What you should know about the curious case of Ethereum’s metrics

For the first time ever, the cumulative crypto-market cap surpassed the $3 trillion mark, a development that was celebrated by the community. In fact, on the back of Ethereum‘s gains, the altcoin’s market cap too broke out to hit new ATHs. The crypto’s price is now well and truly heading towards price discovery.

Ethereum’s trajectory since 30 September 2021 has been a sweet ride north. The king of altcoins has generously rewarded both long-term and short-term HODLers with a weekly ROI of 9.93% and a monthly ROI of over 33%. At the time of writing, Ethereum was trading at $4,796.98, charting 2.95% daily gains and 9.30% weekly gains.

Interestingly, with the altcoin’s value oscillating close to its ATH, ETH’s gas fees and trading volumes slumped. So, what does this curious case entail and what lies ahead for the top altcoin?

A curious case

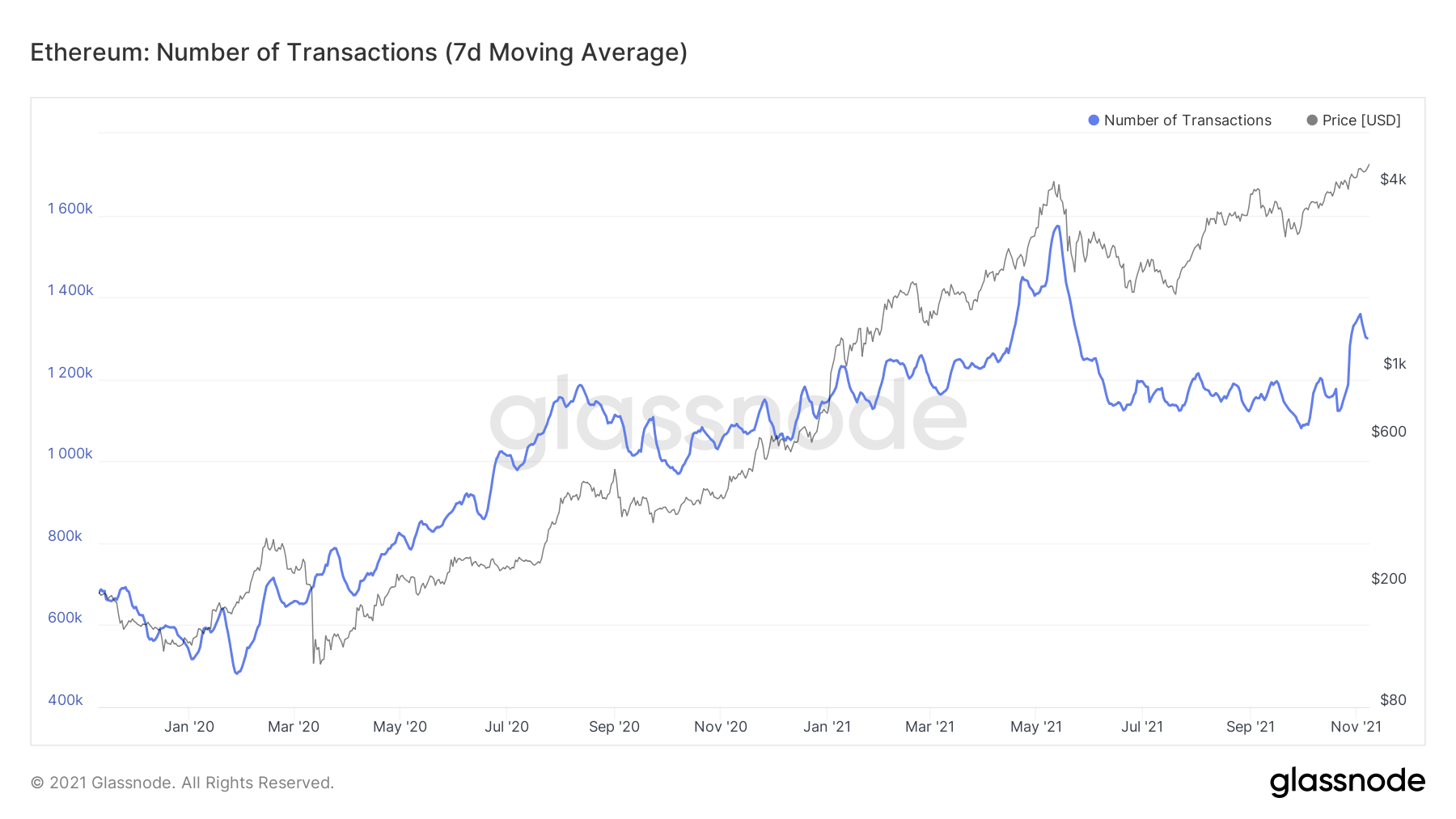

Ethereum’s gas fees have been plummeting for the last five days as the price continued to rise. The average transaction fee on 7 November was $37.19, which was an over 33.5% reduction from a week ago when the average gas fee on Ethereum was $55. Additionally, transaction count has also fallen alongside the crypto’s rising price.

Source: Glassnode

Ethereum transactions per day reflect the daily number of transactions completed on the network. And, the same was indicative of lowered optimism among participants. Apart from that, the network’s hash rate continued to soar to new heights.

