Bitcoin’s comeback to $55,000: When and how?

At the time of writing, Bitcoin was trading around the $50,000-level, with the crypto-asset on the road to recovery following the market-wide depreciation on the 23rd of February. Now, the price drop was largely due to miner inflows, stablecoin inflows, and activity on Bitcoin’s network.

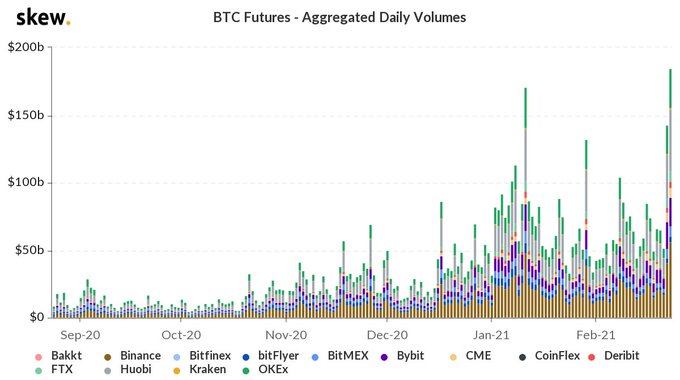

However, what often gets forgotten is the fact that activity on derivatives exchanges can be considered to be indicative of the ongoing price trend. Ergo, it’s worth noting that based on data from Skew, BTC Futures volume hit an ATH on the charts yesterday.

Bitcoin Futures Aggregate Daily Volume || Source: Skew

In fact, its impact was felt across spot and derivatives exchanges after the price made a comeback above the $50,000-level. The previous ATH in Bitcoin Futures Open Interest was observed last month. At that time, the ATH fueled a rise in Bitcoin’s price, with the same hitting a new ATH of $40,000 before the end of the second week of January 2021.

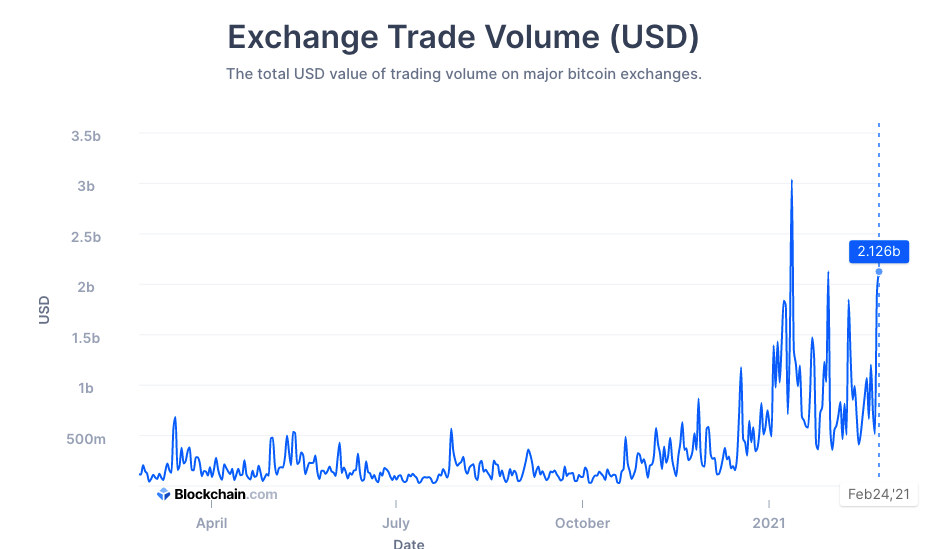

Source: Blockchain

Additionally, Bitcoin trade volume on all exchanges seemed to suggest that there was a spike in trade activity. The 24-hour gain in price was over 6%, at press time, and Bitcoin inflows, though reduced, hadn’t dropped to pre-ATH levels.

Further, at the press time inflows rate, the volatility was observed to be 16.15%, according to Woobull charts. Before 2021, exchange-traded volume last hit a peak in the last quarter of 2020, with the same characterized by an increase in Bitcoin’s price as well.

Exchange-traded volume too has emerged as a relatable metric for assessing Bitcoin’s price action and trend reversal. Based on the exchange-traded volume at press time, Open Interest in Bitcoin Futures, and miner inflows, the volatility of the asset had risen from 14% to 16.15%, with the same being a positive sign for the ongoing price rally.

Other signs of bullish development in Bitcoin’s price include Square adding $170 million worth of Bitcoin to its existing purchase and institutional demand rising consistently. Hence, it’s evident that there’s a lot of support behind Bitcoin’s recovery.

In fact, there seemed to be additional support pushing the price to cross the psychological hurdle of $55,000 in the short-term since retail traders and institutions have bought Bitcoin at this price level and above it as well, all the way to the ATH. Hence, there may be a comeback for Bitcoin’s bull run on the price charts, before the $2.5 billion Options expiry on Friday.

![3 catalysts that could send Ethereum [ETH] to $5,000 in 2025](https://ambcrypto.com/wp-content/uploads/2025/05/Abdul_20250515_122605_0000-400x240.webp)