Here’s what stands between Ethereum and $3,500

The month of September has been bearish for most of the market’s top coins. However, as October hit, renewed market anticipation was spotted among participants. The start of Q4 has been blasting, to say the least, with Bitcoin and Ethereum noting close to 10% gains in just 12 hours.

Now, even though these significant gains were met with consolidation at key resistance levels, the market’s anticipation going into the last quarter of 2021 has heightened.

One breach after the other

On 1 October, Ethereum broke past the $3100-resistance. At press time, ETH was trading at $3275, noting daily gains of close to 7.71% and weekly gains of 10.77%. On higher timeframes, the Relative Strength Index (RSI) for ETH noted a sharp uptick as cash inflows poured in.

Even though Ethereum was seeing major resistance at the $3300-level, there were clear signs that pointed towards a good growth trajectory for the top altcoin. One of the signs was that more than 1.2 billion worth of ETH was burned in the third quarter. This gave way to supply shock narratives in the market.

The aforementioned conditions, alongside price gains and a noticeable downtrend in Ethereum reserves on exchanges, could stir up a supply shock. This could pump the price further over the mid-short term.

Ethereum’s metrics – Are they even on the same page?

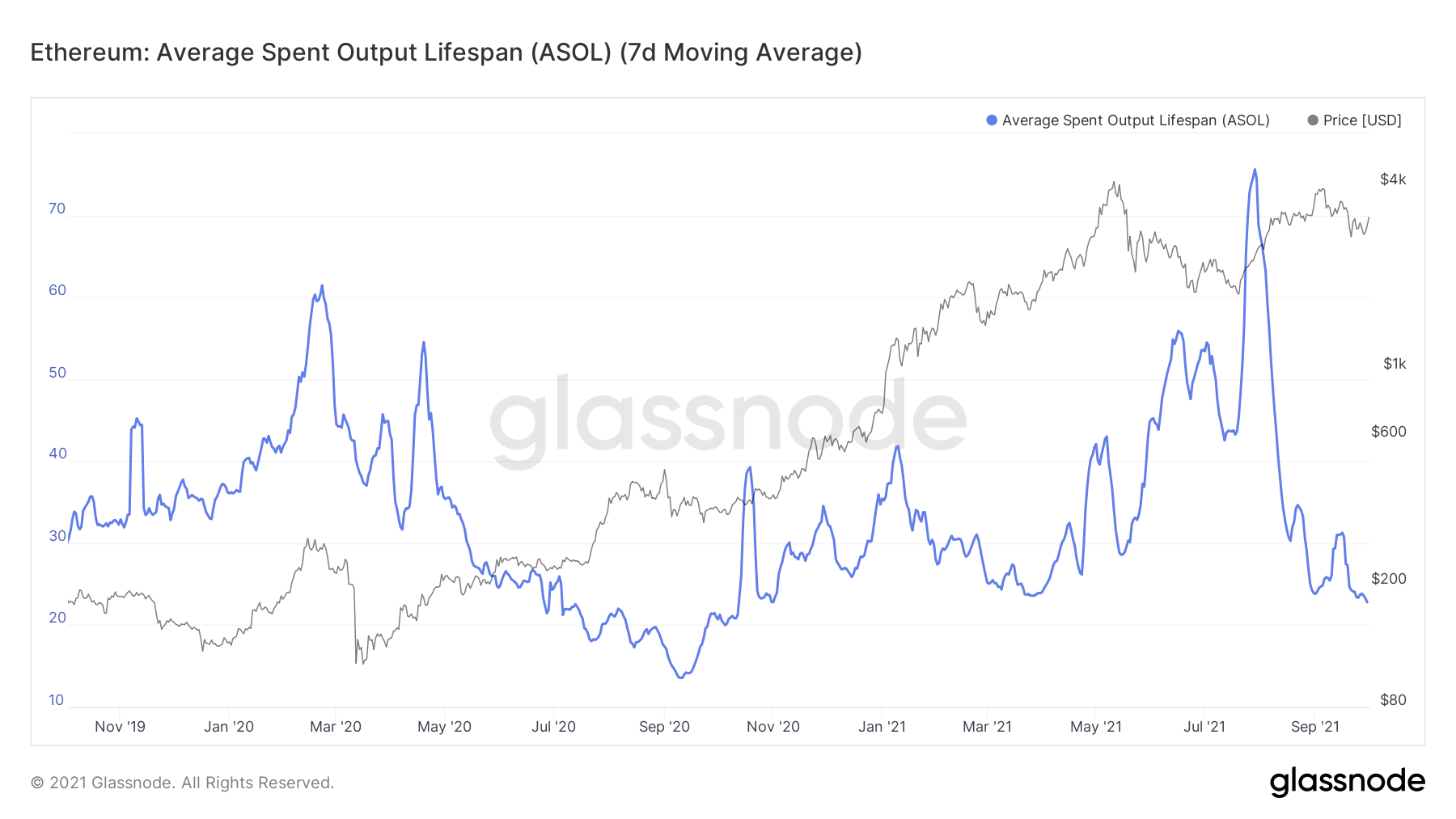

Notably, active addresses holding ETH for less than a month (which mostly constitutes retail traders) have seen a slight increase over the previous month. Looking at the market division for ETH, it was notable that while holders remained more or less the same, cruisers and traders were more active during last September when compared to August. This further aligned with the downtrend of the ASOL.

At the time of writing, the ASOL for ETH sat at its lowest level since 20 October. This downtrend was indicative of young coins being spent. This is often associated with traders and short-term holders. This also means that older transaction outputs remain dormant and conviction to continue holding the asset is high.

That being said, ETH’s Network Growth has remained stagnant, despite rising prices. In comparison to the May rally, network growth has considerably gone down.

However, after Visa revealed the concept of Universal Payment Channels through a layer-2 network powered by Ethereum, market anticipation from the top alt has heightened again. The effects of the same were seen in the high positive social sentiment for Ethereum, at the time of writing.

While some metrics did paint a bullish picture for the top altcoin, the price did face strong resistance going forward. It will be crucial for ETH to flip the same for a sustained recovery. Only then can $3500 truly be in the crypto’s sights.