Hash rate determines the network’s computing power and according to Etherscan, the highest avg. hash rate of 830,058.8955 GH/s was recorded on 7 November.

Additionally, retail FOMO has been visibly cooling off. In fact, trade volumes have seen a constant downtrend over the last week. So, while the demand for Ethereum might have dropped off, the network still has a long way to go.

A long way ahead

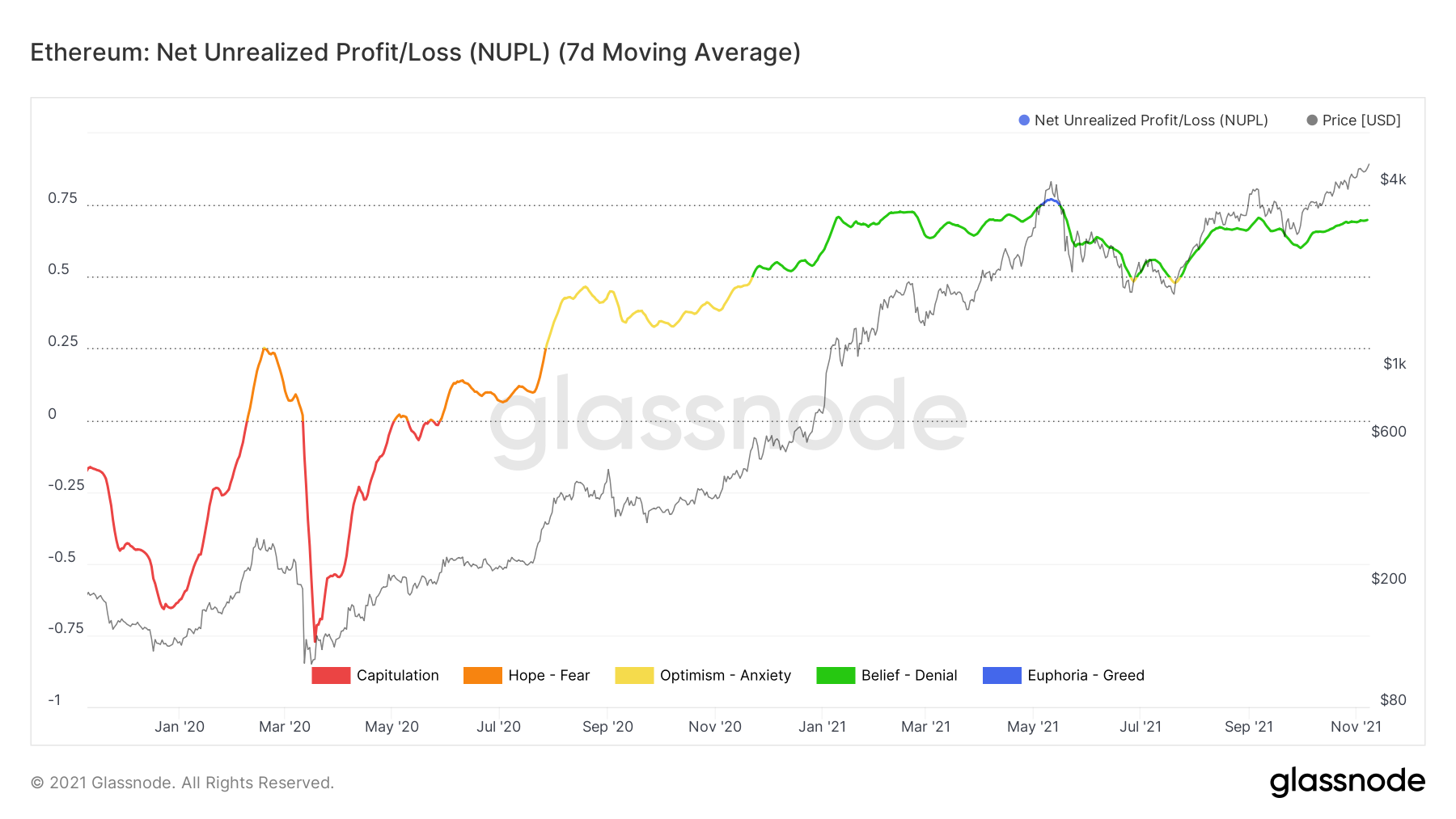

Notably, Ethereum’s NUPL (Net Unrealized Profit/Loss) is still not in euphoria. In fact, the latest market rally hasn’t witnessed the euphoria phase yet, leaving scope for more growth for the asset.

Even though the network was in a state of profit, it hadn’t reached the sell-off point. This also meant that HODLers wouldn’t take profits anytime soon.

Source: Glassnode

According to some like analyst Benjamin Cowen, the next reasonable price target for ETH would be to get to a valuation of 0.1 BTC or around $6,571. Calling Etherem an “absolute beast,” he further added,

“I still stand by that going into 2022 should still be relatively bullish for Ethereum, especially with The Merge and whatnot coming up.”

So, with analysts looking at ETH from a bullish perspective and ETH’s constant upward price movement, it does look like ETH’s way from here if only up. However, a short-term price pullback can be a good entry point in the market.