83% AVAX holders now in profit: What will a rise to $70 mean for you?

- AVAX’s price climbed past $64, the highest it has hit in the last 22 months.

- If the token breaks the $70 psychological resistance, the value could hit $75 in the short term.

In the last 24 hours, the price of Avalanche [AVAX] has increased by 13.60%, according to data from CoinMarketCap.

As a result, the 9th-ranked cryptocurrency was the best-performing asset out of the top 10. But that’s not the area where it gets juicy.

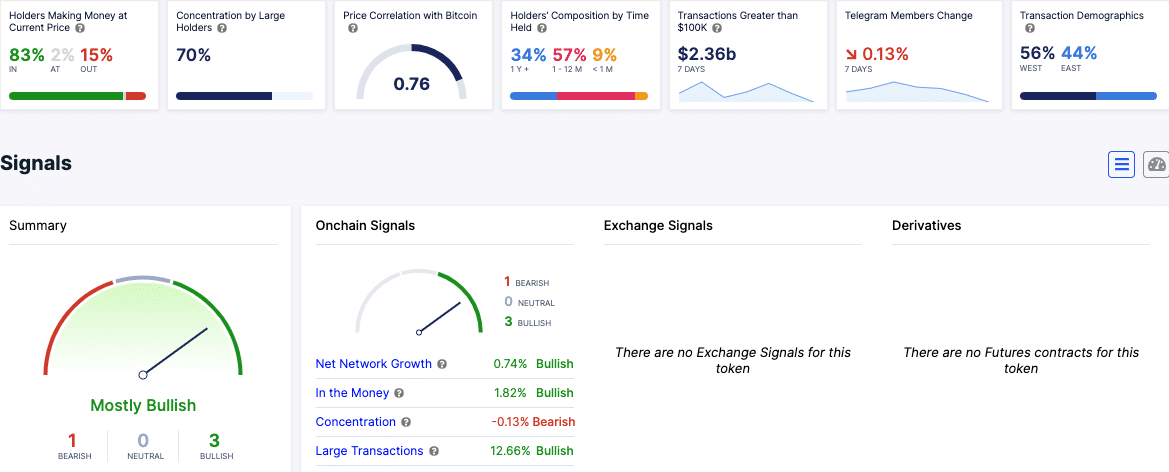

According to AMBCrypto’s on-chain analysis, the price increase has ensured that 83% of AVAX holders are now in profit.

Using IntoTheBlock’s data, we also observed that 15% were in loss while the remaining 2% were at a breakeven point.

Bag-holding the token may be the way

AVAX’s price increase could be linked to many factors. But AMBCrypto was able to identify some of them. As of this writing, large transactions on the Avalanche network have increased.

However, the most important part about the increase was that most of the transactions were buy orders. With this condition, the price of the token might be ready to hit $70.

At press time, AVAX changed hands at $64.16. This was the highest point the cryptocurrency has hit since May 2022.

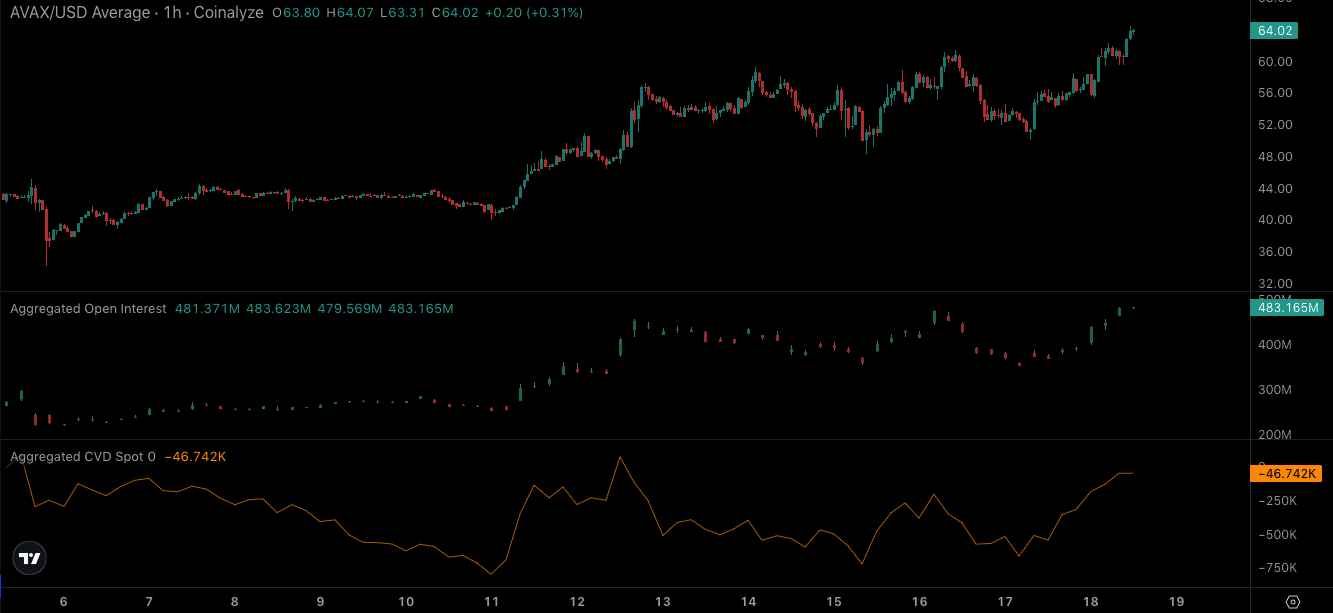

Apart from the on-chain buying pressure, we also looked at what was happening in the spot market.

To have an idea of the dynamics, we focused on the aggregate Cumulative Volume Delta (CVD) data. The CVD is a metric used to analyze the difference between buying and selling volumes.

Spot and derivatives collaborate to keep AVAX on top

According to AMBCrypto’s analysis via Coinalyze, AVAX’s CVD has been increasing since the 17th of March, indicating high demand for the token in the spot market.

This rise is considered a bullish signal that could drive AVAX prices higher.

On the derivatives end of the market, interest in AVAX has also been rising. At the time of writing, Open Interest (OI) had increased to $483.16 million in the 1-hour timeframe.

OI is the sum of all open positions in a contract. It increases based on net positioning. So, there is always a seller for every buyer.

However, a price increase alongside a surging OI does not mean that there are more longs than shorts. Longs are traders betting on an asset price to increase while shorts are those predicting a decline.

Instead, the rising price and OI imply that buyers are more aggressive. From a trading perspective, the large OI could help AVAX break through any overhead resistance.

Should this trend remain the same, the price of AVAX could rally toward $75.

Though AVAX bulls could push the price toward $75, they could face resistance around the $70 psychological resistance. If the price closes above the resistance, AVAX might hit the bullish target.

Is your portfolio green? Check out the AVAX Profit Calculator

On the other hand, rejection at the region could trigger a downswing that drives the token back to $63. At the peak of the bull market, the value of the token might double from its press time price.

But that potential rally might not be linear.