Ethereum’s ‘vibrant development’ can push prices in the near future

With Bitcoin stealing most of the market attention, the top altcoin, Ethereum has been out of the larger picture since Q4 took off. On the price front, BTC’s growth has raised the market’s anticipation while Ethereum has taken an underdog approach with its developmental side looking rather vibrant.

Demand for Ethereum makes a comeback

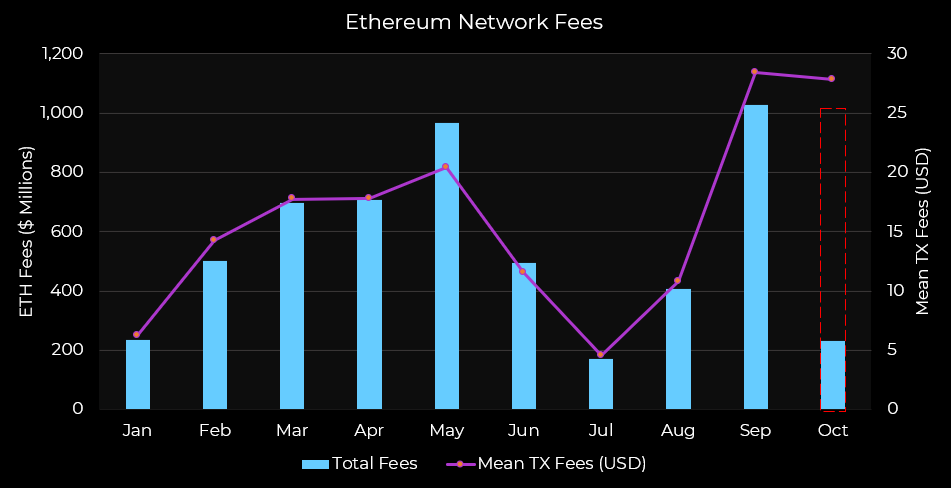

After a massive surge in Layer-2 protocols towards the end of Q3, demand for Ethereum blockspace seemed to have rebounded as the last quarter of the year began. Notably, Ethereum’s transaction fees surpassed $1 billion in September with an average transaction fee of $28.

After EIP-1559 went live, a staggering 55% net reduction in ETH issuance was noted with over 474K ETH ($1.7B) being burned. This in turn made way for s supply shock narrative which was bullish for ETH’s long-term trajectory.

However, as noted by analyst SpencerNoon, Ethereum sustained high fees hampered the user experience and served as a tailwind for more user adoption of cheaper L2s and alternative L1s.

This could be one reason why active addresses on Ethereum were close to 577K, which was down by almost 25% since May highs. Nonetheless, a booming NFT market alongside Defi growth over the last quarter indirectly enabled a more robust Ethereum ecosystem.

Healthy HODLing behavior

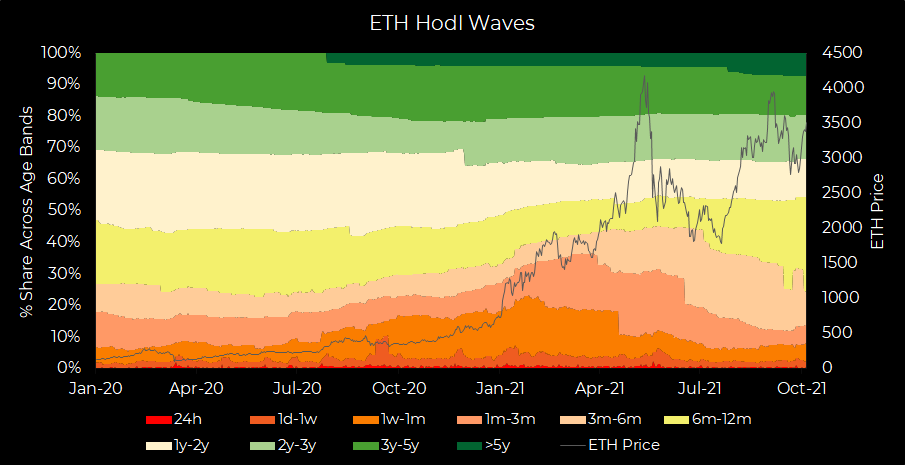

Ethereum HODL waves help track how active the current ETH supply is based on the last on-chain movement. Notably, 76% of the supply hasn’t moved in over six months and around 46% of the supply is in age bands of greater than one year.

