Assessing why Bitcoin could be key to SUSHI’s recovery

SushiSwap’s token SUSHI has been in a bit of a rut for some time now, but the issues in its price action are not limited to the spot market. Its performance in the DeFi market too has been rather lackluster. Even so, SUSHI happens to be very dependent on Bitcoin and it seems like only the king coin can save it now.

SUSHI rolled

While there are many other DeFi protocols that are faring well and recovering, SushiSwap continues to decline in terms of TVL and volumes. Down from $7 billion to $5.4 billion, the protocol, at press time, had already lost 22% of its TVL in 10 days.

SushiSwap TVL | Source: DeFi Llama – AMBCrypto

On top of that, its volumes too have fallen by 50.76%. And, as the protocol suffered, so did its token SUSHI in the spot market.

Its price action has observed a decline of 23.34% over the same time period and on top of that, it has already lost more than 38% of its active addresses. Since people are running into losses, it appears to be that they are exiting the market probably.

SUSHI price action | Source: TradingView – AMBCrypto

This has also led to a lot of selling over the last few days, with a few instances of some long-term holders (LTHs) shedding their assets as well.

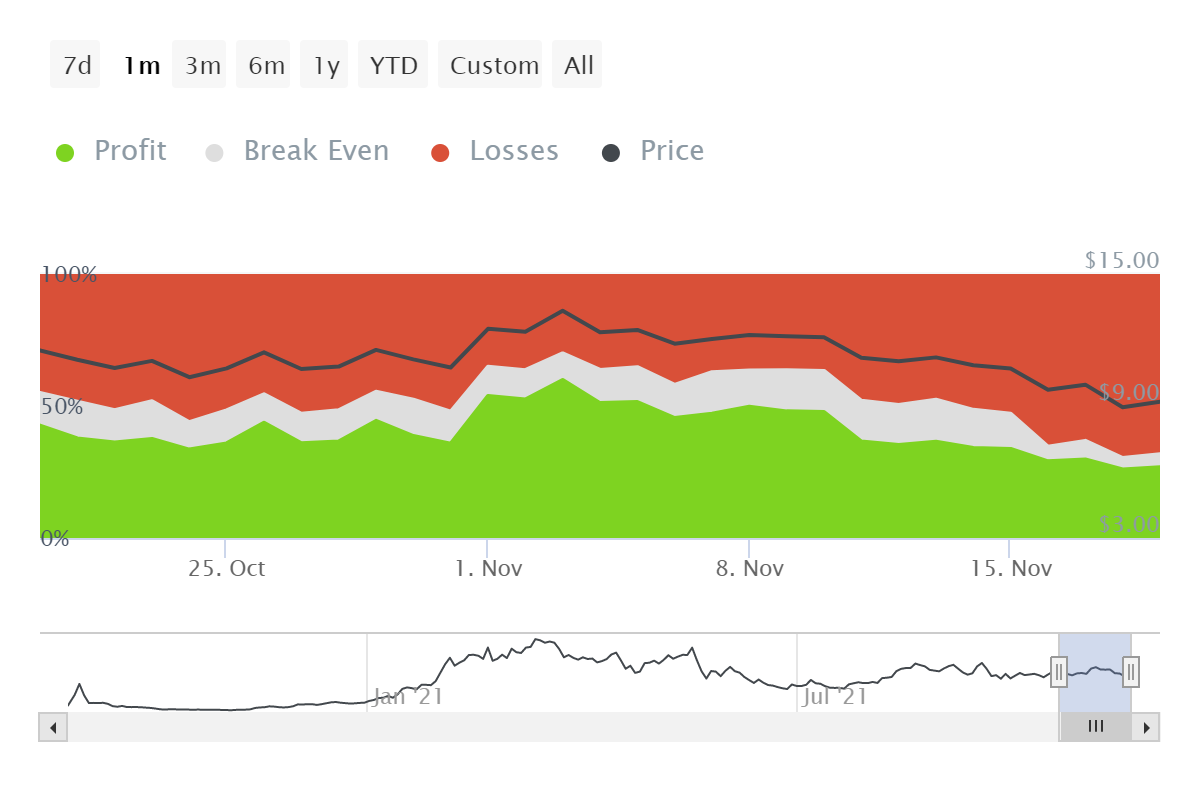

And, their decision does make sense since SUSHI has had a bad November and its investors are suffering from severe losses. The addresses in profit, for instance, have come down to just 29% – The lowest in 6 months.

SUSHI profitable investors | Source: Intotheblock – AMBCrypto

The only saving grace is that whales are not yet selling, despite 65% of the supply being dominated by whales.

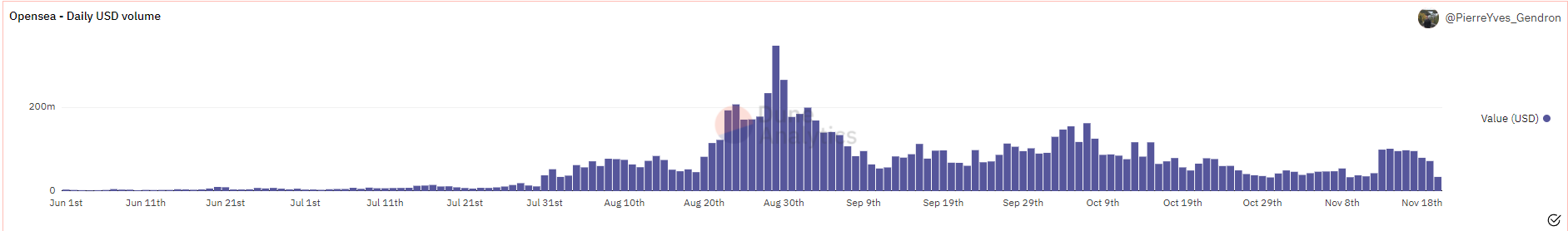

The recent launch of its NFT marketplace and metaverse Shoyu could potentially act as a trigger. However, since the NFT hype has died down and volumes are lurking in the lower $40 million range now, it could hardly make a significant impact.

Opensea NFT volumes | Source: Dune – AMBCrypto

Since its correlation with Bitcoin remains high, any major hike on the king coin’s chart might help SUSHI recover as well. Otherwise, it will remain in the lower lows of $9.09.