26% of ETH 2.0 staking is from exchanges, here’s what this means

The Ethereum network has been preparing for the launch of Ethereum 2.0 for a while now and the community is expecting the launch to be sooner than expected. As the launch nears, the Ethereum community received answers to most many key questions about the second-largest crypto as it transitions to the 2.0 version.

The Chief Strategy Officer at HRF, Alex Gladstein who was showcasing his pessimism about Proof of Stake [PoS] was interrupted by Ethereum developer Tim Beiko. Beiko took this opportunity to answer questions about the upcoming upgrade for the Ethereum network where he explained Ethereum’s unique position concerning pushing back against “top-down changes.”

With staking coming into effect in ETH 2.0, the top question remained about validation and how will it be distributed among exchanges, pools, or those hosted by people on Amazon Web Services [AWS]. Currently, 26% of staking was from exchanges, meanwhile, 15% was directed via pools. The remaining was a mix between all the available means to stake.

However, Beiko noted that:

“One important thing to note is that Ethereum’s PoS algorithm uses penalties that are correlated with how many other people do something wrong along with you.”

This meant that even though the Ethereum network cannot stop people from staking on AWS or other popular clients, it can provide “an economic incentive to setup staking node in a way where their failures are uncorrelated from the rest of the network.”

The PoS protocol aimed at validators to be profitable if they are online “>2/3 of the time.” This meant that it was less risky for people to stake on non-production-grade infrastructure, as per the developer.

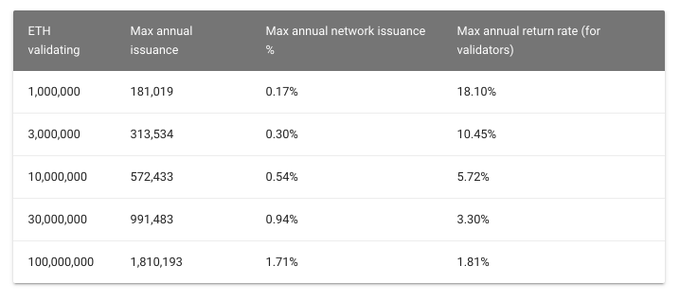

Meanwhile, the ETH 2.0 issuance has been expected to be between 100k and 2M per year. Users have been speculating the reason for such a vast difference in certainty about the issuance for which Beiko shared the chart below.

Source: Twitter

Beiko added:

“While these numbers are for issuance, it is worth noting that Ethereum will introduce a “fee burn” this summer (EIP-1559). That change could be its own thread, but in short, it burns a large % of all transaction fees, reducing supply. The % burnt increases with blockspace demand.”

This will help to maintain a balance between limiting inflation and ensuring a long-term budget for validators’ rewards.

The developers for the Ethereum foundation have been open and transparent when it comes to clarifying what benefits Ethereum 2.0 will bring along, however, the issuance may once again be a point of discussion when the 2.0 is finally out. This was seen a few months back when the crypto community was raging against the not-so-fixed supply of Ethereum. Although the developers managed the situation, a lot more education may be necessary to understand the issuance procedure.