Does this metric hold the key to trading Bitcoin profitably?

Bitcoin shorts have increased in volume. Besides, shorts require additional leverage with Bitcoin’s price at the $30000 level based on price data from coinmarketcap.com. Thus the funding rate is negative yet again. Does this signal that it is a good time to buy, and Bitcoin is expected to consolidate as the funding rate becomes further negative?

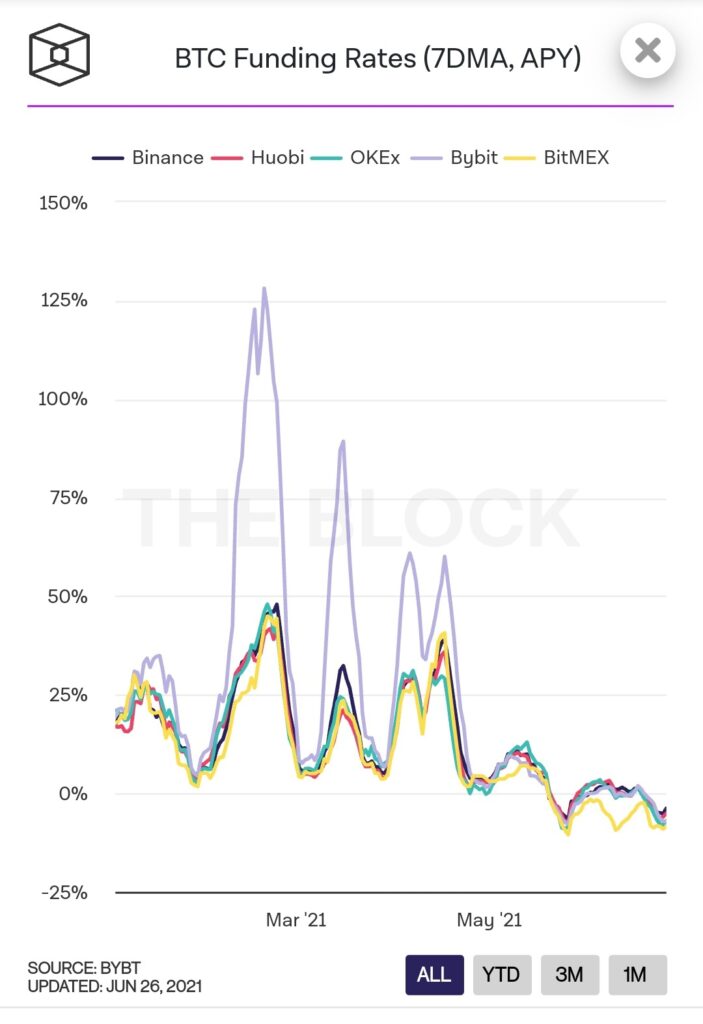

BTC Funding Rates || Source: The Block

There is demand at the current price level across spot exchanges and derivatives exchanges but it is not sufficient enough for adequate longs. The funding rate has dropped to a negative 5% on Huobi based on data from The Block.

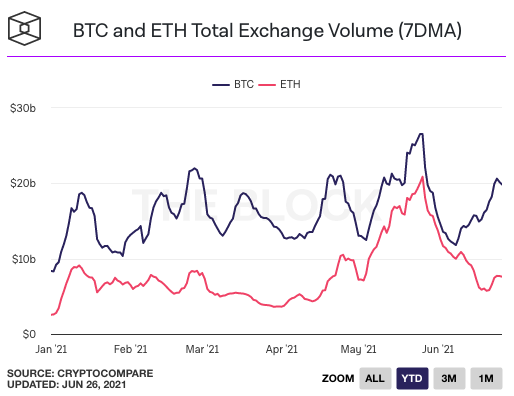

BTC and ETH Total Exchange Volume || Source: The Block

Based on the above chart, after dropping consistently through mid-June 2021, after hitting a peak, the total exchange volume has increased. The negative funding has been indicative of dropping exchange volume, this supports the narrative of accumulation and supports the bullish narrative of Bitcoin.

Additionally, based on the past 24-hour buy/sell ratio from Skew, it favors a negative funding rate. The 24 hr buy/sell ratio is bullish for Bitcoin’s price. Though further consolidation is expected, there may be a further drop in prices in the short term.

This may be the ideal way to trade profitably. Unlike the obvious move of shorting Bitcoin, since the beginning of 2020 more traders have considered buying when the asset is consolidating, rather than shorting. This equates consolidation and negative funding rate with buying opportunity.

At the current price level, concentration by large HODLers has dropped to the 13% level and the on-chain sentiment continues to remain bearish. Bitcoin’s market capitalization is now at the $573 Billion levels and an increase in the price and demand is likely to increase the market capitalization and dominance in the short term.

Back in 2018, the negative funding rate was largely associated with consolidation, however, since the beginning of 2020 and the two rounds of Bitcoin’s price rally, it is now associated with recovery and a run to the closest psychologically important level. As of now, the flash crash is largely behind us now and the asset is set to make a comeback above the $40000 level before the end of July 2021 based on on-chain metrics, negative funding rate and other price charts.