Bitcoin: For traders, these are the clues to ‘higher volatility around the corner’

It’s a fact that traders rely on volatility to make money. Therefore, a decrease in market volatility would have traders stay away from the market and vice versa. So, should BTC Futures’ traders feel comfortable in the current market conditions at press time? Let’s see.

The Bitcoin network’s on-chain activity still appears to be in a bear market despite the current 3.5% in 24 hours. Blockchain analytics firm Glassnode’s latest report on the weekly activity of the Bitcoin network showed the incoming volatility rise. It was primarily associated with the Federal Reserve rate hike (0.25% to 0.5%) in March. Likewise, futures and options markets began to price in higher implied volatility in the short term.

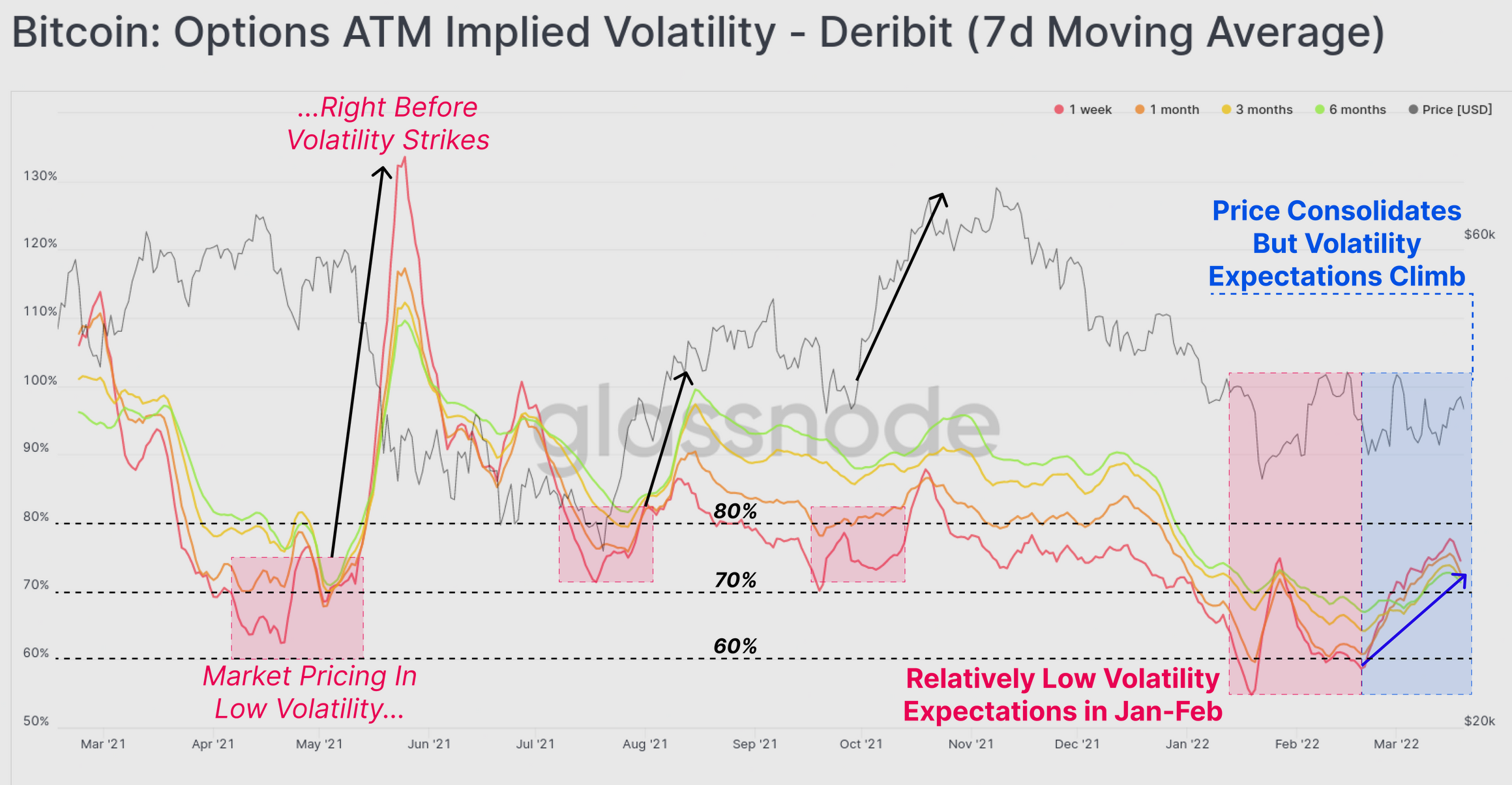

As per the data, Bitcoin’s implied volatility had crept higher as traders set up options positions that would benefit from price swings. As a result, despite prices trading in a sideways range, implied volatility in at-the-money options markets had surged, as seen below.