ETH HODL waves | Source: Glassnode

Some of the major factors impacting HODL waves include ETH’s dominance in Defi, Ethereum staking, and CEX ETH reserves in cold storage. That being said, one worrying factor was that $306 million worth of ETH was deposited into exchanges, compared to $750 million being withdrawn over the last week.

Looking at exchange inflows picking up it seemed like there might be a rise in sell-side pressure to be absorbed around price resistance level.

Development looking vibrant

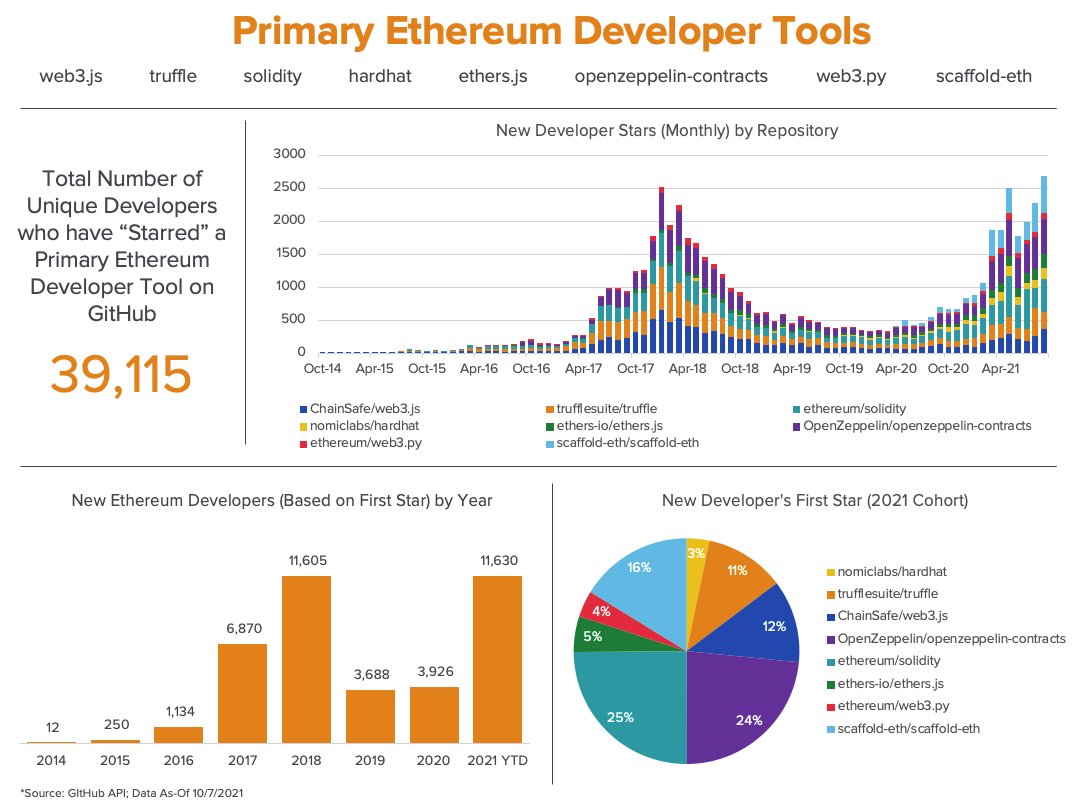

Data scientist Daren Matsuoka stated that the Ethereum developer community “is more vibrant than ever.” In fact, more developers have entered the Ethereum ecosystem so far this year than the previous two years combined.

Source: Daren Matsuoka

The growth of Ethereum’s developer activity was analyzed by looking at the GitHub stars on key developer repositories like web3js, truffle, solidity, hardhat, ethersjs, OpenZeppelin contracts, web3py, and scaffold-eth, over time.

Notably, there were now over 39K Github accounts that have starred at least one of the key repositories. With its development activity on the rise, and demand for the Ethereum network rebounding, ETH’s future looked rather bright.