Bitcoin to $80k: Will Bitcoin head towards a second peak this year

Bitcoin had a pretty impressive run during the initial few months of this year. Its price managed to peak at $64k in mid-April, and soon after that, it began its downward trajectory. The next next few months saw Bitcoin consolidating in the $30k range. The narrative gradually started changing towards the end of July and BTC’s price has fared decently since then. However, will the crypto market witness Bitcoin head towards a second peak later this year?

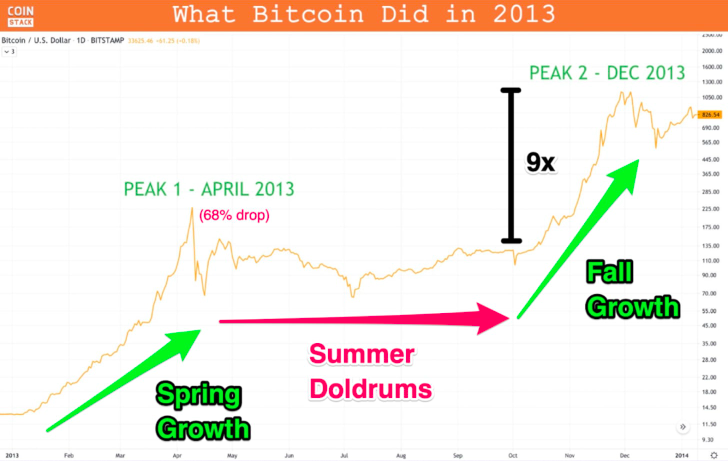

Is 2013 rewinding itself?

2013 was quite an eventful year for Bitcoin. Its market valuation subjected itself to an 18-fold increase during Spring. The surge from $13 to $225 happened in less than four months. Post that, BTC witnessed a sharp 68% dip from its peak and entered a period of consolidation over the Summer. However, its price managed to spurt from the $100 range to $1050 towards the end of the year.

The first two phases have been pretty similar this year as well. Bitcoin has already broken out of its $29k to $42k price band earlier than expected. In fact, at press time, the king coin was trading at $46k. At this stage it can be said that BTC is headed towards the expected double peak and the market would most likely see new all time highs during the last few months of 2021.

Favorable market conditions

For now, the ‘staircase pattern’ is being respected on the price charts. If this trend continues, one can expect Bitcoin’s price to climb higher at a much faster pace in the coming days. A rise in price usually happens when the cumulative supply on the exchanges dip. This has essentially been the case over the past few days.

In fact, the drop in exchange balance has been supplemented with a rise in volume thereby indicating the flow of Bitcoins into private wallets.

Source: TradingView

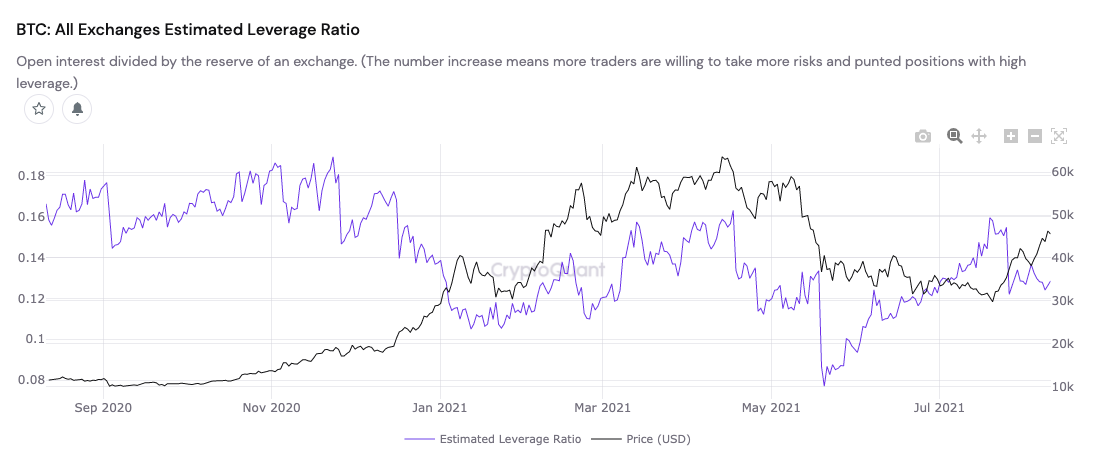

The leverage ratio, however, painted a slightly deterring picture. Even though the same seemed to be inching northward at press time, it should be noted that the current level is substantially low in the macro frame. A rise in this ratio usually indicates that traders are ready to bet and take risky positions with high leverage. This usually happens only when participants are considerably sure about how things are going to unfold in the near term.

Hence, it’d be fair to state that Bitcoin’s rally is only gaining steam at the moment and hasn’t actually kickstarted as such. A breakout towards new ATHs can be anticipated by Fall 2021. Keeping previous trends in mind, BTC’s price would likely cross the $80k mark by the end of this year.