Source: Glassnode

The report noted:

“Options implied volatility is coming off relatively low levels between 60% and 80%. Which historically followed by periods of extremely high volatility. Such high volatility events in 2021 include the May sell-off, the short-squeeze in July, and the October rally to ATHs.”

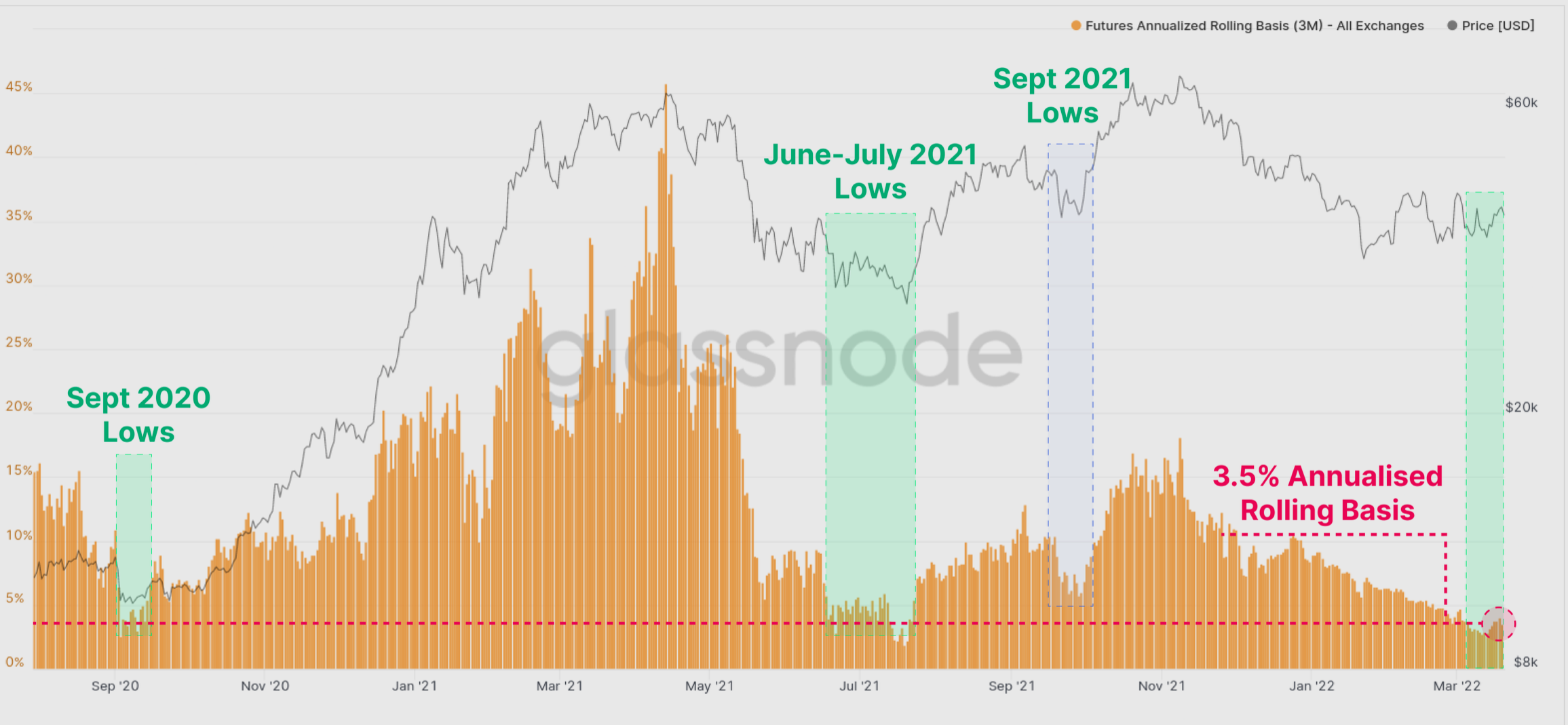

As a result of increased demand to capture futures premium during this drawdown, one could see the three-month rolling basis compression to an annualized return of just 3.5%. Basis compression aligned that in Sept 2020, and at the market, the lows in June-July 2021 preceded very violent upside rallies.

