possibility of further growth in MKR’s price.

First, its Elder-Ray Index, which estimates the relationship between the strength of buyers and sellers in the market, was positive at press time.

A positive Elder-Ray Index value is a bullish signal, depicting an uptick in buying activity.

AMBCrypto’s readings of this indicator revealed that it has consistently returned positive values since the 9th of March. Since then, MKR’s price has climbed by over 50%, defying the general market pullback.

Within the same period, MKR’s MACD line has rested above its signal line, confirming the bullish trend in the token’s spot market.

When an asset’s MACD line crosses above its signal line, it suggests that the short-term moving average is trending higher than the longer-term moving average.

This is a bullish sign, as it indicates the re-emergence of the bulls and a rise in accumulation pressure.

Further, the token’s momentum indicators were spotted above their respective neutral lines, indicating that the demand for MKR outpaced its distribution.

Its Relative Strength Index (RSI) was 63.42, while its Money Flow Index (MFI) was 66.

These indicators showed that market participants preferred to buy more MKR rather than sell their holdings at these values.

Likewise, MKR’s Chaikin Money Flow (CMF) laid above the zero line, and trended upward at the time of writing. A positive CMF value is a sign of strength in the market.

It indicates an inflow of liquidity into an asset and is a good indicator that the price rally may be sustained.

The ball is in your court

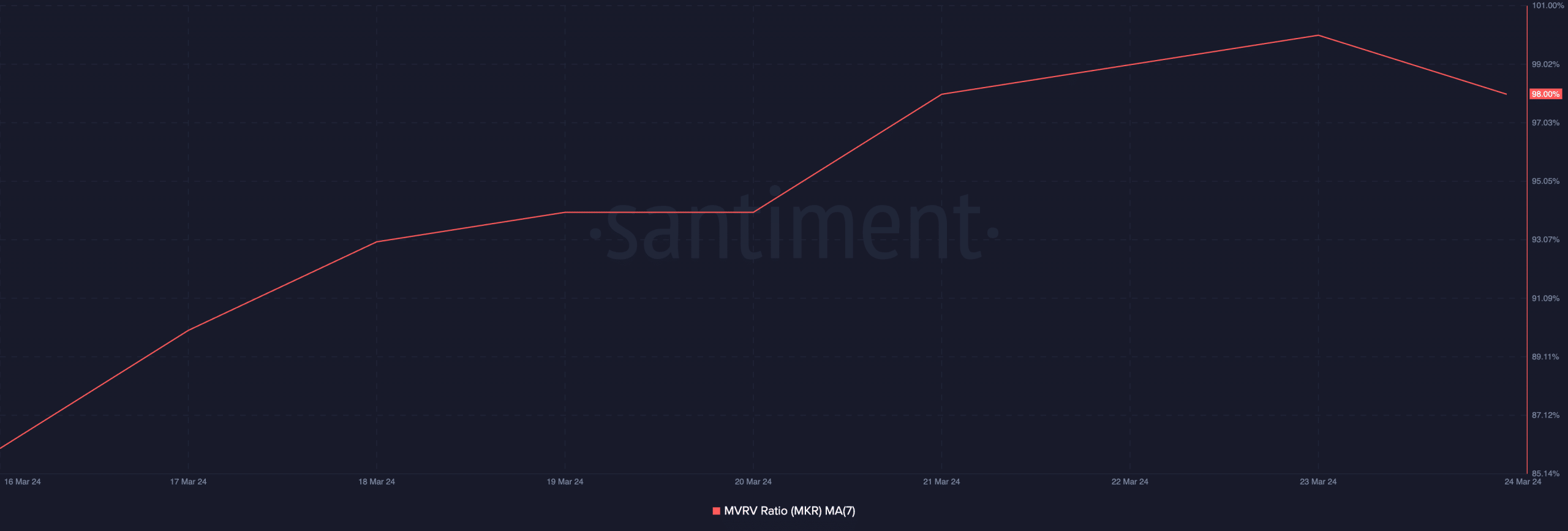

MKR’s Market Value to Realized Value (MVRV) ratio assessed on a seven-day moving average was 98%.

This showed that its press time price is significantly higher than the price at which most investors acquired their tokens, suggesting that MKR might be overvalued.

How much are 1,10,100 MKRs worth today?

While this may seem like a net positive for MKR, Some traders view a high MVRV ratio as a bearish signal.

This is because it allows investors who acquired the asset at lower prices to sell at its higher price, which may lead to downward pressure on the price.