Cardano, BCH, LTC, ETH, Chainlink and VET: Watch out for this sign when it comes to alts

The current altcoin season which kicked off with Dogecoin’s price rally may have slowed down for now. Altcoins like ADA, BCH, LTC, ETH, LINK and VET are currently offering double-digit gains when compared to last week’s prices. The growing interest in altcoins across exchanges is the key factor driving the prices.

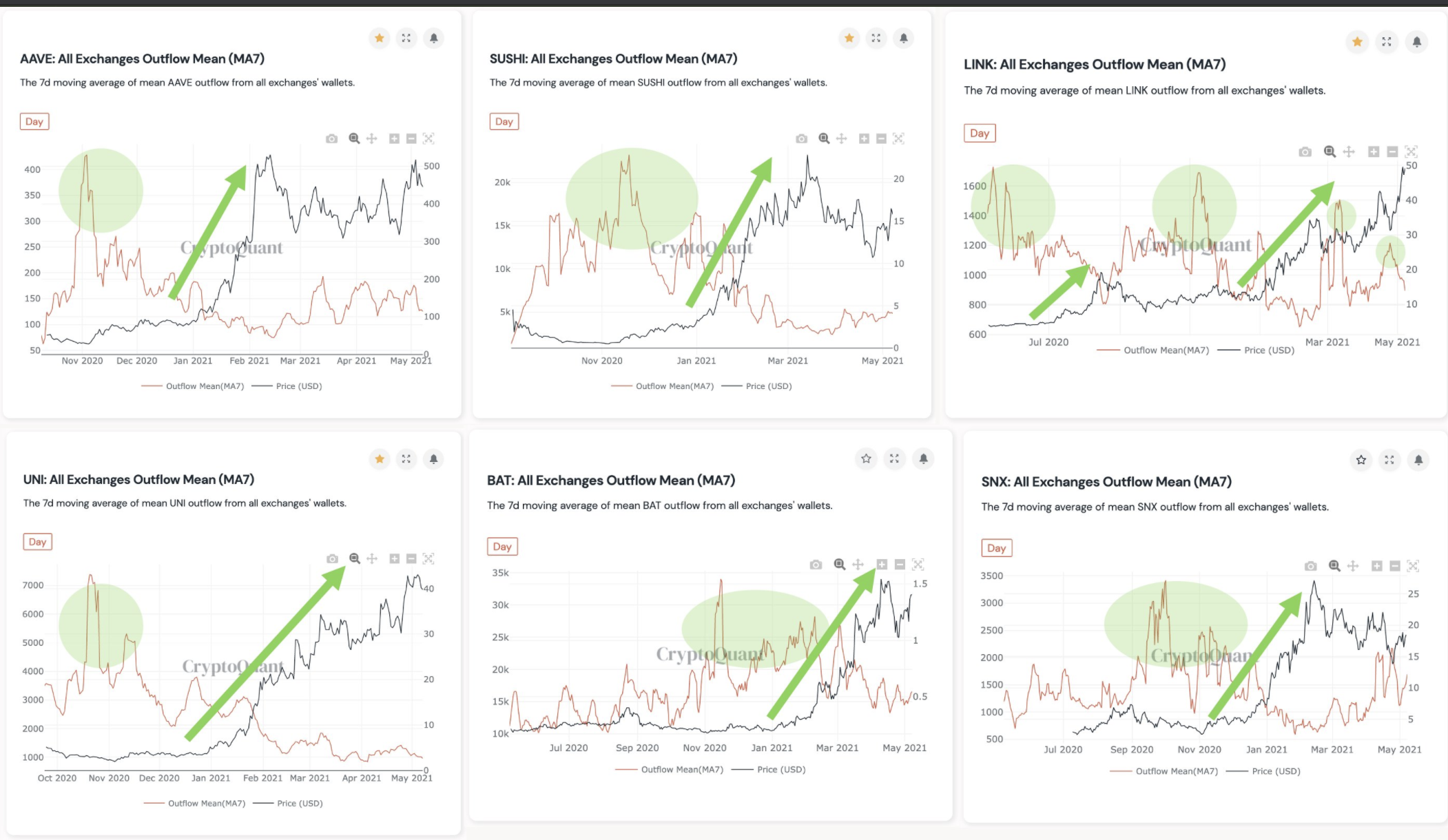

The other factor is the reserve across spot exchanges. It has been observed that altcoin whales have moved their assets from centralized exchanges wallets to other wallets before the price rally is kicked off. In the following chart, based on data from CryptoQuant, here’s the average amount of outflows across all exchanges for AAVE, SUSHI, LINK, UNI, BAT, and SNX.

Altcoin reserves across exchanges || Source: Twitter

Data for altcoins are seeing notably rising (and dumping) levels of whale addresses appearing on their respective networks; the rising pattern is clear. It cannot be determined based on exchange reserves whether BNT, CEL, SKL, RDN, SUSHI & YFI fall on the bullish or bearish side. To determine that, traders are likely to consider the volatility, social volume and the price relationship between the altcoins.

