Is this Ethereum based Layer-2 exchange changing the derivatives market

Layer 2 projects have dramatically taken off in the industry, with the likes of Optimism and Arbitrum enjoying their fair share in the limelight. With benefits ranging from reduced gas fees to instant transaction confirmation, there has been significant transactional activity on these solutions.

Right now, another Layer 2 based exchange is rising up to the occasion. The demand to utilize “Ethereum” L2 seems overwhelming, Arbitrum’s TVL rising from $238 million to $2.5 billion in under 5 days, being a prime example.

dYdX, the next big DEX?

L2 native chain dYdX is a non-custodial decentralized exchange that runs on audited smart contracts on Ethereum. To expand trading, both dYdX and StarkWare have built a protocol for cross-margin perpetuals, and right now, the numbers are speaking for themselves.

After the launch of its recent liquidity mining program, the daily volumes on the platform spiked up to $600 million. At press time, the 24-hour trading volume sat at $340 million.

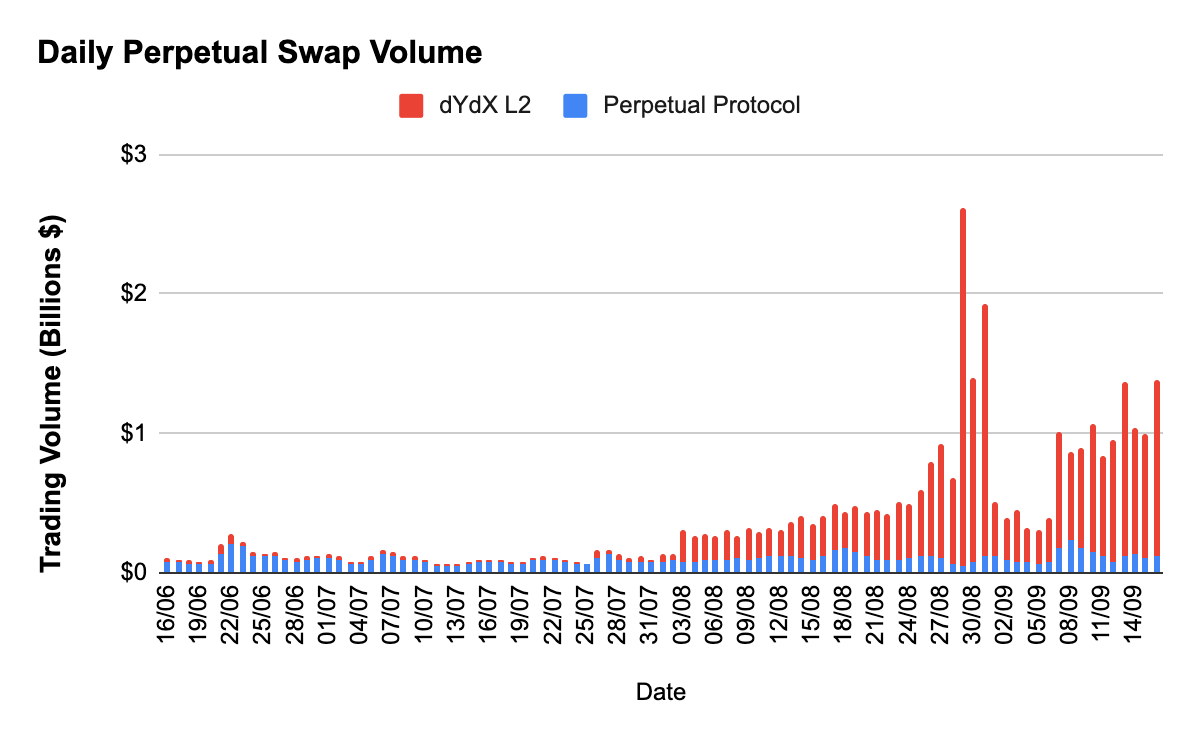

However, comprehensive growth can be identified in the chart below.

As observed, the total value locked (TVL) in dYdX catapulted up to $520 million after being under $200 million during the 1st week of August. Now, recently, the daily perpetual swap trading volume averaged to $1 billion over the past few days, reaching up to $2.5 billion during the 4th week of August.

Is the rally sustainable or momentary?

These statistics are all impressive on paper and with respect to the overall Layer 2 resurgence, it appears to be sustainable as well, but such development should always be approached with a grain of salt. The digital asset industry is massively notoriously for constant domino effects, and the layer 2 development of Arbitrum, Optimism, and other protocols might be playing a part for dYdX as well.

Additionally, the spike over the past two days might be down to the fact that the exchange released its governance token with the latest airdrop surpassing $100,000 in valuation. It may have created an immediate flux of users coming into the space, with the native chain exploding in terms of activity.

While Layer 2 solutions are seemingly the answer to everything at the moment, investing in such projects could lead to massive collapse if the collective L2 market is not calibrated with some form of market protection.