These factors can bring about a paradigm shift for Bitcoin

With Bitcoin up by 37% since 1 October, 2021, BTC’s trajectory in Q4 looked rather promising. For over 10 days BTC’s candles on the daily chart closed in green. As the asset traded at $56.5K the market’s expectations from the coin rose too.

However, as the top coin saw this kind of price growth, it wasn’t just price anticipation that saw a shift, in fact, the way BTC’s status as an asset was viewed, seemed to be repositioning too.

Supply shock narratives

One striking trend about this cycle was that the aggregate Bitcoin balances on the exchanges were on a downtrend since the end of July. In the past, BTC exchange reserves saw new lows, alongside the coin’s ATH prices.

In fact, with new addresses going up, outflows peaking and price on the rise, the market was flooded with positive supply shock narratives. While the possibility of a supply squeeze on exchanges can’t be discarded, BTC leaving exchanges and hopefully ending up in self-custody was a very positive development.

Holders HODLing the wave

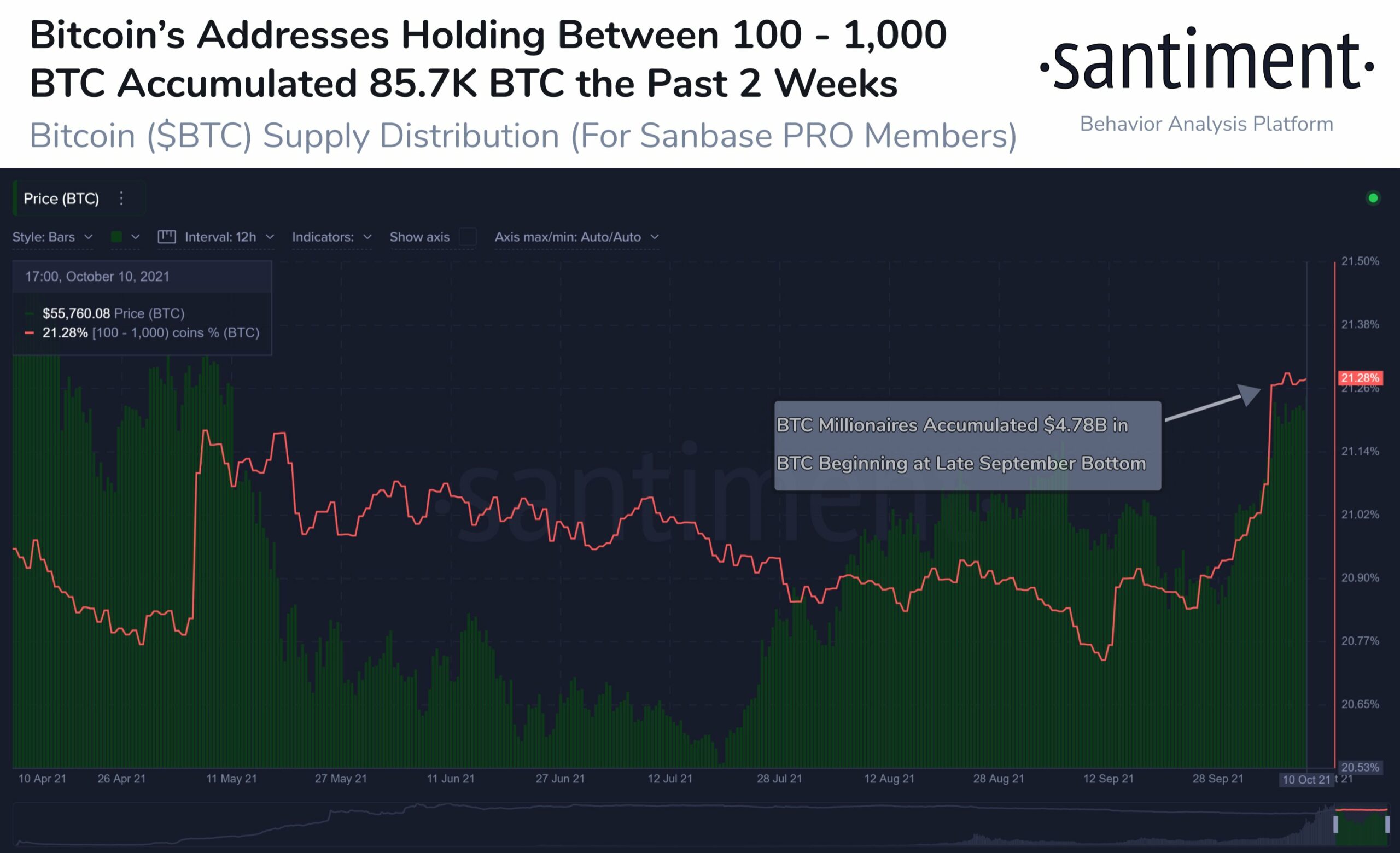

As Bitcoin ended the weekend above $56.3K, data analytics site Santiment iterated how the market continued to be a whales’ market. Notably, addresses with 100-1,000 BTC accumulated 85.7K BTC around late September, 2021.

These whales held 21.3% of the supply now, which is largest of all time. This section of investors finally erased the whole slump and broke out after a five-month-long consolidation.

Further, the percentage of coins last active within the previous three months was at a historic low, never seen before. This behavior was indicative of the shift in the macroeconomic environment while presenting high HODLing behavior.

That, coupled with institutional money coming in, Bitcoin seemed to be arguably establishing itself as a potential safe-haven asset. In fact, BTC’s Sortino ratio which can be interpreted as the actual rate of return in excess of the investor target rate of return per unit of downside risk was arguably close to that of Apple’s. Notably, BTC’s Sortino ratio at the time of writing was 0.021113 while that of Apple was 0.0709.

Shifting paradigm

Looking at BTC’s supply-demand dynamics, with its supply on exchanges decreasing, are people waking up to the idea that Bitcoin is not just a speculative asset that can be flipped short-term but something to hold onto long-term?

There have been monumental shifts pertaining to BTC’s macroeconomic environment with institutional money coming in, and plans for a BTC ETF looking solid.

All these factors coupled with reduced supply and potentially increasing demand, the paradigm shift looks monumental and it’s possible that Bitcoin might be in for some exciting moves in the coming months. But, as unpredictable, and sensitive to external news, as BTC is, one thing was sure – Q4 could make or break the top coin’s case in macro-terms. Either way, it’s going to be a rather interesting time to witness its moves.