SEC and stablecoins: Two experts weigh in on regulations

The SEC is usually seen as an unhelpful regulator, or an obstacle to growing crypto innovation in America. However, are there cases where crypto and DeFi regulation by the SEC could be a good thing?

During the Unchained podcast, host Laura Shin spoke to Greg Xethalis, chief compliance officer at Multicoin Capital, and Collins Belton, founding partner at Brookwood P.C. Together, they discussed positive use cases for regulation and the rise of stablecoins.

A question of control

Belton claimed that some DeFi companies warranted SEC regulation. He said,

“…and unfortunately, a lot of devs – particularly Silicon Valley trained devs – but other devs, they don’t like that: they don’t want to relinquish control. They want to be able to control the front end experience, they want to be able to consistently, you know, capture value from other revenue streams, but that’s a business…”

The view was a controversial one. Crypto influencers like Peter McCormack and Vijay Boyapati strongly favor Bitcoin due to its decentralized nature. Bringing SEC regulation into DeFi could change the very meaning of the industry for many.

When it comes down to it, most alt-coins are exactly like this. A small group of people can just shut down the network on a whim.

Only #Bitcoin is truly decentralized and under the control of no group. https://t.co/V7lXfhjuMN

— Vijay Boyapati (@real_vijay) September 14, 2021

However, Belton added that the SEC needed to “give a quid pro quo” while recognizing industry changes.

Meanwhile, Xethalis spoke about data repositories as new regulatory tools. He said,

“…FinCEN has been all over this and the success of companies like Elliptic and Chainalysis is 100% driven by the same concept that you can regulate through data, that you can investigate through data.”

Befriending stablecoins

Coming to dollar-pegged stablecoins, Belton and Xethalis explored the SEC’s need to restrict these assets. After all, stablecoins represented dollar hegemony in yet another market.

Belton predicted,

“I would expect at some point, somebody says, ‘Hey guys, this is spreading our foreign policy with very little expenditure on our part and very little liability if it goes wrong. Why don’t we kind of let’s see what happens?’ “

For his part, Xethalis pointed out that the dollarization of crypto should have been desirable to policy makers.

American inflation

Congress is currently facing pressure to raise its debt ceiling lest it defaults on the U.S. debt. Against this backdrop, one can see why stablecoins and high-interest crypto products based on them could be a source of concern. USDC issuer Circle recently revealed it was “cooperating fully” with the SEC in an investigation, though further details are unknown.

Coming to Tether [USDT], the stablecoin saw $364.1 million in exchange outflows on 6 October.

? Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $1.8B in

⬅️ $1.9B out

? Net flow: -$75.0M#Ethereum $ETH

➡️ $1.1B in

⬅️ $1.1B out

? Net flow: +$41.4M#Tether (ERC20) $USDT

➡️ $611.0M in

⬅️ $975.2M out

? Net flow: -$364.1Mhttps://t.co/dk2HbGeGwW— glassnode alerts (@glassnodealerts) October 6, 2021

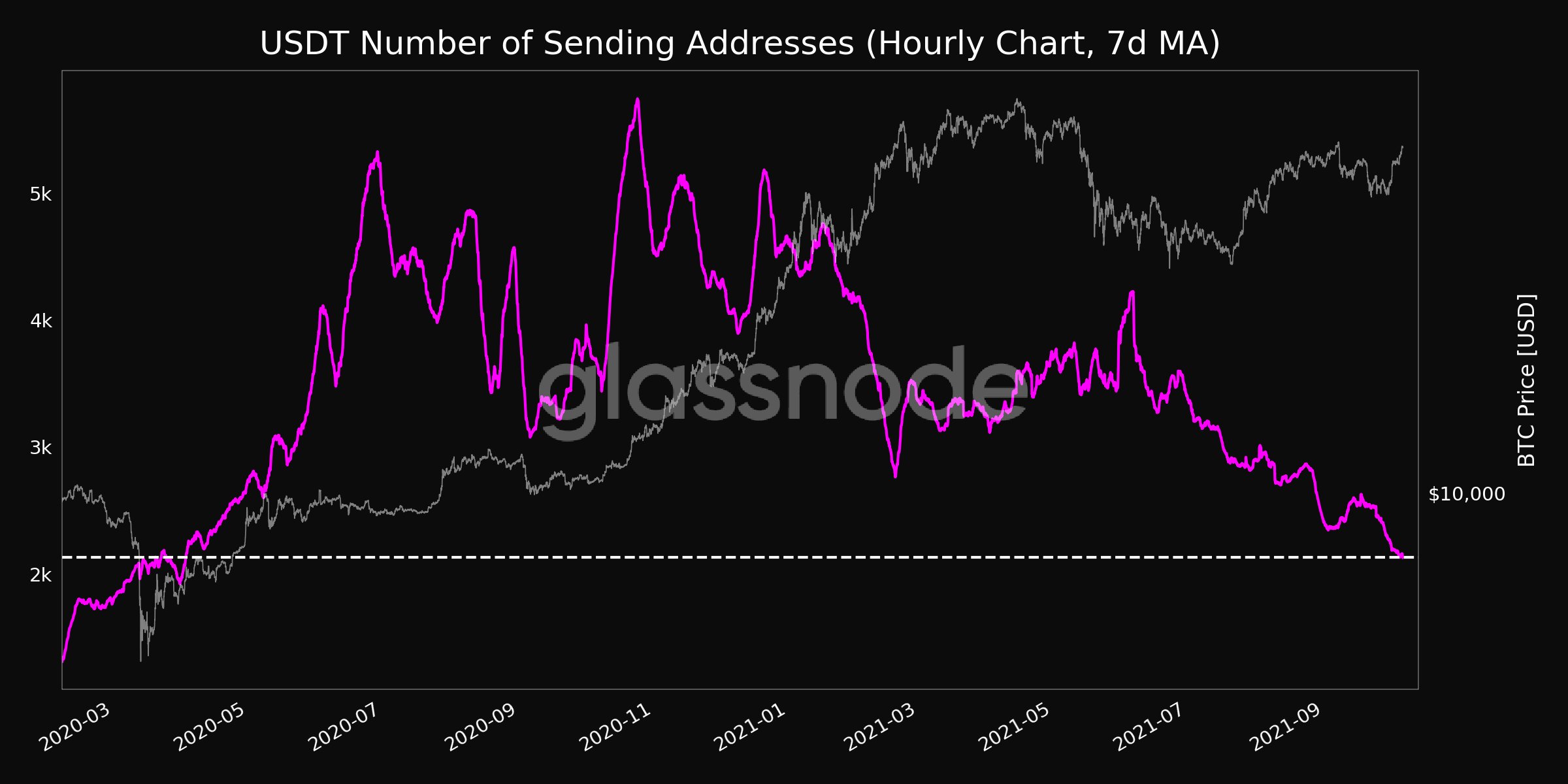

Furthermore, the number of USDT sending addresses hit an 18-month low of 2,129.756

Source: Glassnode