Bitcoin’s Q3 rally: Here’s the key signal you need to know

The cryptocurrency industry is in the thick of another bullish wave; major assets have continued to establish a strong movement in the charts. During such rallies, there are multiple signals going off at the same time which re-direct attention towards an incline or decline. However, major signals that change organically over a longer period of time are important to look out for, when it comes to assets such as Bitcoin and Ethereum.

With Bitcoin and Ethereum both establishing positions above $45,000 and $3000, respectively, there is a key metric that is indicative of a major development.

Is the Accumulation period over for BTC, ETH?

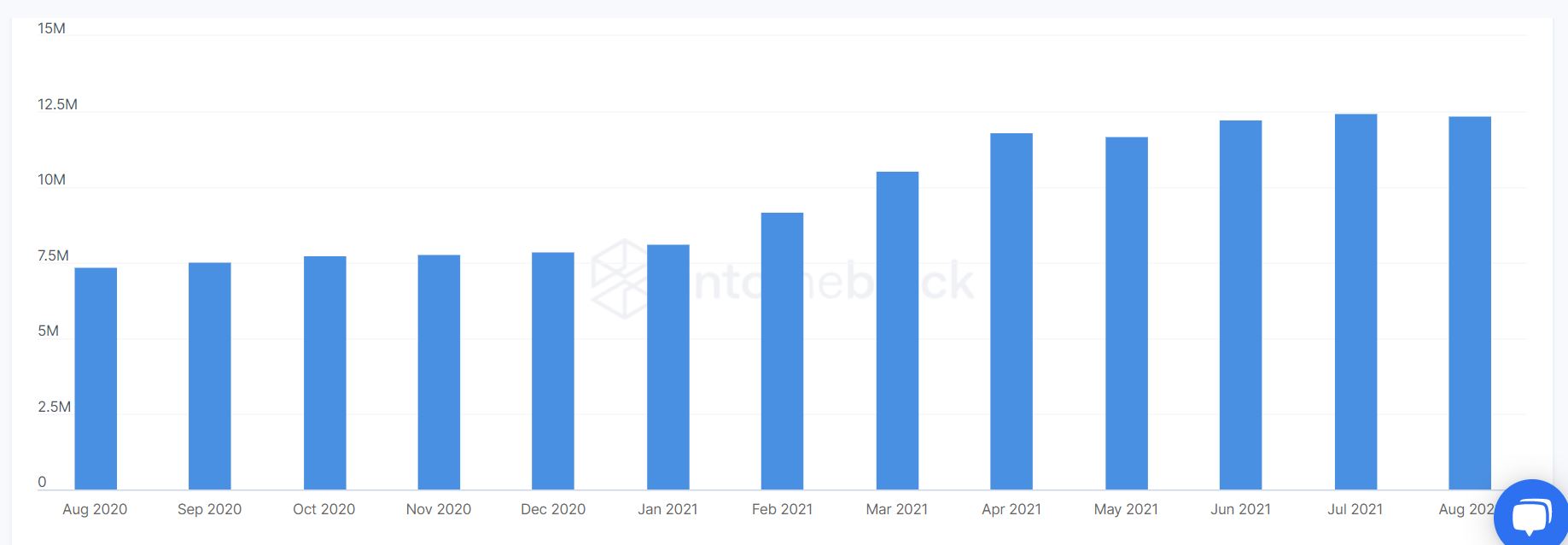

According to Santiment, the mean dollar invested age of Bitcoin, Ethereum is currently reaching a point of plateau. Mean Coin Age is defined as the number of days Bitcoins have remained in their current addresses. Therefore, when the movement becomes rapid, it suggests that there is rising interest in the charts.

Now, the trend can be widely understood by the chart above as Mean Coin Age has begun to fall, BTC prices picked up significant bullish momentum in the market. Between May-July, the mean coin age grew as investors were incorporation network wide-accumulation. Right now, with mean dollar invested age consolidating for BTC, ETH, the collective market may witness another strong rally, which is assisted by dormant tokens.

Is there is a buying opportunity left for Bitcoin?

Some statistics comply with the possibility of a correction. While we have spoken in detail about why some assets should undergo a correction, over the past week of bullish behavior, the number of transactions and transfers for BTC dropped by 5% each. The number of active addresses depleted to 800k from 930k in the charts.

Additionally, Transferred Value (in $) over the BTC blockchain dropped by 17.3% but Ethereum did register a high of 15%.

Now, another minor concern is that there has been little to no change in terms of the accumulation created cruisers addresses. Trader addresses have undergone losses during the May-July breakout during which, these addresses holding BTC between 1-12 months should have registered stronger accumulation.

An absence of sentiment might indicate that Bitcoin is still keeping the doors open towards correction, hence the present week remains important for the industry.