Three metrics reveal why CHZ investors might be in for double profits soon

Chiliz’s price, at press time, pictured a perfect combination of three on-chain metrics. Each of these suggested that it could be due for an explosive move. Considering the bullishness of Bitcoin and the crypto-market in general, this outlook might just be plausible for CHZ.

The trifecta that will propel CHZ by 100%

Chiliz’s price, at the time of writing, was hovering around $0.189. It showed signs that it might undergo a minor pullback to the $0.177-support level. This move might serve as an opportunity for buyers to accumulate before CHZ explodes.

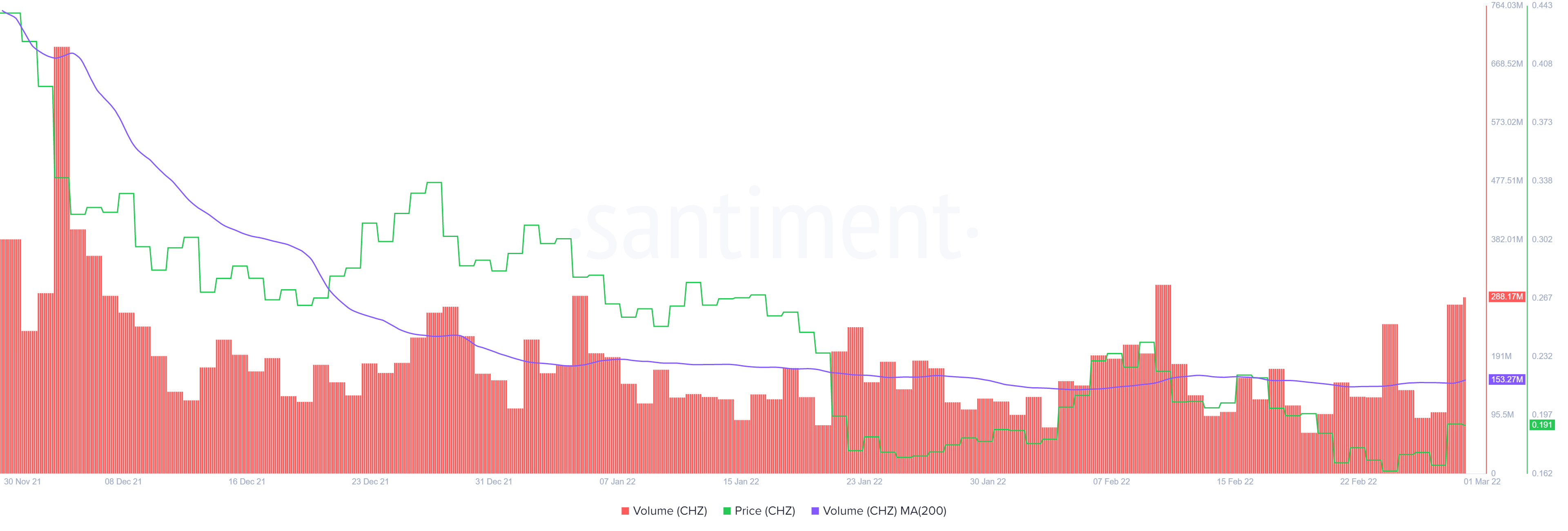

The recent spike in on-chain volume from 136.6 million on 19 February to 291.79 million on 1 March is a significant indication of the rise in interest around the altcoin. The last time CHZ saw such a robust uptick was between 3-10 February. This pushed Chiliz’s price up by 33% on the charts.

Considering the aforementioned uptick in bullish momentum, a surge in on-chain volume could see it climb much higher. This might allow CHZ to set a higher high. Moreover, the on-chain volume has moved above the 200-day moving average, revealing a shift in trend.

While the on-chain metrics hinted at incoming bullishness, the 365-day Market Value to Realized Value (MVRV) model seemed to cement the same outlook for CHZ. This indicator is used to assess the average profit/loss of investors that purchased CHZ tokens over the past year.

A negative value below -10% indicates that short-term holders are at a loss and is typically where long-term holders tend to accumulate. Therefore, a value below -10% is often referred to as an “opportunity zone.”

For Chiliz, the 365-day MVRV was hovering at around -46.8%, at press time, indicating a massive oversold condition. One where 46.8% of the holders that bought CHZ over the past year are underwater.

Therefore, a further move south seems unlikely and hence, a U-turn for CHZ will appear plausible. At least from a long-term investors’ perspective.

The metrics’ big picture

Adding credence to the MVRV indicator is the decline in CHZ held on centralized entities from 2.9 billion to 2.8 billion over the past three months. Roughly 100 million tokens were taken off exchanges, indicating that these investors are confident in the performance of CHZ in the near future.

Therefore, investors that are looking to profit can accumulate CHZ and await an explosion to the immediate resistance barrier at $0.356.