12 days since its ATH, how is Bitcoin doing?

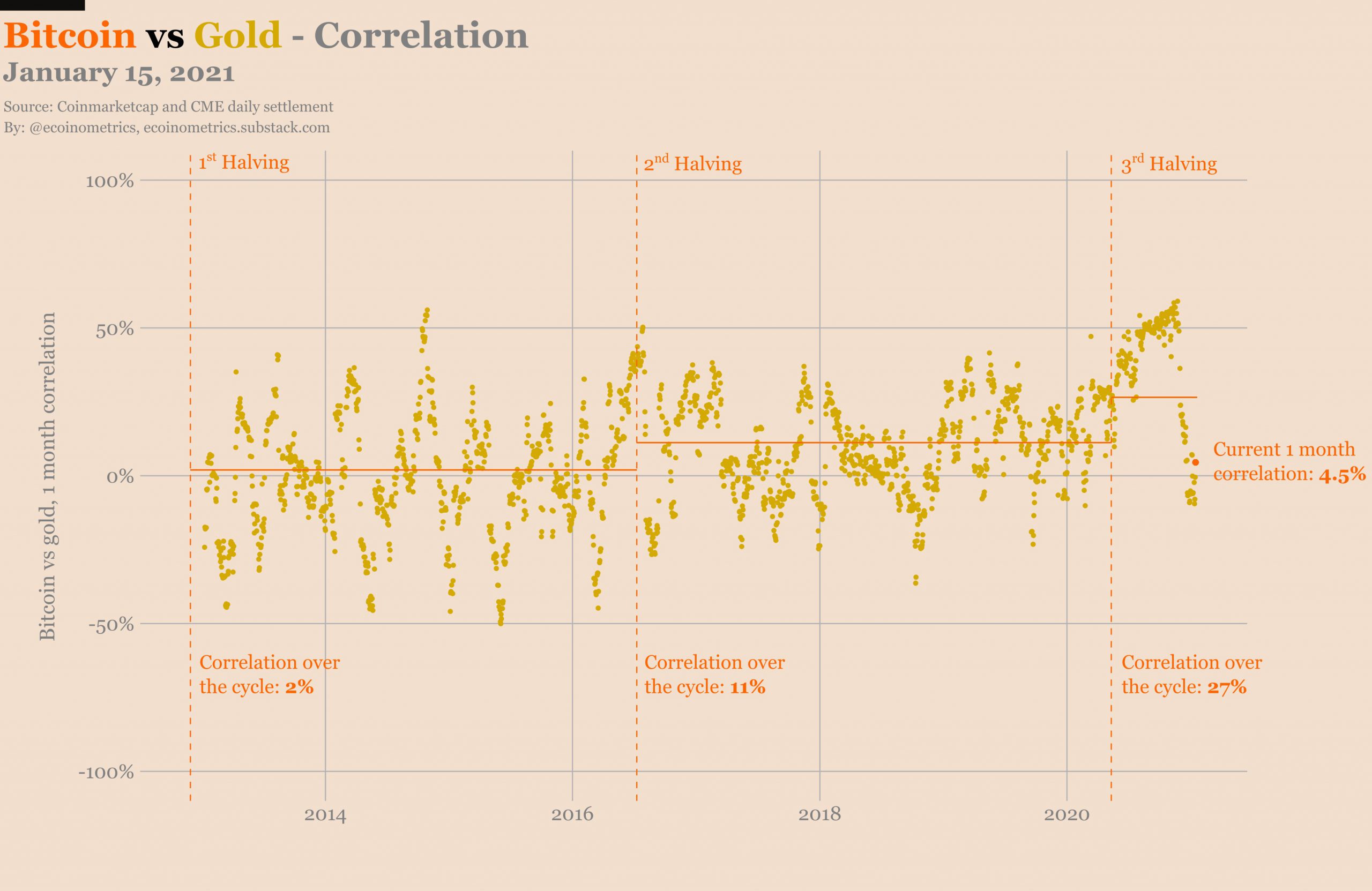

When the third halving took place on 11 May 2020, Bitcoin and Gold were correlated. Today, on the 12th day since Bitcoin hit a new ATH on the price charts, Bitcoin and Gold are uncorrelated. The reversal in the said correlation is incredible, but there is a historical precedent here too. After all, this is similar to the situation back in November 2020 when Bitcoin decoupled with Gold after a consistently high correlation for over 3 months.

