Will Grayscale venture into DeFi with new crypto trust filings

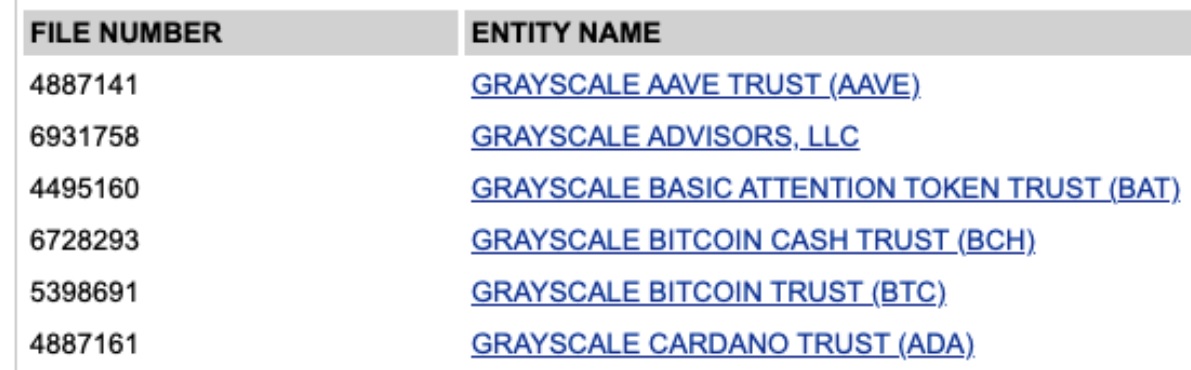

According to a new filing, Grayscale seems to have set the foundation for crypto trusts associated with the decentralized finance (DeFi) space. As of 27 January, the leading crypto asset manager filed to register new trusts for digital assets. According to the Delaware corporate registry, out of the five new trusts, three are connected to the DeFi economy. This includes protocols such as AAVE, Cosmos (ATOM), Polkadot (DOT), as well as privacy coin Monero (XMR) and Cardano (ADA).

According to Grayscale documentation, Delaware Trust Company is the firm’s “statutory trustee” for the US state. It also happens to be the same organization that Grayscale went through to register its Bitcoin and Ethereum trusts, which are now one of the fastest-growing investment products in the crypto space.

However, whether the five new trusts will launch remains uncertain at the moment. The New York-based firm previously registered trusts for other popular digital assets such as LINK, MANA and BAT. But at the time, reports stated a filing does not indicate a launch. According to Grayscale:

Grayscale is always looking for opportunities to offer products that meet investor demands. Occasionally, we will make reservation filings, though a filing does not mean we will bring a product to market. Grayscale has and will continue to announce when new products are made available to investors.

Nevertheless, the new trusts cater to assets that have performed well in the past month. Data from CoinGecko states that Aave recorded 256.7% growth in the last 30 days and is the 15th largest coin in terms of market cap.

Cosmos saw 51.7% growth in the past month with its native coin ATOM trading at about $8. Polkadot registered 162.5% growth in 30 days, gaining popularity. Meanwhile, Monero gained 467% over the year, and Cardano saw a 187% growth at the same time.

As of 13 January, Grayscale Investments’ total assets under management (AUM) were worth $25 billion in crypto according to the firm’s latest announcement.