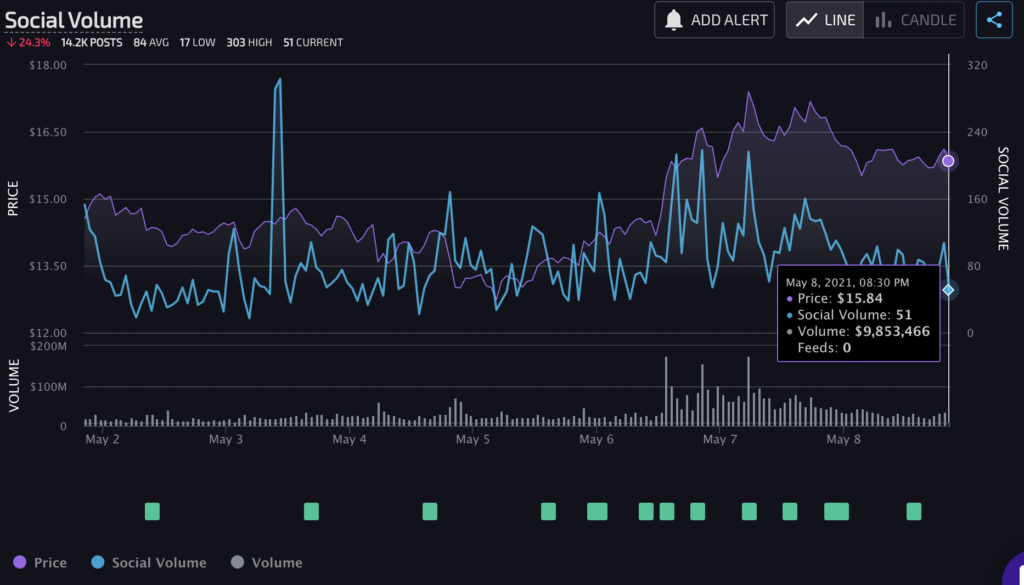

Social volume of SUSHI || Source: Lunarcrush

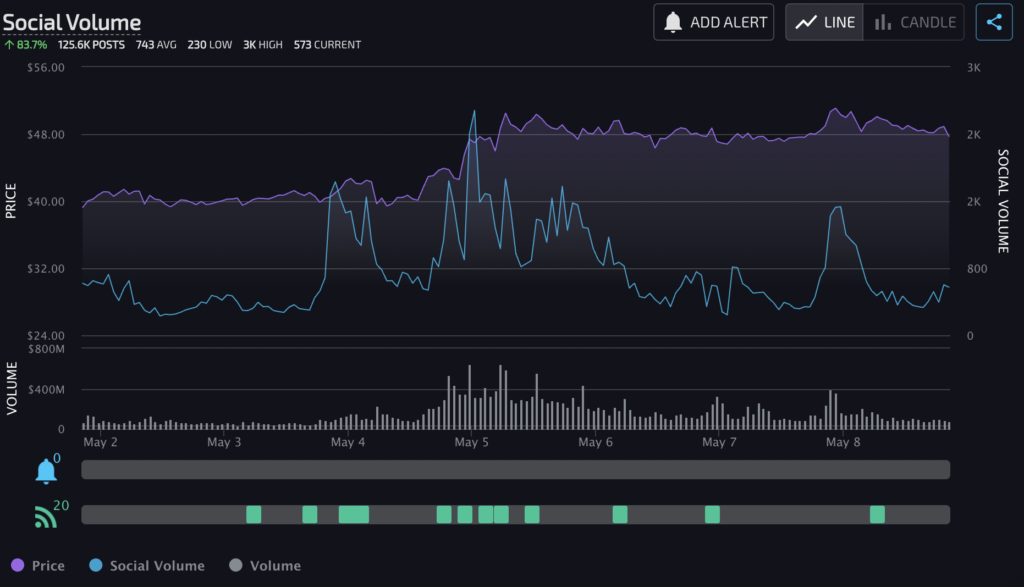

The social volume has dropped in the past week, however, the drops correspond with price rise. Based on social volume SUSHI is one of the top altcoins, however, this is not the case with UNI, BAT or AAVE. These altcoins have high volatility and network activity. LINK’s social volume has a similar relationship with its price, as SUSHI.

Social volume of LINK || Source: Lunarcrush

For retail traders, a combination of social volume and exchange reserves is worth watching out for trend reversals in altcoin rallies. Having said that, there is a fine difference between an asset being overvalued, and an asset being overvalued enough to be shorted.

This difference has been noted based on the price trend and the shorting data, currently, there is no sign of exhaustion in the futures market. It may have slowed down for Bitcoin and top altcoins, however, there are no signs of slowing for ETH and makes it one of the top altcoins likely to be shorted in the short term.