Appraising the probability of Bitcoin staying above $37.5K

Disclaimer: The findings of this analysis are the sole opinions of the writer and should not be considered investment advice

Macroeconomic fears regarding inflation were reflected on the charts in the past couple of months as Bitcoin headed into 2022. The past few weeks have, once again, halted the momentum that bulls had built up. This was related to fear revolving around Russian intentions on the borders of Ukraine, and stock markets across the globe reflected this fear. Bitcoin and the crypto market are risk-on assets and took a strong hit, too.

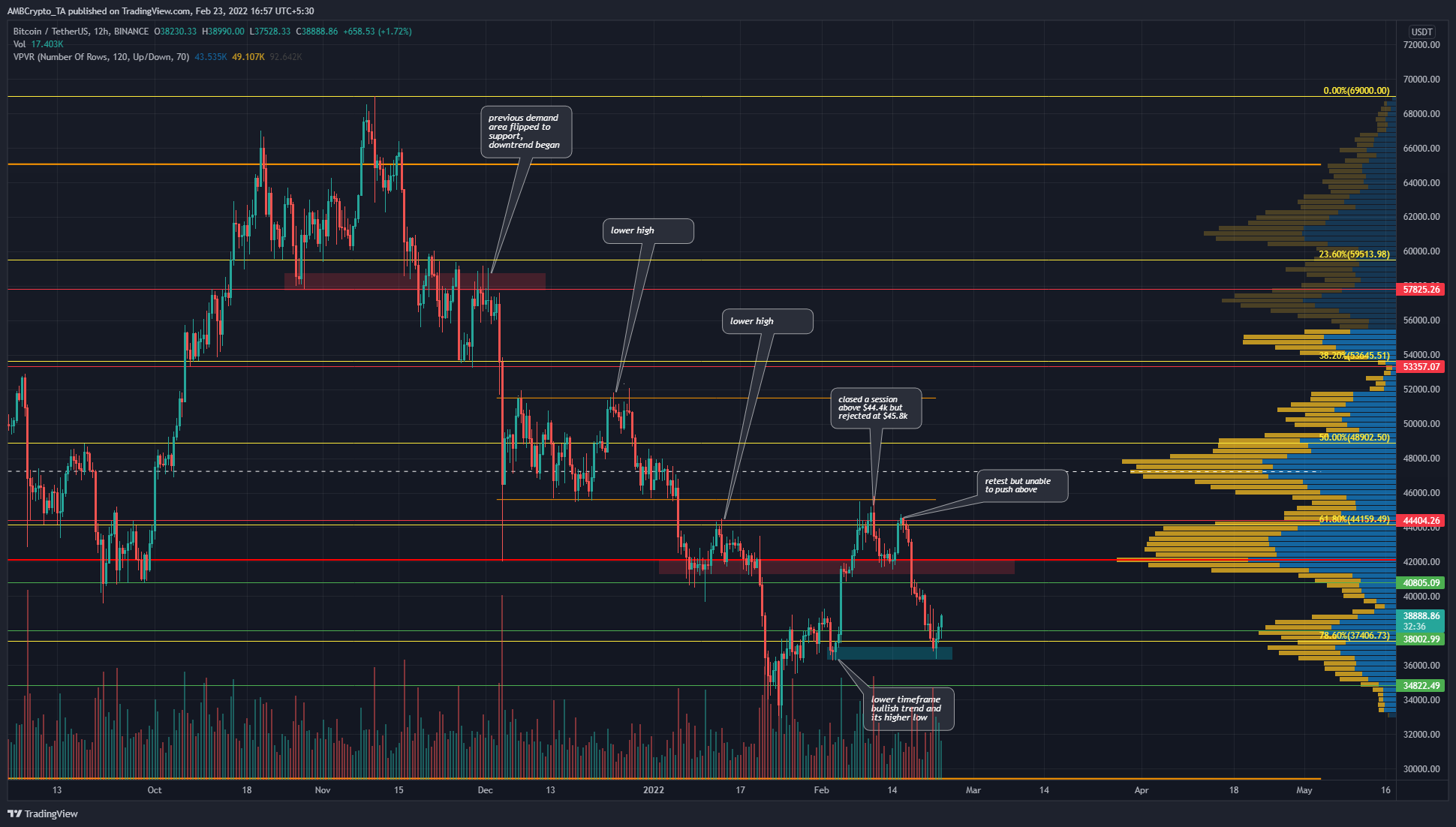

BTC- 12H

On the charts, the price has been in a downtrend since early November and has formed a series of lower highs. In February, the price appeared to break above the previous lower high at $44.4k- but was rejected at $45.8k.

$45.8k was the low of the range that BTC had formed in December. On the other hand, in the past couple of days, BTC has found demand at the $36.4k area (cyan box) and climbed back above $37.4k, the 78.6% Fibonacci retracement level (yellow).

Price seeks liquidity, and the VPVR showed that the Point of Control, the level where the price has traded most since October, lay at $42k. This was also an important area of resistance that bulls and bears have skirmished over recently.

Rationale

The RSI stood at 41, which was slightly encouraging to bulls as it was above the 40 mark and veering toward the neutral 50 level. However, neutral 50 could see the bounce lose momentum, and bears establish their dominance once again.

The CDV indicator showed that selling volume has consistently overwhelmed the buying volume in the past few months. The Chaikin Money Flow also stood below -0.05 to indicate that significant capital flow was directed out of the markets.

Conclusion

The BTC market belonged to the sellers on the longer timeframes, although a bounce to $42k could be seen as BTC searches for liquidity. Therefore, the area between $39k-$42k has become the stronghold of the bears on the charts. Combined with the fear in the markets regarding tensions in Eastern Europe, another leg downward cannot be ruled out. This could see the price revisit $34.8k, $31.1k, and even $28.8k.