Bitcoin: These are the realistic price levels for BTC before end of 2021

In one of our recent articles, we mentioned that Bitcoin possibly needs retail investors to come in and increase buying pressure since there was a lack of FOMO in the market. While FOMO isn’t necessarily a long-term progressive catalyst for consistent price gains, it does allow assets to breach key resistances.

Now that Bitcoin has hit a new ATH level without massive FOMO, that will possibly change because of the following narratives.

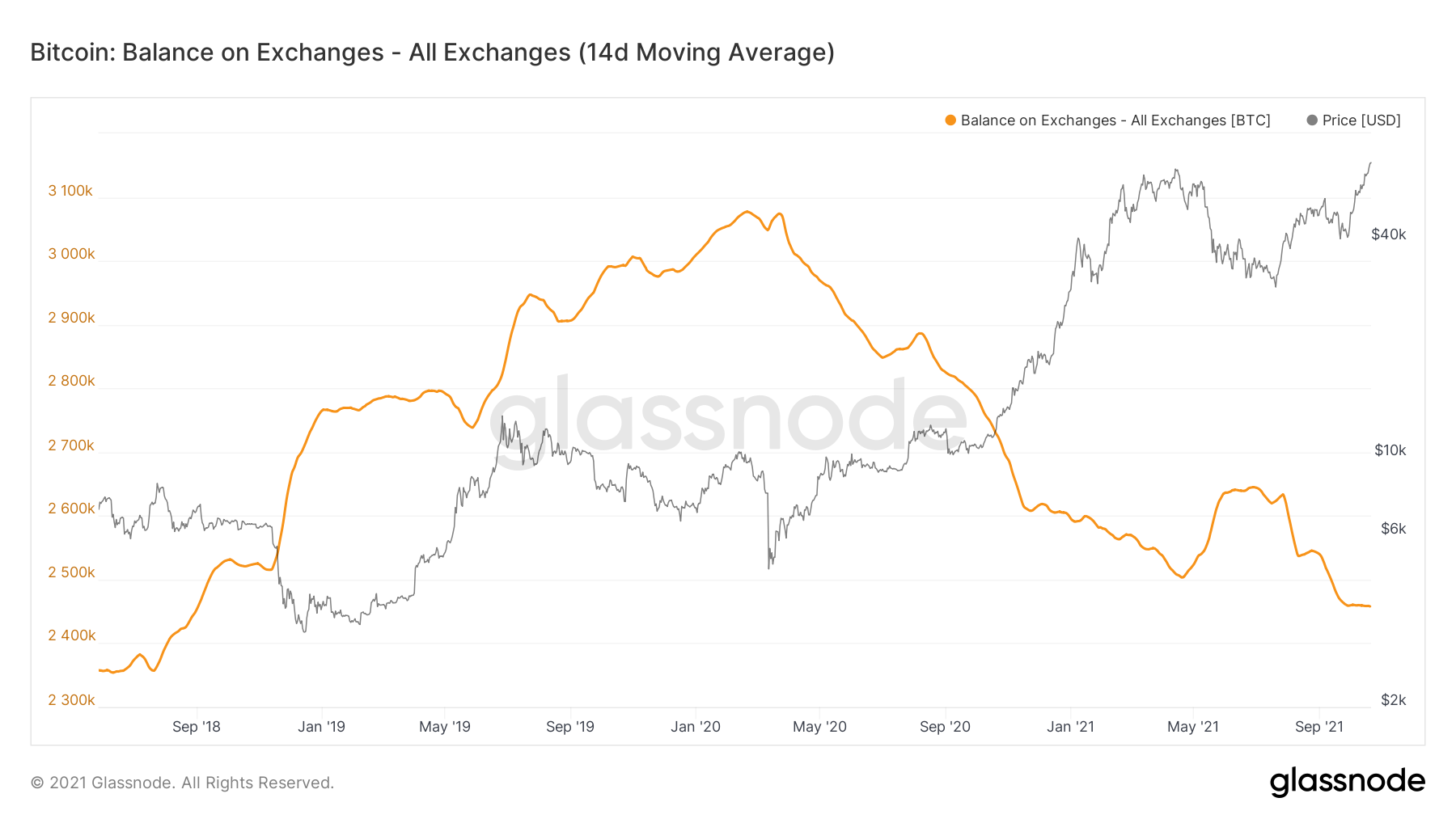

Exchange Reserves dropping down to a 3-year low

With HODLers displaying major conviction over the past few weeks, their activity has triggered Bitcoin exchange reserves to drop down to 2018 levels. At press time, close to 2.45 million BTCs were held on exchanges, a level last seen back on 31 August 218.

It can be inferred that selling pressure has dropped down significantly, especially as Bitcoin hit a new high. The incentive to sell higher is much more than selling at the present price.

