1inch is ticking away, but here’s how long it will…

In a tweet dated 5 October, LunarCrush disclosed that 1Inch’s social engagements measured daily hit 33.23M. This level represented a new high point over the last three months. 1Inch is a decentralized exchange aggregator and also has a token, so what could be responsible for the aforementioned spike?

A possible trigger?

1inch and Unstoppable Domains announced their partnership on 4 October to streamline cryptocurrency payments for users. By leveraging Unstoppable’s naming service, users of the 1inch wallet will be able to submit “human-readable domain names” when receiving cryptocurrency payments, as stated by 1inch.

It is clear that the relationship played a significant role in the uptick in social engagements, but did it have any effect on the 1Inch token price too?

How did the price react?

By the end of trading on 4 October, the trading chart showed that 1Inch had made a profit over a 24-hour period. The asset’s price hiked by more than 2% from its opening price of $0.573 to its closing price of $0.583. Prior to its eventual close, the asset’s price hit a session high of $0.590. With the exception of this brief uptick in price, the asset’s general price trend has been sideways, however.

A daily timeframe support line was drawn at $0.541 and has shown no signs of being broken. Over the same time period, $0.676 acted as the barrier to the upward movement of the asset.

The Awesome Oscillator’s reading was well below zero, indicating a lack of activity. Combined with the asset’s low trading volume, this reflected a weak bear trend. The volume indicator and the On Balance Volume, both of which showed no spike and almost flat lines, confirmed low trade activity.

The Relative Strength Index (RSI) line dipped just below the neutral line and also indicated a downward inflection. In addition to confirming the existence of a bear trend, this seemed to suggest that the trend could persist. The signal line and the minus DI line on the Directional Movement Indicator (DMI) were both above 20 and provided further confirmation of the bear trend indicated by the RSI.

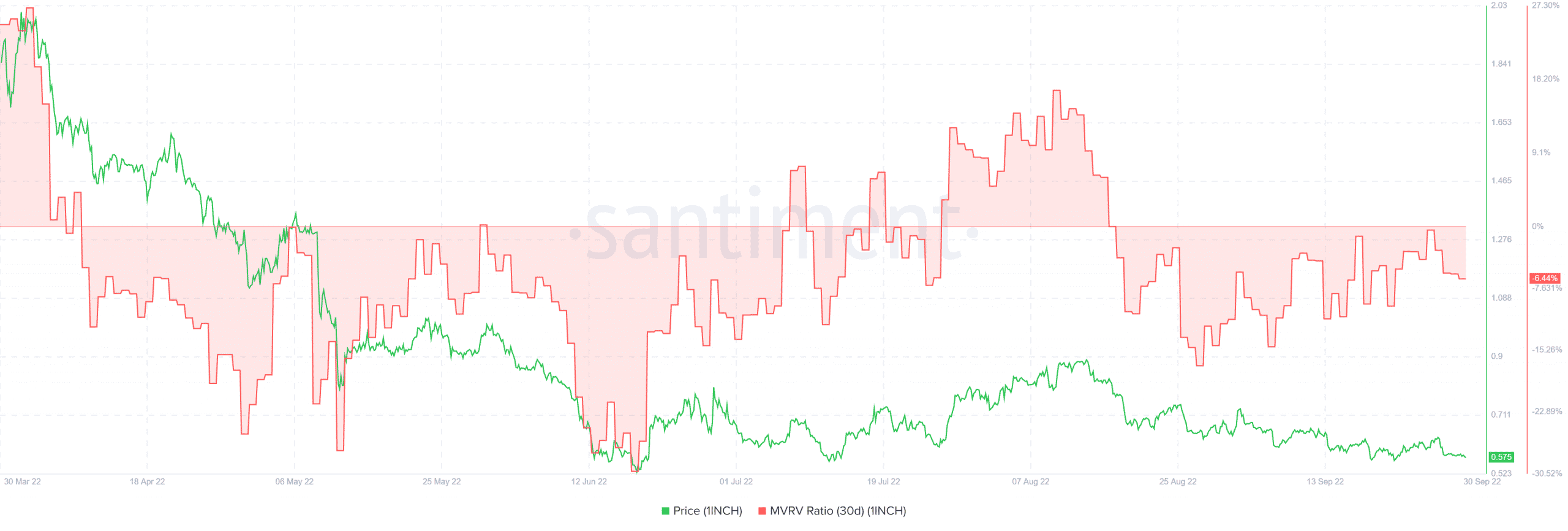

A look at the asset’s Market Value to Realized Value Ratio revealed that it was below valuation. In fact, it also revealed that holders would lose more than 6% of their investments if they liquidated the asset there.

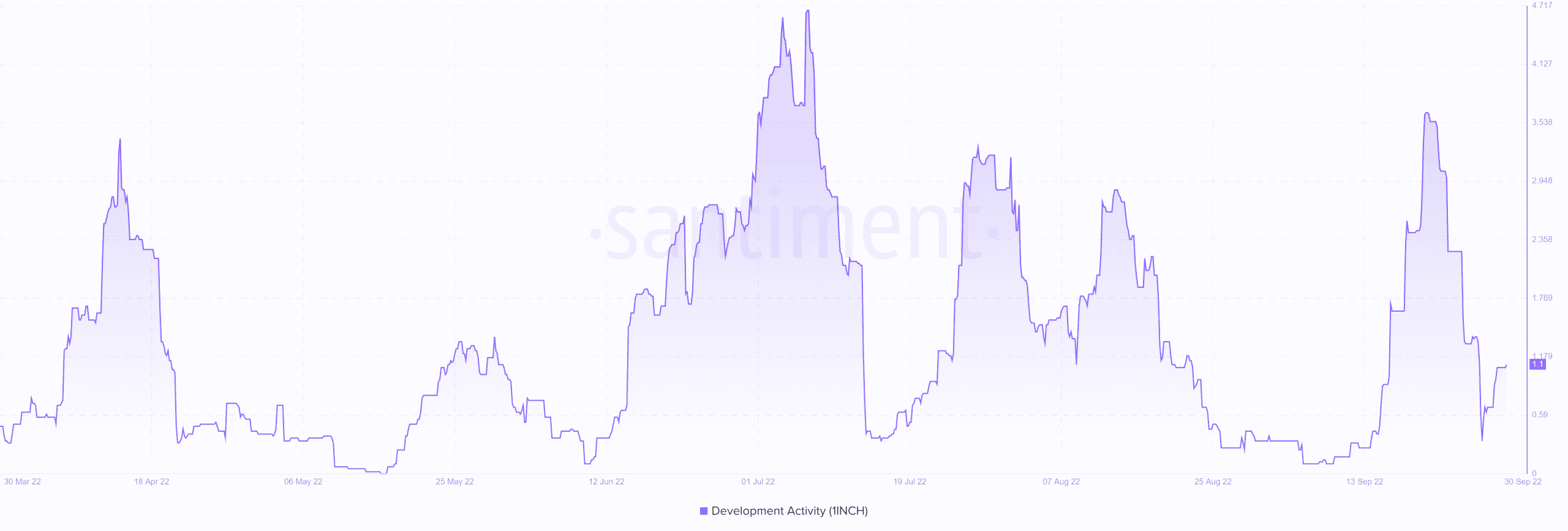

1Inch had a development activity metric of 1.1. This is a sign of minimal developer activity and a hint that the network won’t soon be receiving any updates or new features.

1inch’s potential price movement in the near future tends to remain sideways. Since the bear market has been lingering for some time, 1inch does not appear to be immune to it. However, given that a future price hike has been projected, now would be the ideal time for investors interested in having a long position to invest.