Source: Twitter

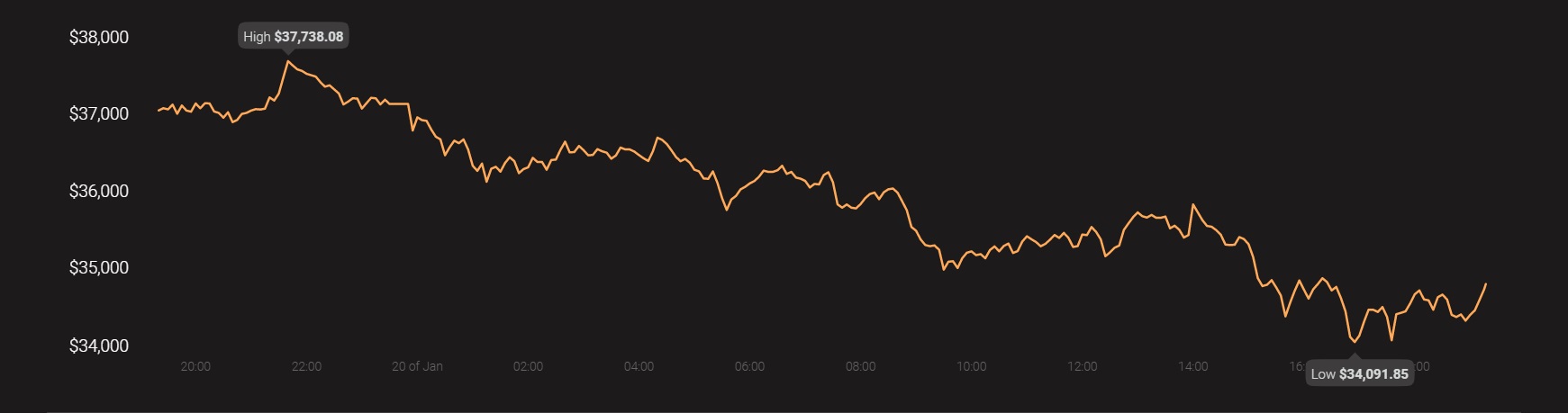

Now, before the third halving, the correlation was over 27%. The one-month correlation since, however, has been just 4.5%. Despite repeated attempts to hit a new ATH, the price was rangebound in the near-term, with BTC trading at $37,200, at press time.

Against Ethereum’s 13.31% gains in 24 hours, Bitcoin gained by just 1.21% and this may have led to a further shift in investment flows. For matching the parabolic rise in price on 8 January, more investments need to flow into Bitcoin. The inflow on spot exchanges, that is the active supply, needs to drop. As of now, the 1Y-2Y active supply is high across all spot exchanges, and this largely represents miners and retail traders.

HODLers who sold Bitcoin above $40,000 are buying at the current price level and the number of addresses with balances above 1000 BTC has gone up since Bitcoin hit its latest ATH. Though there are fears of a pullback and corrections right now, institutional buying may help Bitcoin navigate through periods of low volatility on exchanges in the short-term.

Consider this – In 2020 itself, Grayscale Bitcoin Trust grew from $1.8 billion to $17.5 Billion AUM, based on its report. Overall, conditions in the Bitcoin market have changed in the past 10 days and each change has had an impact on what lies ahead for one’s portfolio. With more and more investment being directed towards Ethereum and the market’s altcoins, away from Bitcoin, the altcoin season may have just kicked off.

Now, this may have a negative impact on the price in the short-term. However, institutions like Grayscale and MicroStrategy are adding more Bitcoin to their holdings, and this may allay the fears of traders in the long-run. Further, this may also boost the price and Bitcoin may hit a short-term top before the price rally resumes on the charts.

Source: Coinstats

Finally, the Open interest in Bitcoin has largely remained the same, but the volume has dropped across Bitcoin Futures trading. Also, the 200-day moving average may take a while to catch up too, as it was well below the price at press time.