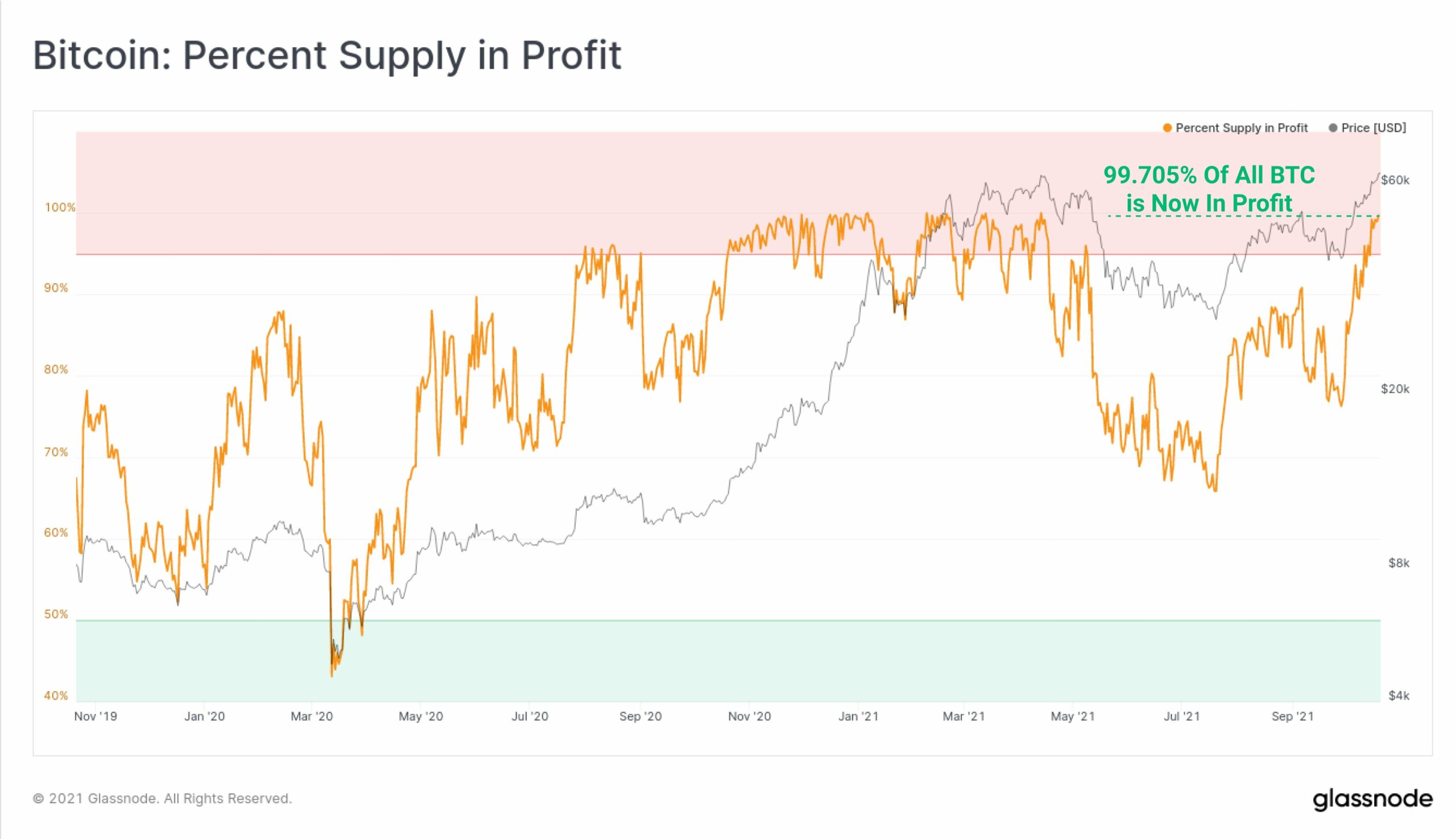

Consider the chart attached herein, for instance. The same revealed that 99.70% of all BTC is currently in profit, something that further validates the decreasing possibility of greater sell pressure.

While the MVRV may suggest some form of profit-taking going forward, FOMO retail buyers will be absorbing maximum capital inflows with rising buying pressure.

Here, it is fair to argue that the Bitcoin ETF approval played a major role in creating enough positive sentiment around the BTC ecosystem. The notional Open Interest on CME Bitcoin Futures reached a new ATH as well, at press time.

This may be possibly due to the ETF holding CME shares under its investment vehicle.

The sky is the limit for Bitcoin?

While the sub-head may be an exaggeration, some of the key levels that can be attained by Bitcoin over the next few weeks can be discussed. With Bitcoin crossing $64,000, there is more conformity behind the aforementioned targets now. Last week, Bitcoin closed its highest weekly candle ever and there is a chance it may close an even higher candle this week.

If another strong week is wrapped up, it sets Bitcoin up nicely to reach its immediate target of $73.4k based on the Fibonacci retracement lines. With a lack of immediate resistance levels, the next level would be at around $83k, upon which Bitcoin will possibly have a final clear path to the elusive $100,000-valuation.

One concerning factor in the price charts, however, remains the lackluster volumes. As can be observed, BTC has registered receding trade volumes since the beginning of 2021. This isn’t a good sign and points to reduced asset distribution.

While a drop down to $46,000 is unlikely at the moment, retail investors will need to kick in soon in order for Bitcoin to flourish beyond its new ATH level.