$60,000 finally falls as Bitcoin closes in on its ATH

Bitcoin is on yet another journey of price discovery, with its recovery on the charts almost complete. It is in the news today after it finally breached the $60,000-mark for the first time since 18 April. It did so on the back of a 4.5% daily hike and a weekly hike of 11.5%.

What’s more, the cryptocurrency’s market cap recently went past the $1 trillion-mark too. The same was a sign of the bullish sentiment in the market, especially after the lows September brought.

Bitcoin had first embarked on this breakout rally on 5 October. That day, it broke out of its monthly price range above the $47,000-resistance. The aforementioned rally came on the back of the cryptocurrency falling victim to a lot of FUD over the past few months.

Of late, however, the growing likelihood of a Bitcoin ETF finally being approved in the United States has spurred market momentum.

JUST IN: Bitcoin futures ETFs said not to face any opposition at SEC, according to multiple sources confirming this (aside, I’m hearing same thing). Pretty much done deal. Expect launches next week. Nice late night story from @kgreifeld @VildanaHajric @benbain pic.twitter.com/axT6ME4MeI

— Eric Balchunas (@EricBalchunas) October 15, 2021

Earlier today, the U.S Securities and Exchange Commission also shared guidelines for investor protection when investing in funds holding Bitcoin futures contracts.

Accordingly, market sentiment has also improved drastically, prompting the Fear and Greed index to return to Greed after long periods of Extreme Fear in September.

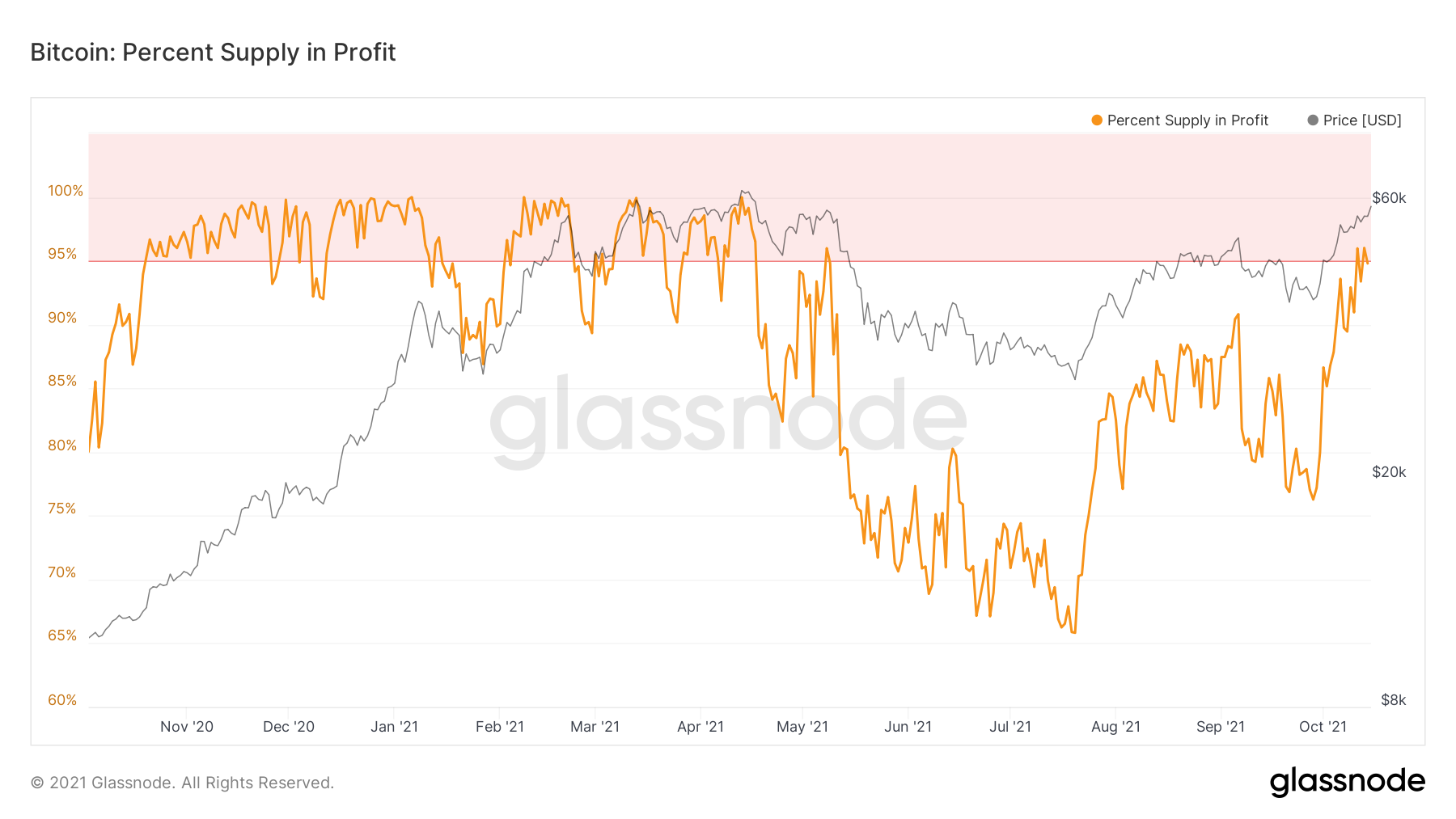

Moreover, the percentage of circulating supply in profit has been rising dramatically since the beginning of October, hitting the 93%-level, at the time of writing. These levels haven’t been seen since the market crash in May.

What’s more, the loss of miners and hash rate that had been prompted by the mining crackdown in China has also recovered. This followed after a shift of mining power to the U.S and neighboring Kazakhstan and Russia.

Moreover, the prominent family office of George Soros also revealed its Bitcoin holdings in an interview, prompting many to flip to bullish once more. This was accompanied by a clarification from SEC’s Gary Gensler. It suggested that there won’t be any China-style crackdowns in the United States.

In its September report, Kraken Intelligence had noted that the fourth quarter is historically Bitcoin’s best quarter, with an average and median return of 119 percent and 58 percent, respectively. With the crypto gaining in valuation, all eyes are now set on a breach of its ATH from a few months ago.