Report: Indians maintain a cautious outlook as crypto markets witness a bloodbath

The global cryptocurrency market cap on 22 January went down by a massive 13.5% in the last 24 hours, to settle at around $1.6 trillion. Needless to say the tumble follows the year when the market witnessed its first record $3 trillion in cumulative market cap.

Market mayhem

Some, like the President of El Salvador, are taking it to be another buy-the-dip opportunity. While others are keeping a cautious outlook. Indians are reportedly falling into the latter category.

An ET report citing data from industry players suggests that the buying intensity among Indian crypto investors and traders is lower this time around. This is in comparison to all other dips that the market witnessed.

It is worth noting that the market has experienced five straight weeks of digital asset investment outflows as per Coinshares’ latest report. While the report predicted that negative sentiment could be cooling off, outflows totaled a weekly record of US$73 million in the past week.

Indians are cautious

Nischal Shetty, co-founder of WazirX told the paper,

“The buying intensity is definitely lower than the last several months. But this has less to do with India and more to do with global crypto sentiment.”

Further explaining that Indian investors might be taking the ‘wait and watch’ approach.

Why are they holding back?

While there was definitely positive news with tech giants like Google testing the crypto waters, the market is largely sitting on uncertainty with the regulators. Globally, Russia’s recent release of a possible crypto ban has further soured the sentiments. So much so that Bitcoin couldn’t keep its crucial support level of $40,000. Domestically, the upcoming Budget Session on 1 February is also something that might be impacting the sentiments.

Edul Patel, founder, and CEO of crypto investment platform Mudrex told the media outlet,

“The selloff is in line with what we are witnessing in other asset classes like equities.”

India and crypto scams

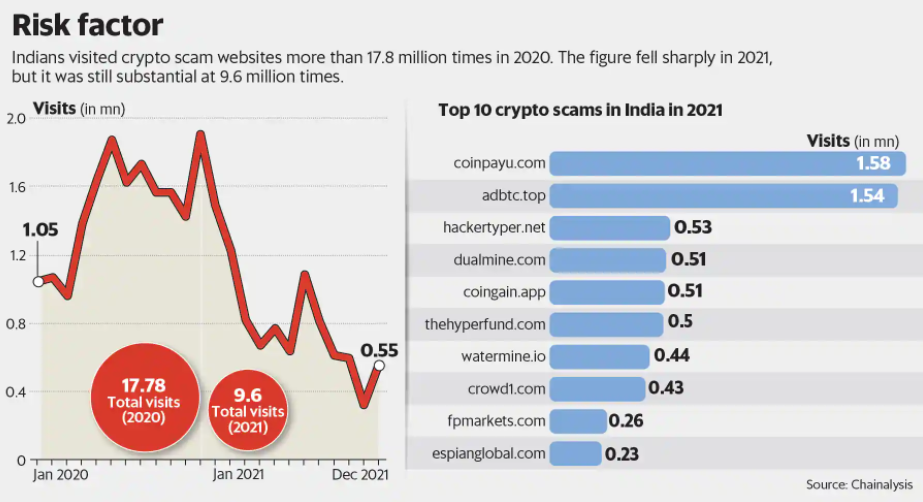

While Indians are trying to stay cautious with the volatile asset class, they might not have been as cautious with scammers. It is unfortunate to note that Chainalysis found that Indians visited crypto scam websites more than 17.8 million times in 2020. While the figure fell significantly in 2021, it still stood at 9.6 million. Apart from that, previous local reports had also found several MLM schemes emerged in India on the back of skyrocketing interest in the crypto sector.

Take, for instance, the Morris Coin scam or the Bitconnect’s extortion racket which also targeted crypto enthusiasts in many parts of India.

The data named scamming websites like coinpayu.com, adbtc.top, hackertyper.net, dualmine.com, and coingain.app as the most visited sites in India. Reportedly seeing 4.6 million visits from India last year.