Here’s why stablecoins and not Bitcoin is the new ‘safe haven’

Stablecoins appear to have done very well in an otherwise turbulent year for most mainstream cryptocurrencies. While most cryptocurrencies have rebounded from their deficits, stablecoins maintained their course throughout.

Now, the question remains- Should investors continue to look at stablecoins for long-term gains? Well, it’s important to note that after years of presence in the market, the role of stablecoins has been regularly scrutinized. Coins such as Tether have a massive $80 billion market cap at press time.

One of the primary ideas behind launching stablecoins was to bridge the gap with fiat currencies. Despite all the criticisms, there has been a huge surge in dollar-backed cryptocurrencies.

Furthermore, the largest stablecoins by market capitalization are Tether, USD Coin, Binance USD, TerraUSD, and Dai. All of these are pegged to the U.S. dollar while there are others that are valued against gold and silver. Well, their growth in recent months cannot be undermined.

Stablecoins are used for various purposes in the crypto world. They are used during cash transactions between businesses. And, also to avoid the risk of volatility.

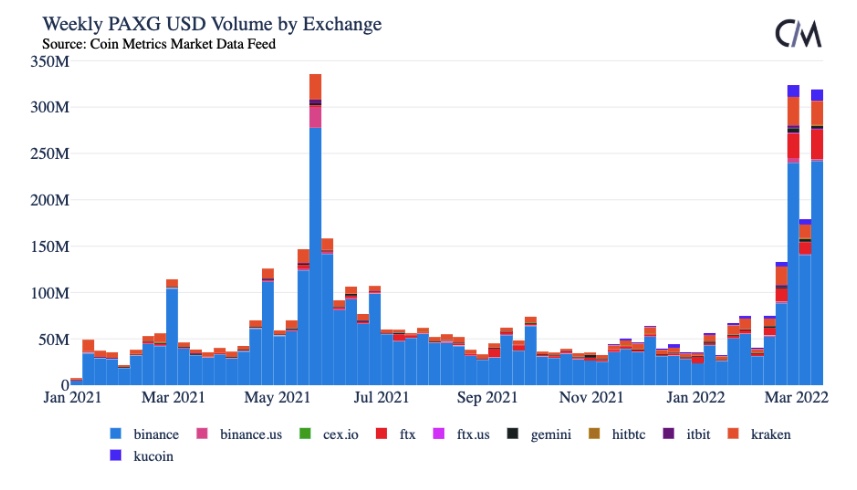

Notably, there has been a significant increase in the amount of ETH addresses holding PAXG. The numbers have surged by 15% since 1 February 2022 and are expected to increase further. In fact, trading volume is also expected to go up high.

Furthermore, the instability and volatility in coins such as BTC and ETH is a major factor behind the rise of stablecoins. When BTC dropped 8.34% on 4 December 2021, USD Coin was sailing smoothly as a safe haven.

But does everyone approve of it?

Not everyone in the crypto-sphere is a fan of stablecoins, however. For instance, Gary Gensler, the U.S. Securities, and Exchange Commission (SEC) chair told a news publication,

“These stablecoins are acting almost like poker chips at the casino right now.”

It’s important to note that there are several downsides to stablecoins. Some investors say that investing in stablecoin makes little sense since these coins have little upside capability as compared to other investments such as BTC.

Tether, for example, has never crossed the $1 threshold after mid- November 2021.

What about the future?

Importantly, for short terms gains, stablecoins do not seem to be the most preferable investment. However, their role in the crypto ecosystem cannot be understated. Notably, a rare sense of stability in this “wild” crypto market must be welcomed.