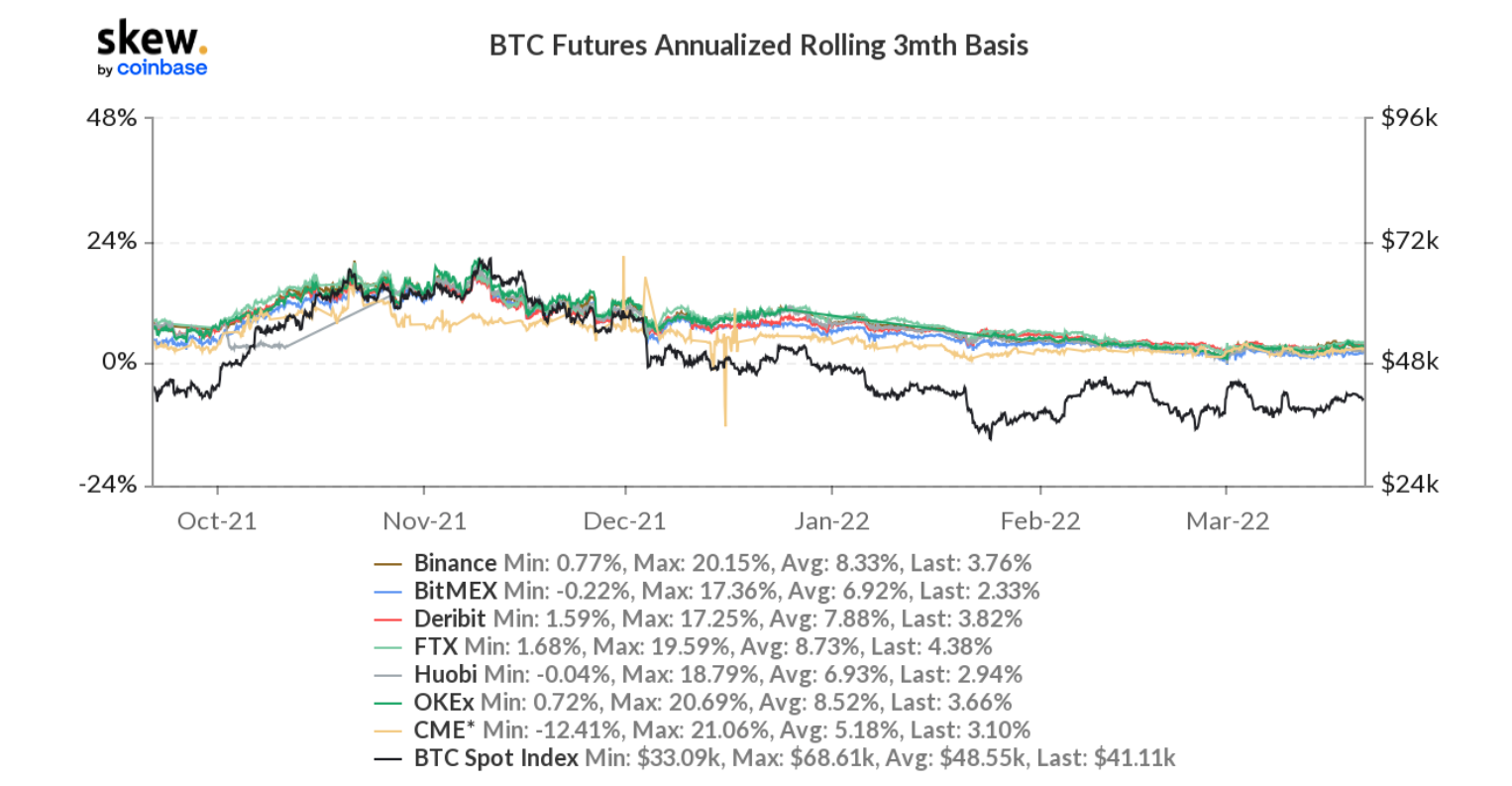

This decline was reiterated in a data from Skew that suggested the same narrative. For instance, Binance, had a three-month rolling basis of 3.54%, a huge fall from 13.71% on 1 November, 2021.

In addition, Bitcoin’s volatility index (BVIN) witnessed a hike too. At the time of writing, the metric stood at 78.69%.

So what does all this imply? To summarize the insights explored above, implied volatility climbing and leverage ratios in futures markets approached overheated levels. Such market structures preceded periods of very high volatility and therefore a “regime of higher volatility may be around the corner.”